Institutional Bitcoin Inflows to Hit $426.9 Billion by 2026, Bitwise Reports

Institutional adoption of Bitcoin is booming, with $426.9B projected by 2026. This could send BTC past $200K—if supply constraints hold.

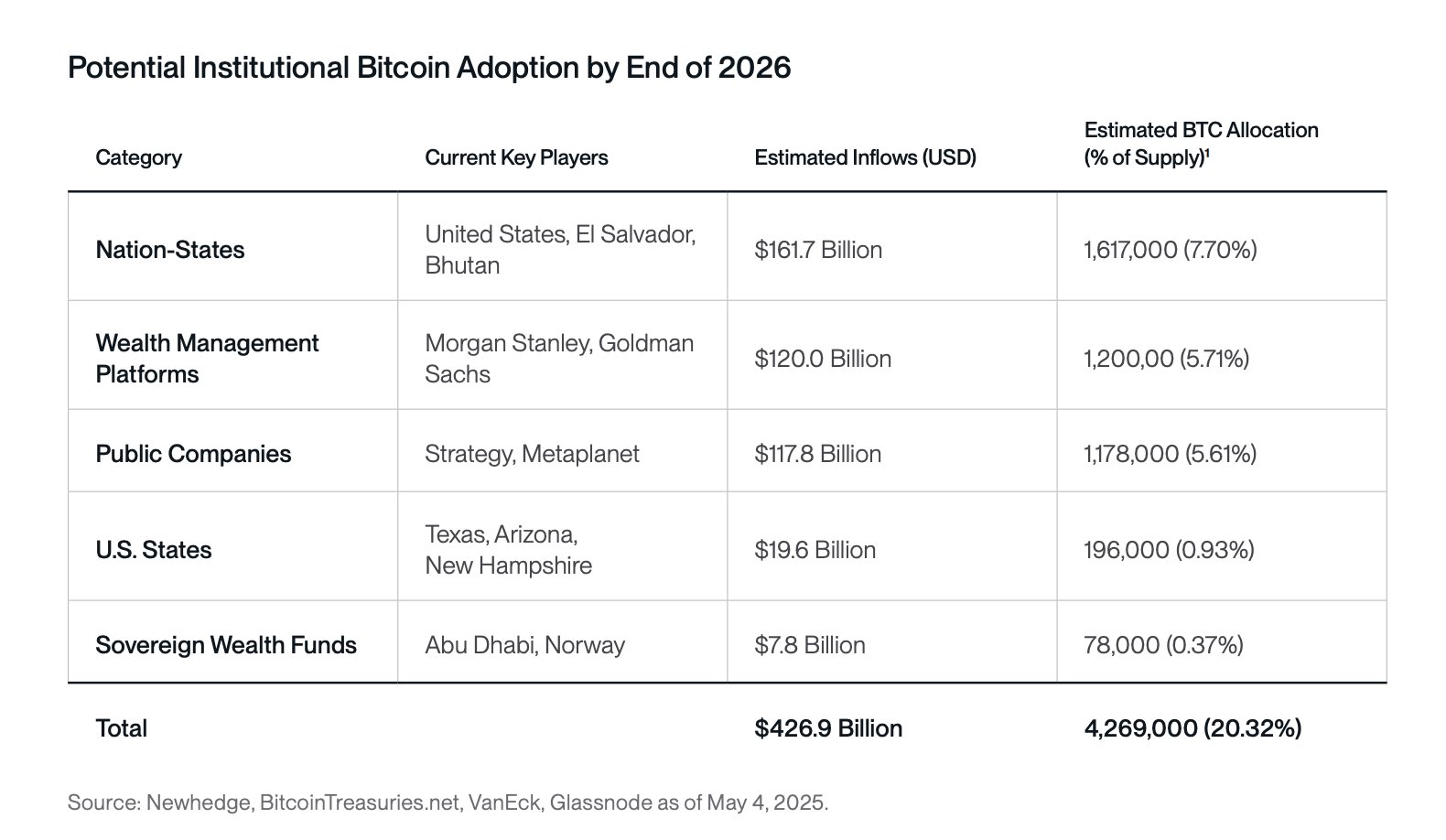

According to a report by Bitwise Investments, institutional capital flowing into Bitcoin (BTC) will reach $426.9 billion by 2026.

This capital inflow would equate to approximately 4.2 million BTC, equivalent to 20% of the total supply, potentially acquired by nations, corporations, and asset management platforms by then.

The Explosion of Institutional Bitcoin Adoption

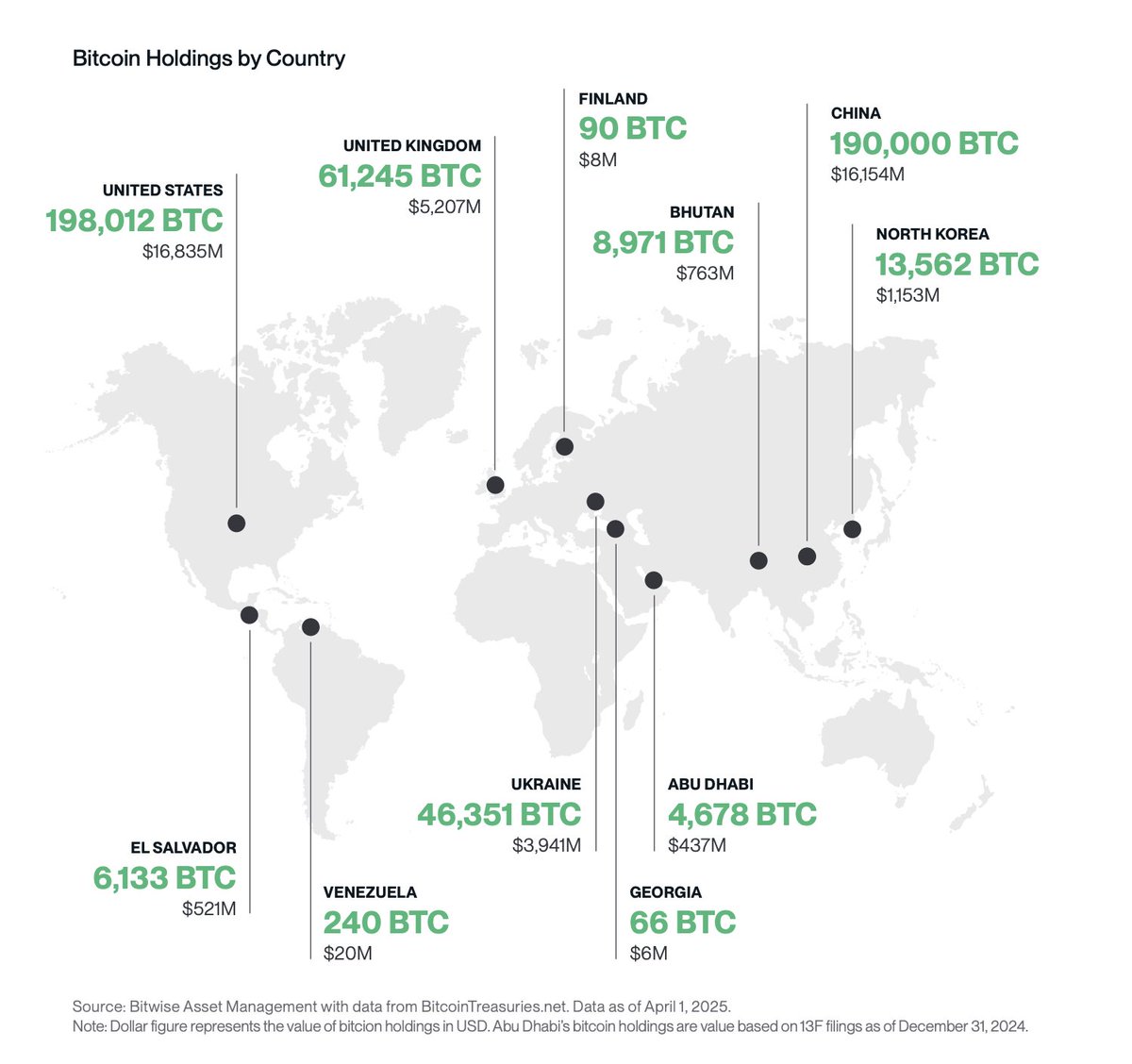

According to Bitwise Investments’ report, El Salvador currently holds 6,133 BTC, valued at $521 million. Meanwhile, China has 190,000 BTC worth nearly $16.1 billion despite banning cryptocurrency trading. Leading the pack is the United States, with 198,012 BTC valued at approximately $16.8 billion.

BTC holdings by country. Source:

Bitwise Investments

BTC holdings by country. Source:

Bitwise Investments

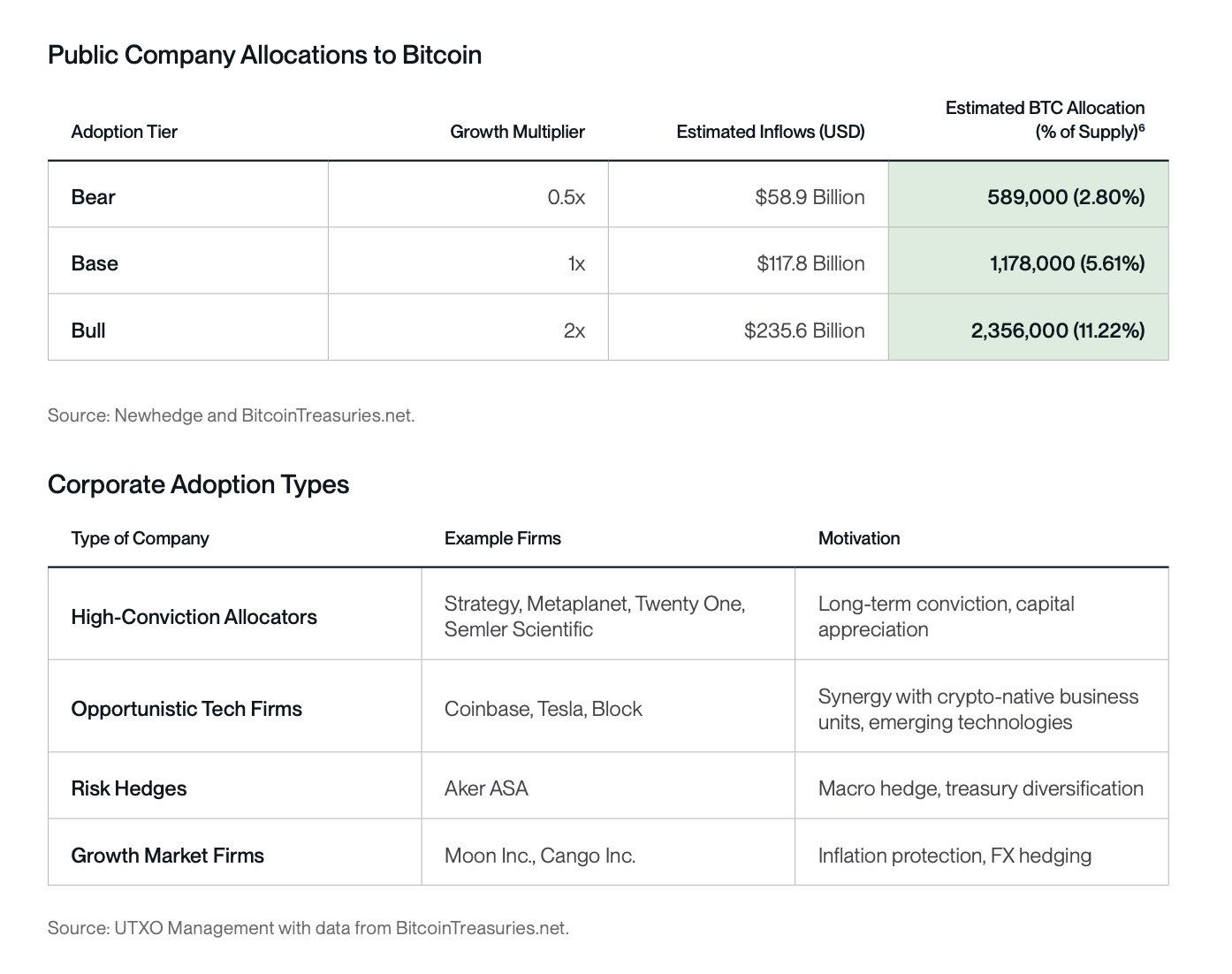

Major asset management platforms like Morgan Stanley and Fidelity have actively participated since 2024, with BlackRock’s Bitcoin ETF (IBIT) managing $71 billion worth of Bitcoin. Strategy, the leading institutional investor in Bitcoin ownership, has increased its holdings to 576,230 BTC, equivalent to $63.7 billion, accounting for 2.74% of the total supply and continuing to accumulate.

Newcomers like Metaplanet also try to collect or incorporate BTC as an asset on their balance sheets.

Public company allocations to Bitcoin. Source:

Bitwise Investments

Public company allocations to Bitcoin. Source:

Bitwise Investments

US states like Texas are not sitting on the sidelines. The state’s teacher retirement fund invests $500 million in Bitcoin ETFs. Sovereign wealth funds, such as Norway’s Norges Bank and the Abu Dhabi Investment Authority, have also experimented with Bitcoin allocations.

This institutional participation is creating significant pressure on Bitcoin’s supply. With 4.2 million BTC projected to flow into institutional hands, representing 20.3% of the total supply, and only about 164,250 BTC issued annually after the 2024 Bitcoin Halving with a block reward rate of 3.125 BTC, the market is already facing a severe supply shortage.

Potential institutional Bitcoin adoption by the end of 2026. Source:

Bitwise Investments

Potential institutional Bitcoin adoption by the end of 2026. Source:

Bitwise Investments

This may have contributed to Bitcoin’s strong price surge in May 2025, when it reached a new all-time high. Positive market developments and on-chain indicators support predictions that BTC could hit $200,000 in this cycle.

However, this wave also carries significant risks. The supply shortage could drive prices to soar, but the market could face significant volatility if major institutions sell off simultaneously. Regulatory risks are also a major concern, with the US SEC increasing scrutiny over Bitcoin ETFs, raising questions about the stability of institutional capital flows.

In addition, macro factors such as Fed interest rates are expected to remain unchanged in June 2025. This could slow capital flows into risky assets like Bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!