A major Chainlink (LINK) whale has begun offloading tokens after more than a year of accumulation, raising concerns about increased sell pressure and a potential price downturn amid broader market weakness.

According to on-chain analytics firm Lookonchain, the whale transferred 403,000 LINK, worth approximately $5.87 million, from Kraken to Binance following a year-long accumulation spree during which they amassed 1.75 million LINK.

The investor originally purchased LINK tokens at an average price of $7.03, putting total realized gains around $12 million.

Sponsored

However, the whale still holds 1.35 million LINK, currently valued at $18.6 million, which may weigh on market sentiment if further liquidation occurs.

LINK Price Reacts

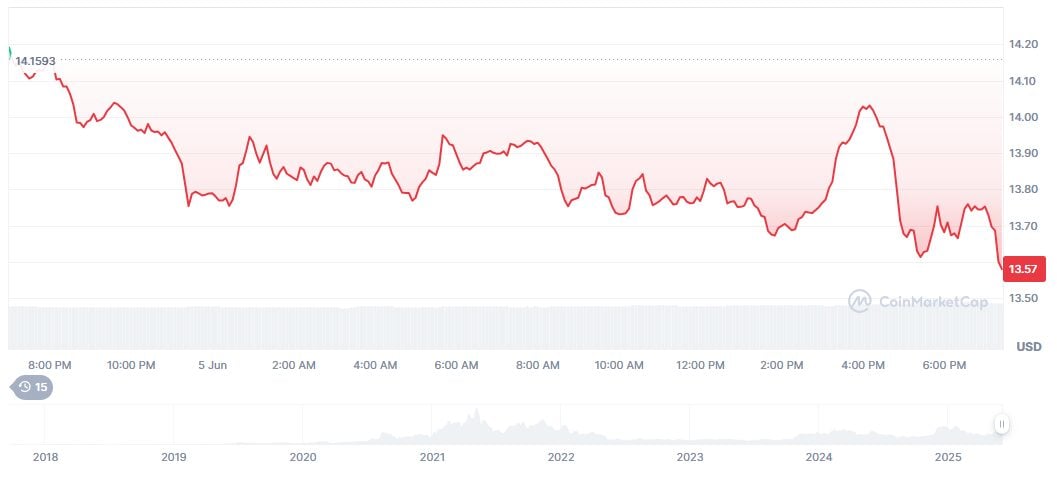

Chainlink’s price reacted swiftly, falling nearly 6% from $14.47 to $13.6 before the brief attempt to break above the $14 mark on Thursday.

Chainlink (LINK) price declined nearly 6% on Thursday. Source: CoinMarketCap .

Chainlink (LINK) price declined nearly 6% on Thursday. Source: CoinMarketCap .

The selloff occurs amid a broader crypto market cooldown, with the overall market declining 1.6% to $3.26 trillion, as most traders lock in gains from the early 2023 rallies.

Opinions are divided on the whale’s strategy. While some see it as a smart exit, others view it as a bearish signal.

“Sizable LINK transfers signal imminent sell-side liquidity, adding to the current slide in price, volume, and open interest,” comments AlvaApp official X account, adding that technical indicators hint at short-term volatility over accumulation.

Despite that, the Chainlink (LINK) price remains above a major support line of $ 12.50. This level has historically acted as both resistance (2020–2021) and support (2022–2023 and early 2025).

LINK price nears the major support. Source: TradingView

LINK price nears the major support. Source: TradingView

On the weekly timeframe, the Relative Strength Index (RSI) stands at 44.98, near the lower end of the neutral range, indicating waning bullish momentum. While not yet in oversold territory, the RSI suggests that further downside is possible before any meaningful reversal signals emerge.

Meanwhile, the MACD line (-0.13) remains below the signal line (-0.59), with both positioned beneath the zero line. This configuration points to sustained negative momentum and increases the likelihood of short-term downside continuation.

A breakdown below the key support level could confirm a mid-term bearish reversal. Conversely, if this support holds, it may signal bottoming behavior and set the stage for potential accumulation.

On The Flipside

- Ronin Bridge recently completed its migration to Chainlink’s Cross-Chain Interoperability Protocol (CCIP), moving $450 million in assets to enhance cross-chain reliability.

Dig into DailyCoin’s popular crypto news:

Apex Fusion Unveils Decentralized Cross-Chain Bridges Reactor and Skyline

Bitcoin Breaks Into Big Banking: JPMorgan Approves ETF Collateral

FAQs

Chainlink’s LINK token launched in September 2017, raising $32 million through its initial coin offering (ICO). The Chainlink network itself, which provides oracle services for smart contracts, officially went live in 2019.

Chainlink can be a strong long-term investment due to its critical role in enabling smart contracts through decentralized oracles. However, like all cryptocurrencies, it carries risks tied to market volatility, competition, and adoption. Always do your own research.