Greeks.Live: Institutions Have Low Expectations for Bitcoin's Recent Rapid Rise, More Anticipate Long-term Moderate Growth

Greeks.Live analyst Adam posted on social media stating, "Options expiration data for June 6: 31,000 BTC options expired, with a Put Call Ratio of 0.71, a max pain point of $105,000, and a nominal value of $3.18 billion. 241,000 ETH options expired, with a Put Call Ratio of 0.63, a max pain point of $2,575, and a nominal value of $590 million.

For most of this week, the market was mainly volatile. Last night, due to the publicized conflict between Trump and Musk, Tesla's significant drop led to a noticeable pullback in both the US stock and crypto markets. Looking at the main expiration data, the expiration volume is about 10% of the total open interest. After weeks of decline, this week saw a rebound. Additionally, several large orders this week are worth noting, indicating increased market activity. Overall, crypto institutions have low expectations for a rapid rise in Bitcoin in the near term, with more anticipation for a moderate long-term increase."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: Fidelity-linked wallet deposits 14,978 ETH worth $53.57 million to an exchange

Data: Upexi’s SOL Holdings Surpass 2 Million, Over 1.26 Million Added in July

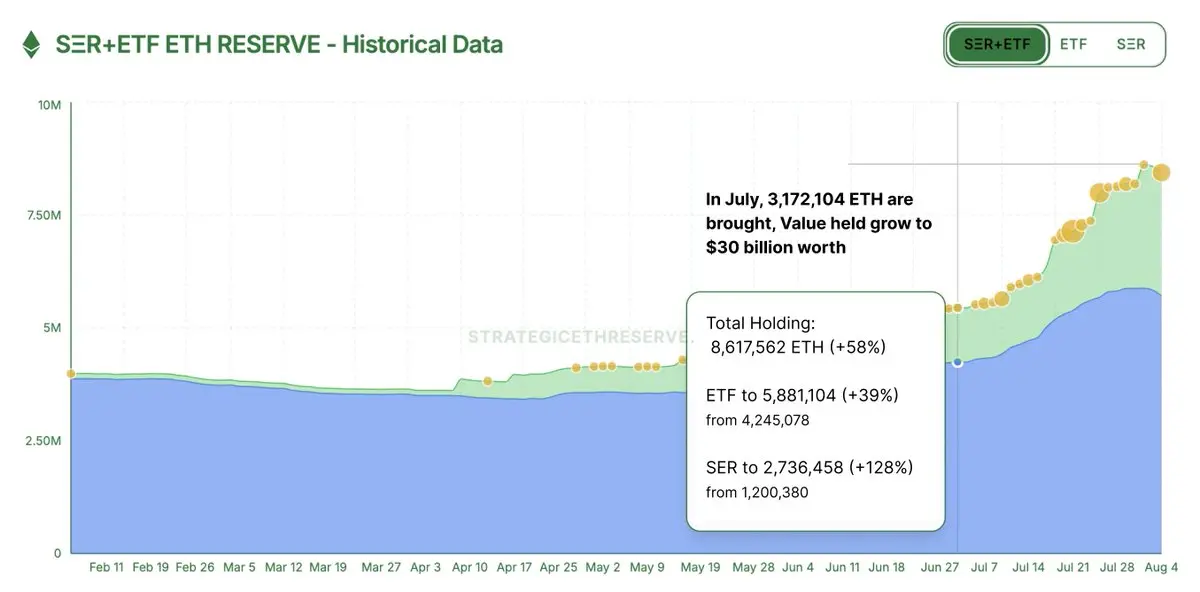

Data: July Market Demand for ETH Reaches 3 Million, Half Sourced from Ethereum Reserve Companies