Traders Lean Towards Betting That the Fed Will Only Cut Rates Once in 2025

According to a report by Jinse Finance, traders are increasingly betting that the Federal Reserve will only cut interest rates once this year, amid signs of resilient economic growth and persistent inflation. The U.S. will release May's CPI data on Wednesday, which is expected to show an increase. As the Federal Reserve is assessing the impact of tariffs, this will reinforce the central bank's cautious stance on further easing of monetary policy. It is widely expected that the Federal Reserve will keep rates steady next week. Futures and options tracking the expected path of Federal Reserve policy show that traders are moving to remove the rate cut premium for the coming months. Swap traders now anticipate a rate cut of about 0.45 percentage points by the end of the year, the smallest expected rate cut since President Trump announced high tariffs in early April.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

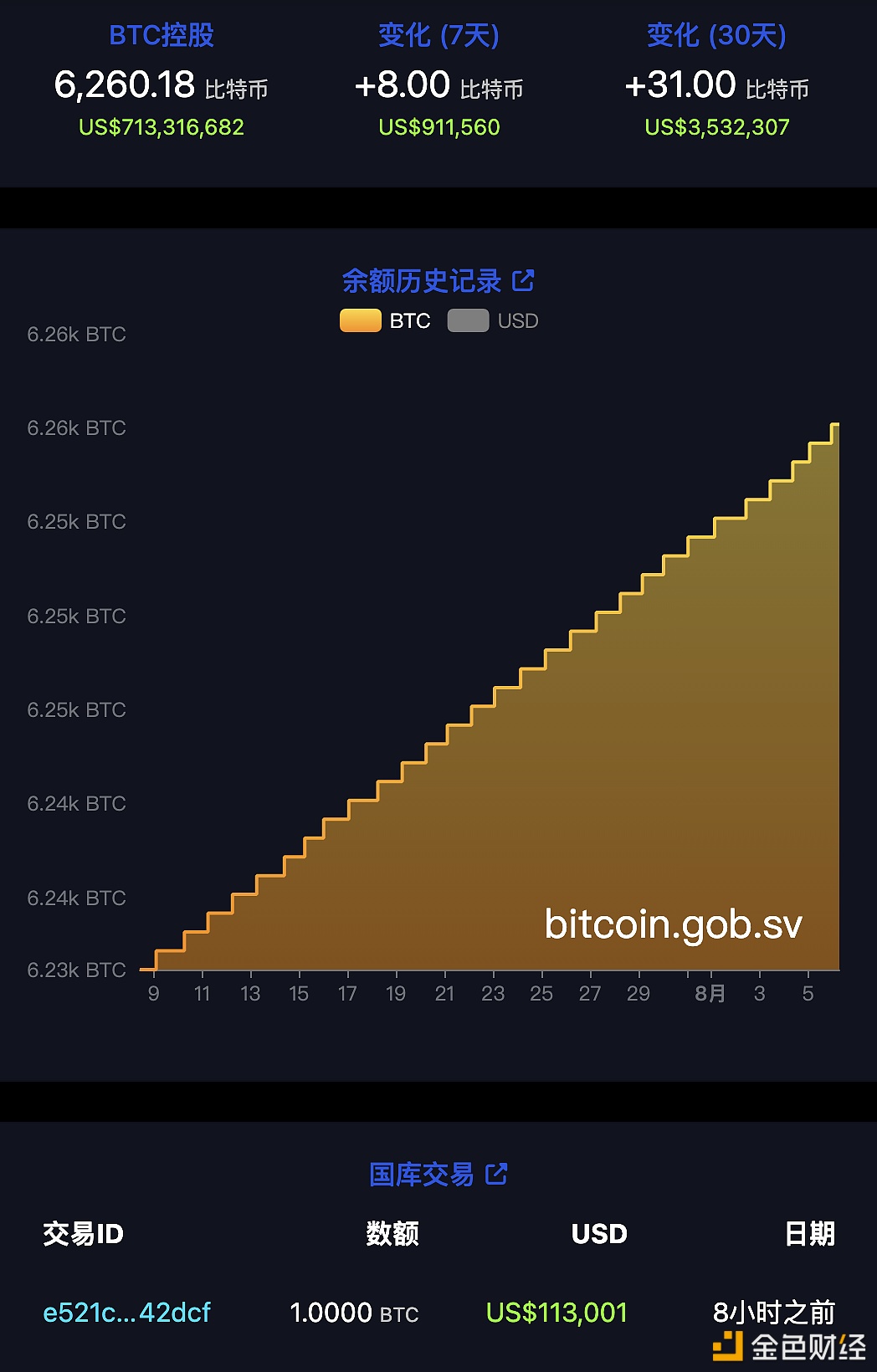

El Salvador's Bitcoin Holdings Reach 6,260.18 BTC

Anthropic launches the more powerful AI model Opus 4.1 ahead of competitors

Bank of America CEO: The Federal Reserve Will Cut Interest Rates in 2026