The latest Labor Department data showed that the headline US Personal Consumption Expenditures (PCE) inflation has decreased for the second month to 2.1%, reported the Bureau of Economic Analysis on Friday. Moreover, the core PCE inflation in the United States has eased to 2.5%, the lowest since March 2021.

Following the release, Bitcoin price recovered slightly from the pullback that caused a broader crypto market crash earlier today. Besides, it appears that the large investors are likely to grab the buy-the-dip opportunity after retail and derivatives traders liquidate their holdings.

US PCE Inflation Comes in at 2.1%

The U.S. Bureau of Economic Analysis released the Federal Reserve’s preferred inflation gauge, US PCE data, on May 30. The annual PCE inflation comes in at 2.1%, lower than the market expectations, and down from 2.3% last month. Also, the month-over-month (MoM) inflation rose 0.1% from a flat reading in the previous month.

The annual core US PCE inflation data showed a decline of 2.5% from 2.6% in the previous month, in line with the market forecasts. The monthly US core PCE inflation comes in at 0.1%, up from a flat reading last month.

Wall Street Expectations of US PCE Inflation

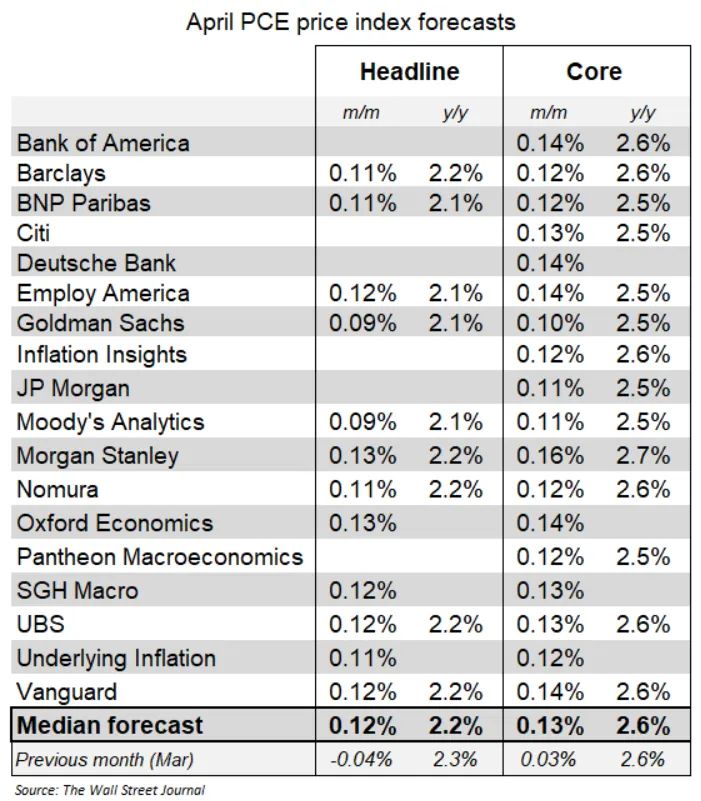

Wall Street giant Goldman Sachs estimated headline US PCE inflation to drop to 2.1% and monthly inflation to 0.09%. While JPMorgan, Morgan Stanley, UBS, Vanguard, and others predicted a 2.2% reading.

US PCE Estimates | Source: Wall Street Journal

US PCE Estimates | Source: Wall Street Journal

The financial services firms were mixed on core US PCE predictions, with Goldman Sachs and JPMorgan’s in line with economists. Whereas, Morgan Stanley forecasted a jump in core PCE inflation to 2.7%.

US Fed to Keep Interest Rate Unchanged

US Federal Reserve Chair Jerome Powell met with President Donald Trump on Thursday and said the monetary policy decisions, such as interest rates, will depend only on the upcoming economic data.

However, the CME FedWatch tool showed a 94.6% probability for the Fed to keep interest rates unchanged in the next FOMC meeting on June 18. The rates are expected to remain stable amid new inflation data and increasing uncertainty in the markets, as indicated by the CME data.

Bitcoin Recovers Slightly After PCE Data Release

BTC value today recovered slightly by 0.5% after the US PCE inflation data, with the price at $105,833 at the time of writing. The 24-hour low and high were $104,649 and $108,595, respectively.

On the other hand, the trading volume has increased by 18% in the past 24 hours, indicating interest among traders despite uncertainty. Amid this, popular analyst Michael van de Poppe pointed out that Bitcoin has lost the crucial support level as it fell today.

However, he added that the drop wasn’t as severe as it looked. He predicted the possibility of hitting a new all-time high if it reclaims the $106,500-107,000 level.

Bitcoin 4-Hr Chart | Source: Michael van de Poppe.

Bitcoin 4-Hr Chart | Source: Michael van de Poppe.

Bitcoin futures open interests also saw a slight rebound after the PCE inflation data release, according to Coinglass data. Total BTC futures open interest jumped 0.30% to $74.44 billion within just an hour of the data release.