H100 Group and Adam Back Plan to Raise 750 Million SEK for Bitcoin Acquisition

Odaily Planet Daily News: According to an official announcement, Swedish listed company H100 Group AB has signed a new round of investment agreement with Bitcoin pioneer Adam Back. The company will raise up to SEK 750 million (approximately USD 70.4 million) through a convertible loan to support its Bitcoin asset allocation strategy.

Under the agreement, Adam Back will subscribe SEK 150 million in the sixth round of financing. The subsequent two rounds (seventh and eighth) may each reach up to SEK 75 million, with Adam Back holding both priority and mandatory subscription rights. The conversion price for the current sixth round is set at SEK 6.38 per share, representing a 33% premium over the closing price on June 13. The conversion prices for the following rounds are SEK 8.48 and SEK 11.27 per share, respectively.

The H100 board stated that the conversion pricing reflects market conditions, and the choice of this financing structure is aimed at quickly securing funds and bringing in strategic investors with aligned values. This supports the company’s long-term Bitcoin reserve strategy while avoiding the complexity and high costs of traditional equity financing processes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

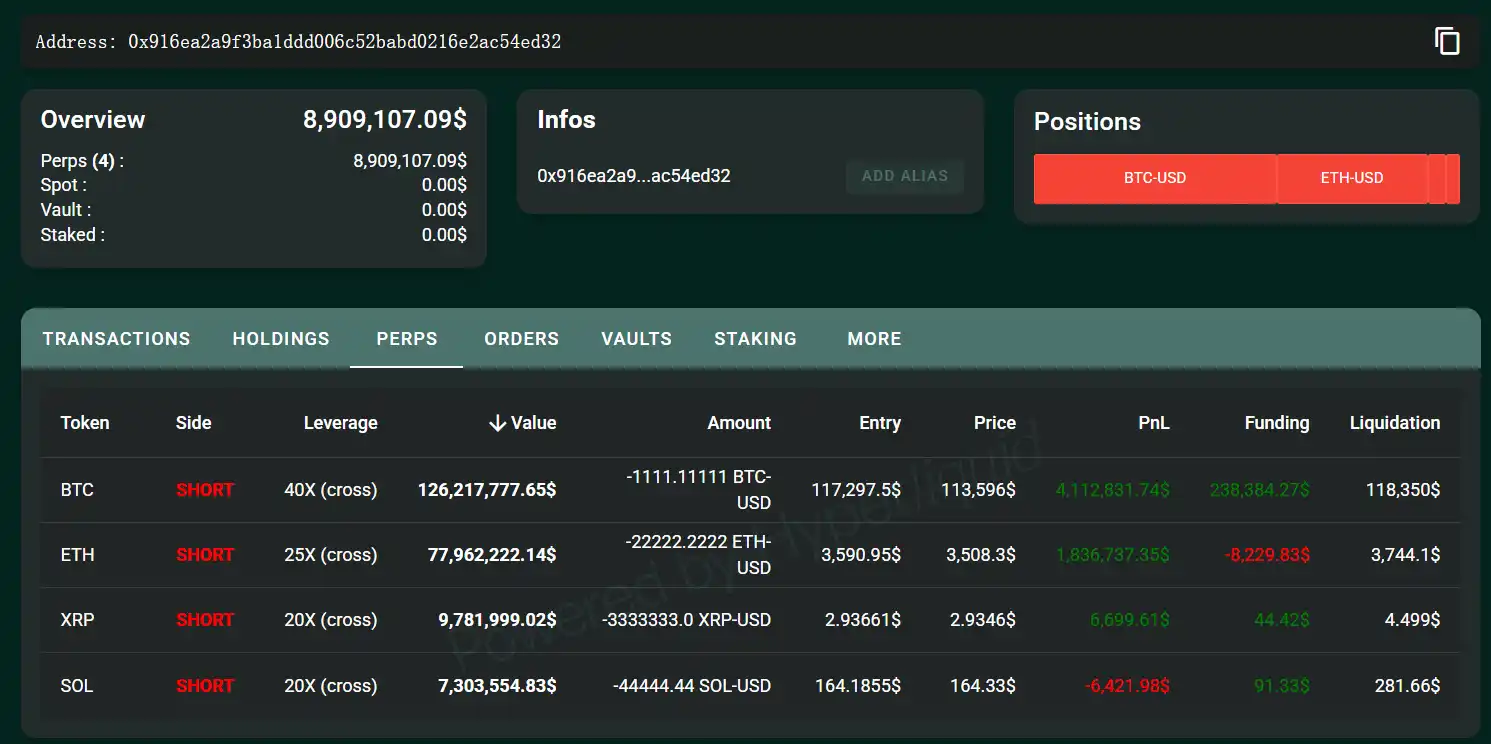

"Insider Trader" Adds New Short Positions on XRP and SOL, Total Unrealized Profit Approaches $6 Million

Trump Tariffs Deal Heavy Blow to Berkshire Hathaway’s Consumer Goods Business