Research Report|FLock.io Project Overview & $FLOCK Valuation Analysis

1. Project Overview

2. Key Highlights

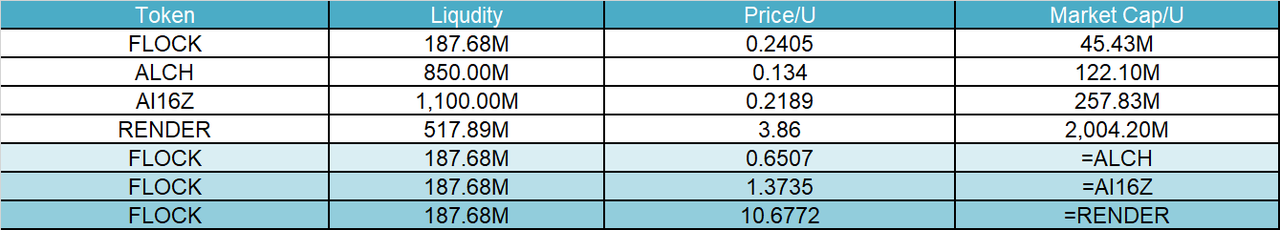

3. Valuation Outlook

4. Tokenomics

-

Community: 47.00% (470M)

-

TGE Unlock: 10.64% (50M)

-

Cliff: 0 months; Vesting: 60 months linear

-

-

Team & Advisors: 17.00% (170M)

-

TGE Unlock: 0%

-

Cliff: 12 months; Vesting: 24 months; Total: 36 months

-

-

Ecosystem: 19.70% (197M)

-

TGE Unlock: 40% (78.8M)

-

Cliff: 0 months; Vesting: 48 months

-

-

Investors: 16.30% (163M)

-

TGE Unlock: 0%

-

Cliff: 12 months; Vesting: 24 months; Total: 36 months

-

-

Task Participation & Contribution Rewards

-

All participants (devs, validators, nodes, delegators) must stake/use $FLOCK to join tasks.

-

Data contribution, training, and validation are rewarded with $FLOCK, establishing a positive feedback loop.

-

-

Payment & Usage

-

$FLOCK is used to access hosted models on the AI Marketplace—covering API calls, inference requests, custom model builds, etc.

-

Developers pay $FLOCK for model deployment and access, generating usage-side demand.

-

-

Task Bounties & Delegation

-

Task creators can set bounties in $FLOCK to attract high-quality node operators for training/validation.

-

Users can delegate $FLOCK to validators or nodes and share in rewards, improving accessibility and token utilization.

-

-

Community Governance

-

Token holders can participate in FLock DAO to propose/vote on protocol upgrades, parameters, new features, etc.

-

$FLOCK holders drive protocol direction, emphasizing governance utility.

-

-

Staking & Security

-

Nodes must stake $FLOCK to train/validate models; malicious behavior is punished via slashing.

-

This ensures trust and reliability while rewarding honest contributors.

-

5. Team & Funding

-

Seed Round (Mar 2024): $6M

-

Investors: DCG, OKX Ventures, Faction, Volt Capital, Inception Capital, Hyperithm, Tagus Capital

-

-

Strategic Round (Dec 2024): $3M

-

Investors: DCG, Animoca Brands, Fenbushi Capital, GSR, Gnosis VC, Bas1s Ventures

-

6. Risk Factors

-

Multilateral Incentive Risks: While FLock’s incentive model effectively engages developers, validators, and delegators, it could attract strategic exploitation—e.g., spam models, incentive farming, validation manipulation. If not mitigated, these behaviors may cause negative feedback loops.

-

Ecosystem Participation Dependence: FLock’s model heavily depends on community-driven training, validation, and governance. Attracting and retaining high-quality node operators is critical. Without sufficient activity, the platform may face both underperformance in model quality and governance inefficacy.

7. Official Links

-

Website: https://www.flock.io/

-

Twitter: https://x.com/flock_io

-

Telegram: https://t.me/flock_io_community

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How to achieve an annualized return of 40% through arbitrage on Polymarket?

By demonstrating arbitrage structures with live trading, this provides a clear reference for the increasingly intense arbitrage competition in the current prediction markets.

Interpretation of ZAMA Dutch Auction Public Sale: How to Seize the Last Interaction Opportunity?

ZAMA will launch a sealed-bid Dutch auction based on fully homomorphic encryption on January 12, selling 10% of its tokens to achieve fair distribution, with no front-running and no bots.

Standard Chartered Bank lowers its 2025 Bitcoin price forecast to $100,000.