Ethereum Crashes 10% as Israel-Iran Conflict Sparks Market Turmoil

Ethereum’s price has dropped sharply amid rising geopolitical tensions between Israel and Iran. Market indicators suggest continued bearish sentiment, with traders betting on further losses.

Today, Ethereum has suffered a double-digit price decline as escalating geopolitical tensions between Israel and Iran rattle investor confidence across global markets.

On-chain data reveals that ETH’s sharp decline has sparked a surge in short positions across its futures market, signaling that many traders are now betting on further price losses.

ETH Crashes Amid Middle East Turmoil

The airstrike launched by Israel on Friday has intensified fears of broader conflict in the Middle East, sending shockwaves through both traditional and digital asset markets.

ETH, the second-largest cryptocurrency by market cap, has been hit hard, plunging over 10% in the past 24 hours as traders respond to growing geopolitical uncertainty.

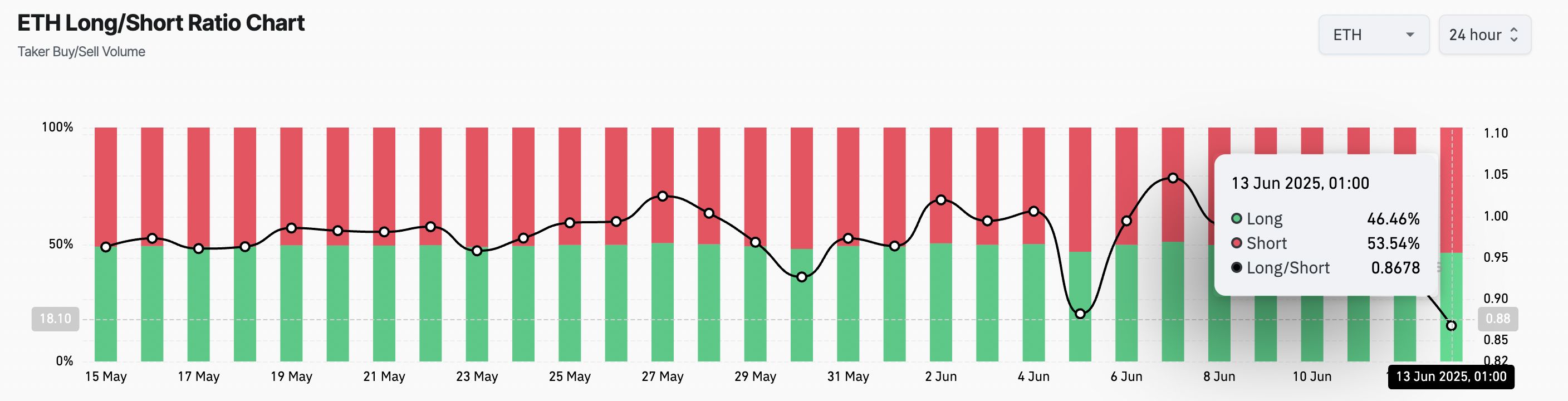

On-chain data suggests that many traders expect this price dip to continue, as reflected by the coin’s long/short ratio readings. At press time, this stands at 0.86, indicating more traders are betting against the altcoin.

ETH Long/Short Ratio. Source:

Coinglass

ETH Long/Short Ratio. Source:

Coinglass

This ratio compares the number of long and short positions in a market. When an asset’s long/short ratio is above 1, there are more long than short positions, indicating that traders are predominantly betting on a price increase.

Conversely, as seen with ETH, a ratio below one indicates that most traders are positioning for a price drop. This shows the heightening bearish sentiment and growing expectations of a continued decline.

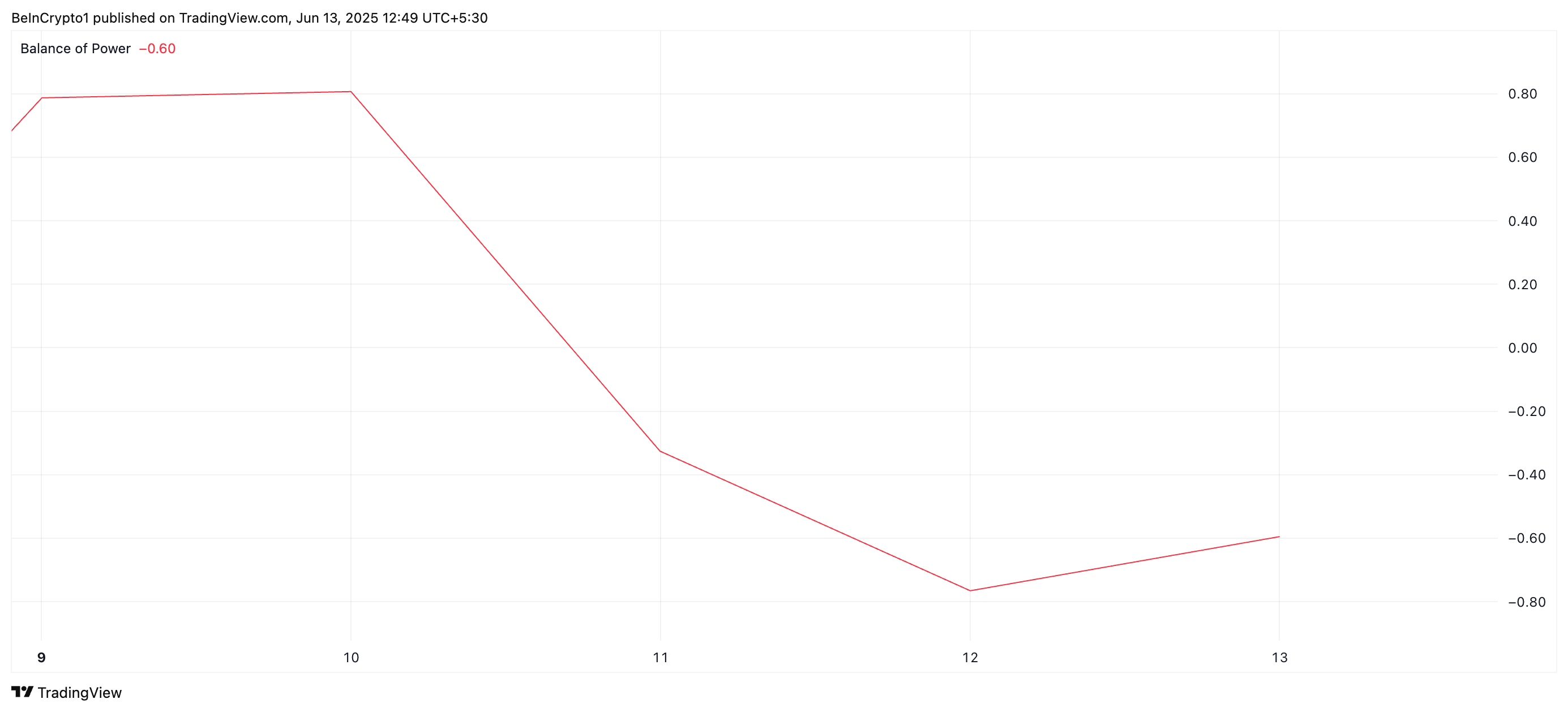

Furthermore, ETH’s negative Balance of Power (BoP) supports this bearish outlook. At press time, this momentum indicator is at -0.69, confirming the waning demand for the leading altcoin among market participants.

ETH BoP. Source:

TradingView

ETH BoP. Source:

TradingView

The BoP indicator measures the strength of buyers versus sellers in the market. A negative BoP reading suggests that selling pressure dominates, indicating a lack of fresh demand and a higher likelihood of continued price decline.

Market Awaits ETH’s Next Move

At press time, ETH trades at $2,523, holding just above the support floor at $2,424. If sell-side pressure strengthens, the coin could break below this floor, potentially triggering a further drop toward $2,027.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

Conversely, a renewed wave of buying interest could invalidate the bearish outlook. In that case, ETH might rebound and rally toward $2,745.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Philippines’ budget office launches Polygon blockchain system to track government and public funds

Share link:In this post: The Philippines has launched a blockchain system on Polygon to track and verify government spending. The system connects the DBM’s internal processes to a public ledger using BYC’s Lumen and Prismo Protocol. This move aims to eliminate document fraud and restore public trust in government financial transparency, with plans to include procurement, inventory, and real-time auditing.

Russia mulls deadline to end support for Mastercard and Visa cards

Share link:In this post: Bank of Russia to scrap cards issued by Visa and Mastercard. Russia’s monetary authority is to set expiry dates for the foreign payment cards. The central bank invites Russians to replace their Visas and Mastercards with Russian Mirs.

Amazon reports stronger-than-expected Q2 earnings, credits revenue growth to AI

Share link:In this post: Amazon’s Q2 2025 revenue rose 13% to $167.7 billion, driven by AI and strong AWS performance. Net income increased to $18.2 billion, while operating income hit $19.2 billion, both beating last year’s numbers. Prime Day broke records, new AI tools launched, and satellite and streaming projects expanded.

Michael Saylor’s Strategy sees all-time high revenue growth in Q2 thanks to Bitcoin purchases

Share link:In this post: Strategy reported $14.03B in Q2 operating income and $10.02B in net income, driven by Bitcoin gains. The company holds 628,791 BTC at a total cost of $46.07B and saw a $13.2B BTC dollar gain YTD. Over $10.5B was raised via stock offerings in Q2 and July, including IPOs and ATM programs.