$7.24 Trillion Parked in Money-Market Funds: Bitcoin Breakout Imminent?

With $7.24 trillion parked in money market funds and global liquidity surging, analysts see growing potential for a Bitcoin price breakout amid monetary stimulus.

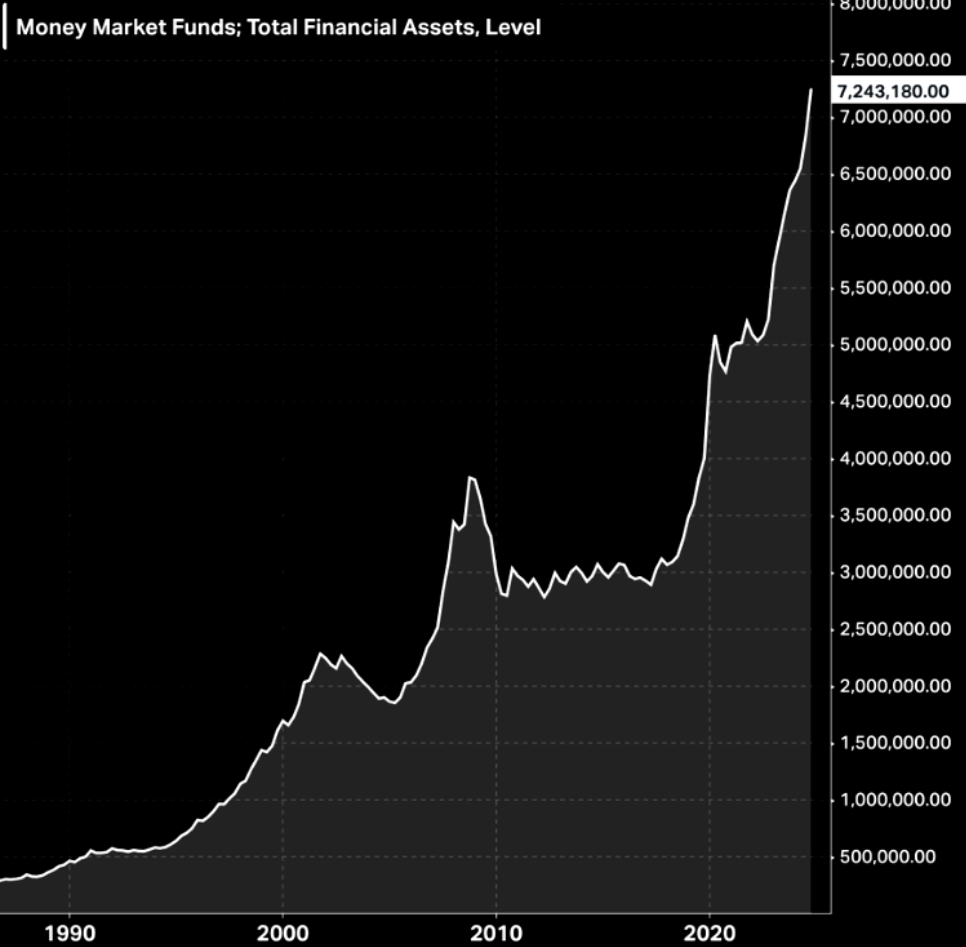

According to Barchart data, the total assets held in money market funds (MMFs) have soared to an all-time high of $7.24 trillion. This raises speculation that Bitcoin could soon benefit from sidelined liquidity.

Meanwhile, data also shows global liquidity rising to COVID-19 levels, adding credence to analysts’ bullish suppositions about Bitcoin and crypto.

$7.24 Trillion in Sideline Cash Sparks Bitcoin Speculation

Barchart indicates that liquidity held in MMFs has soared to an all-time high as investors seek safety amid economic uncertainty. MMFs are low-risk investments offering liquidity and yields.

$7.24 trillion sitting in MMFs. Source:

Barchart on X

$7.24 trillion sitting in MMFs. Source:

Barchart on X

Some analysts view this cash buildup as a signal of market hesitation that could pivot bullish. Meanwhile, others warn the narrative overstates investor readiness.

Crypto strategist SightBringer called the chart a “tension coil,” describing the current MMF levels as “stored disbelief” rather than safety. The analyst argues that even a modest rotation of 5% of MMFs into Bitcoin could ignite a new monetary regime.

“This isn’t just cash on the sidelines. It’s an ark of disbelief and once belief ignites, the dam breaks,” he posted.

According to SightBringer, traders are looking for a signal that could be decisive confirmation that Bitcoin is a reserve-grade asset in a world that is losing faith in traditional finance (TradFi).

“Liquidity doesn’t disappear. It waits. It watches. And then it floods with reflexive violence,” SightBringer added.

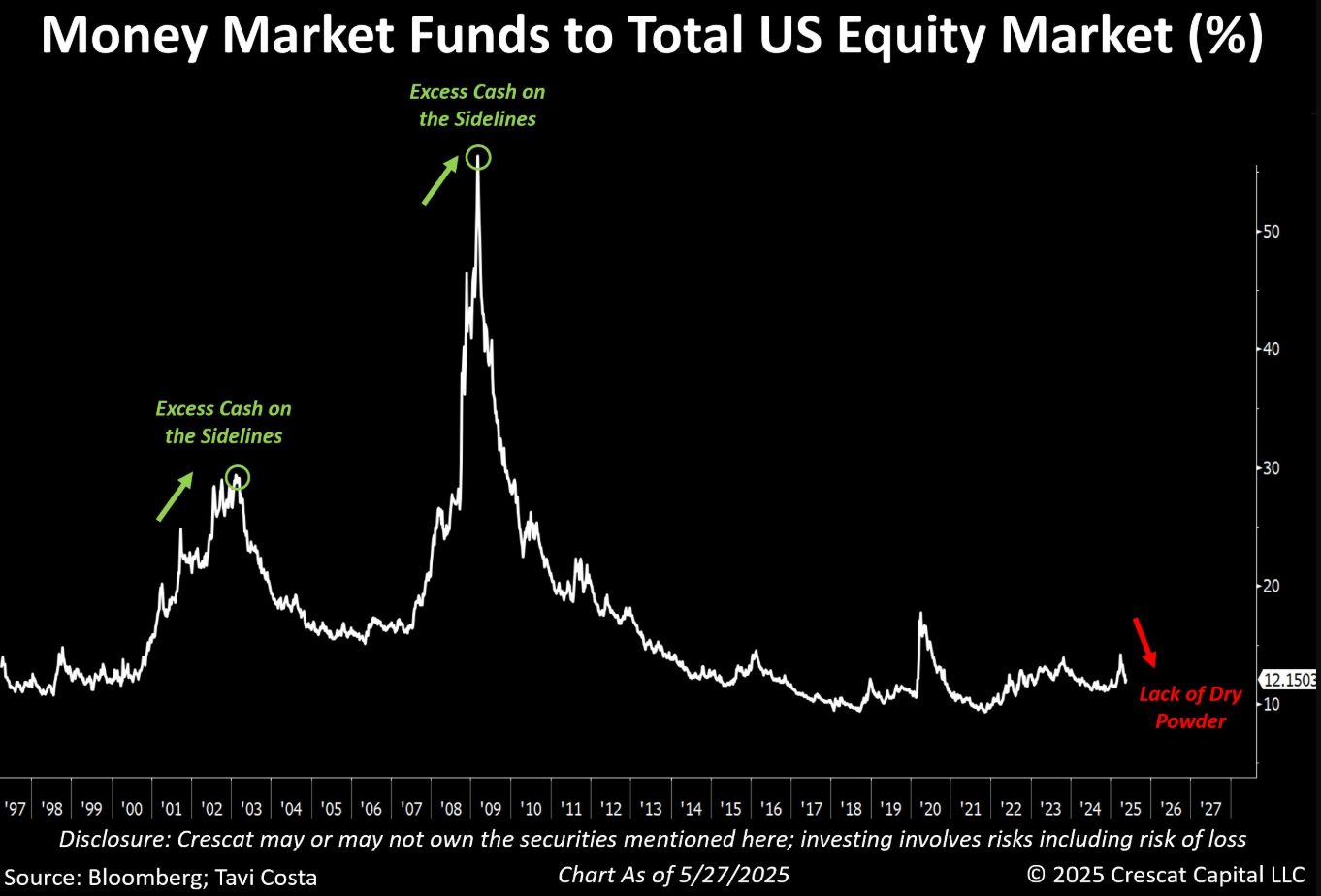

However, other analysts do not share this view. Macro analyst Otavio “Tavi” Costa countered that MMFs must be viewed in proportion to total market capitalization.

“At the bottom of the Global Financial Crisis, money market funds were 56% of US equity market. Today, we’re nowhere near that,” he stated.

MMFs to the overall market size. Source:

Analyst Otavio on X

MMFs to the overall market size. Source:

Analyst Otavio on X

The macro analyst argues that investors may have less dry powder than many believe relative to equity market size.

Despite the debate around the MMF narrative, data suggests that global liquidity is back and approaching levels not seen since the COVID-19 era.

Global Liquidity Surges: Echoes of 2020 and Bitcoin’s Historic Bull Run

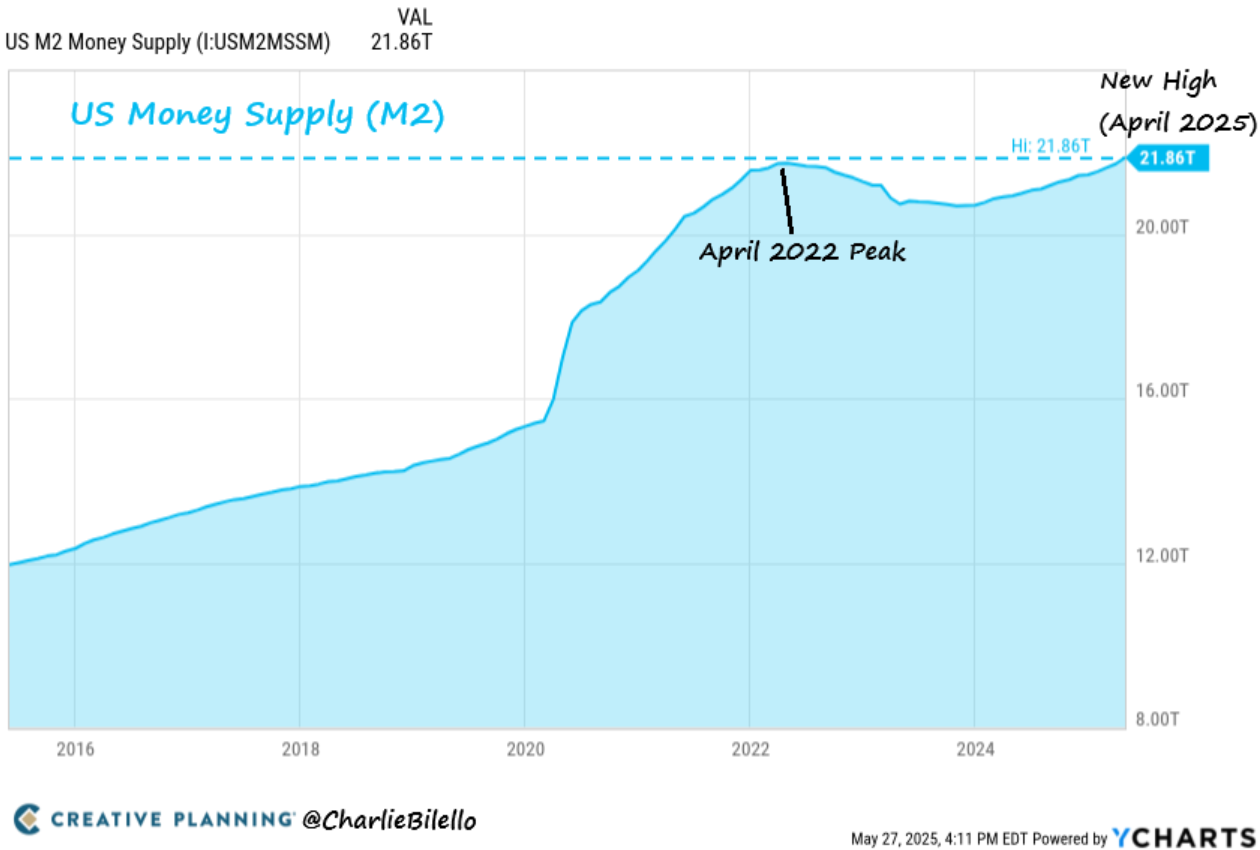

Elsewhere, recent data shows the US money supply hit a new all-time high in April 2025 for the first time in three years. Investor Charlie Bilello noted that “after a brief hiatus, money printing is back,” with liquidity ramping up beyond the US.

Global liquidity surges to a 3-year high. Source:

Charlie Bilello on X

Global liquidity surges to a 3-year high. Source:

Charlie Bilello on X

This suggests a resumption of monetary expansion, as the increase aligns with historical trends where M2 growth correlates with asset price rises.

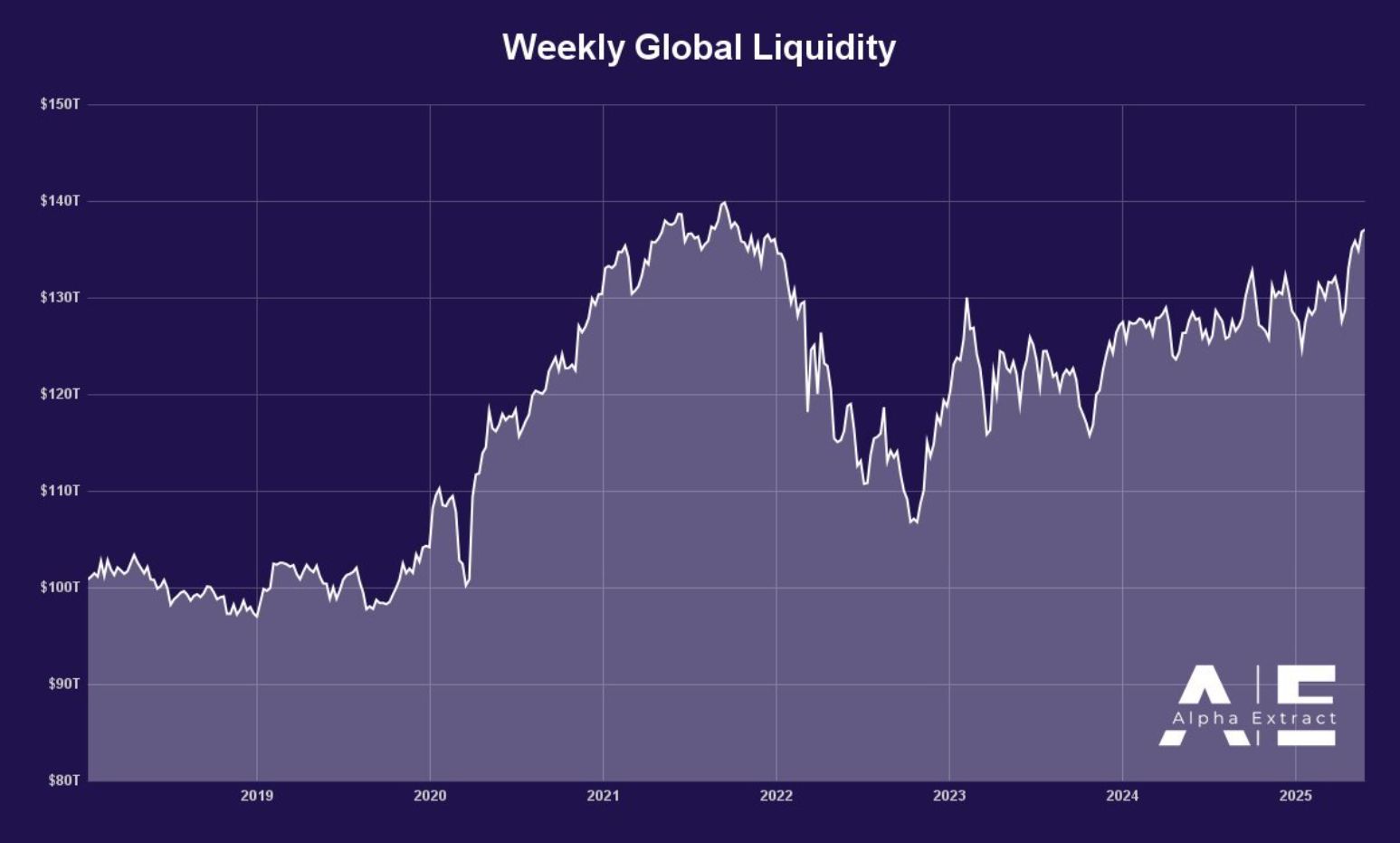

Meanwhile, analyst Crypto Dan observed that global liquidity is now nearing $140 trillion. Notably, this threshold is comparable to the era of unlimited quantitative easing in 2020–2021.

“It is also related to the overall rise in the cryptocurrency market,” he noted.

Global liquidity. Source:

Crypto Dan on X

Global liquidity. Source:

Crypto Dan on X

With inflation tamed but recession risks lingering, central banks in the US, China, and Europe have resumed stimulus efforts, quietly fueling asset prices. That bodes well for Bitcoin, which has historically surged alongside liquidity injections.

Research firm CrossBorder Capital emphasized that Bitcoin is “a true global asset that mainly responds to global liquidity,” with China continuing to play a pivotal role in these flows.

Julien Bittel, Head of Macro Research at Global Macro Investor (GMI), suggested Bitcoin may be entering the banana zone. This means a phase of explosive upward price movement driven by macro liquidity and market reflexivity.

Whether the $7.24 trillion in MMFs is a fuse or a false flag, the ingredients for a major crypto move align. These include rising liquidity, hesitant institutions, and a maturing Bitcoin narrative amid geopolitical and monetary uncertainty.

Nevertheless, the question is not whether it flows. Rather, it is what signals the fear, with traders and investors encouraged to do their own research.

Bitcoin (BTC) price performance. Source:

BeInCrypto

Bitcoin (BTC) price performance. Source:

BeInCrypto

As of this writing, Bitcoin was trading for $108,875, down by 0.7% in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TAUSDT now launched for futures trading and trading bots

Bitget to decouple loan interest rates from futures funding rates for select coins in spot margin trading

Bitget Launches HYPE On-chain Earn With 2.1~4.5% APR

New spot margin trading pair — ERA/USDT!