Federal Reserve Meeting Minutes: Options Pricing Suggests One to Two Rate Cuts This Year

The Federal Reserve meeting minutes indicate that the baseline policy path implied by option prices (representing the mainstream market expectation) slightly shifted downward during this period, suggesting a possible rate cut of 1 to 2 times (25 basis points each) by the end of the year—only slightly more than the expectation during the March FOMC meeting. The probability distribution of year-end rates implied by options has shifted to the left, with significantly increased downside risks. As the market perceives an increased risk of policy rate cuts, the expected policy path implied by the futures market has been adjusted downward more significantly, indicating approximately 3 rate cuts before the end of the year. However, the median baseline rate path shown by market expectation surveys has changed little, still suggesting 2 to 3 rate cuts this year. The survey notes that the divergence among respondents regarding the most likely policy path is widening. (Jin10)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AAVE surpasses 320 dollars

James Wynn: Missed the Shorting Opportunity, Will Wait Until the PUMP Fully Bottoms Out Before Considering Entry

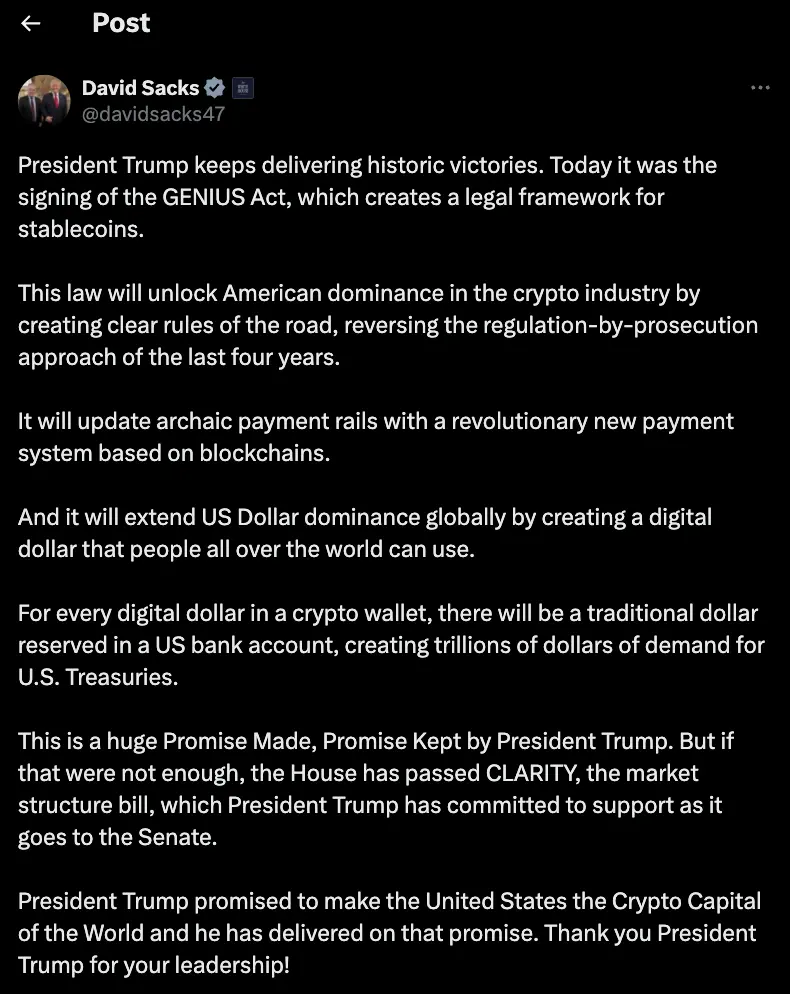

Crypto Czar David Sacks: The GENIUS Act Advances Digital Dollar and Stablecoin Legislation