Solana 'makes sense' as treasury asset amid outpacing ETH, says Cantor

Quick Take Cantor Fitzgerald analysts said Solana “makes sense” as a treasury asset over Ethereum, despite Ethereum’s broader adoption and higher total value locked. The firm initiated coverage on three companies stockpiling Solana: DeFi Development Corp., Upexi, and SOL Strategies.

Cantor Fitzgerald said Monday it has begun covering three Solana treasury companies, citing what it sees as the advantages of stockpiling the cryptocurrency.

The investment bank initiated coverage of DeFi Development Corp. , Upexi, and Sol Strategies — three companies aiming to replicate the success of Strategy, the Bitcoin-focused treasury firm that has seen its market cap and share price surge alongside the price of BTC.

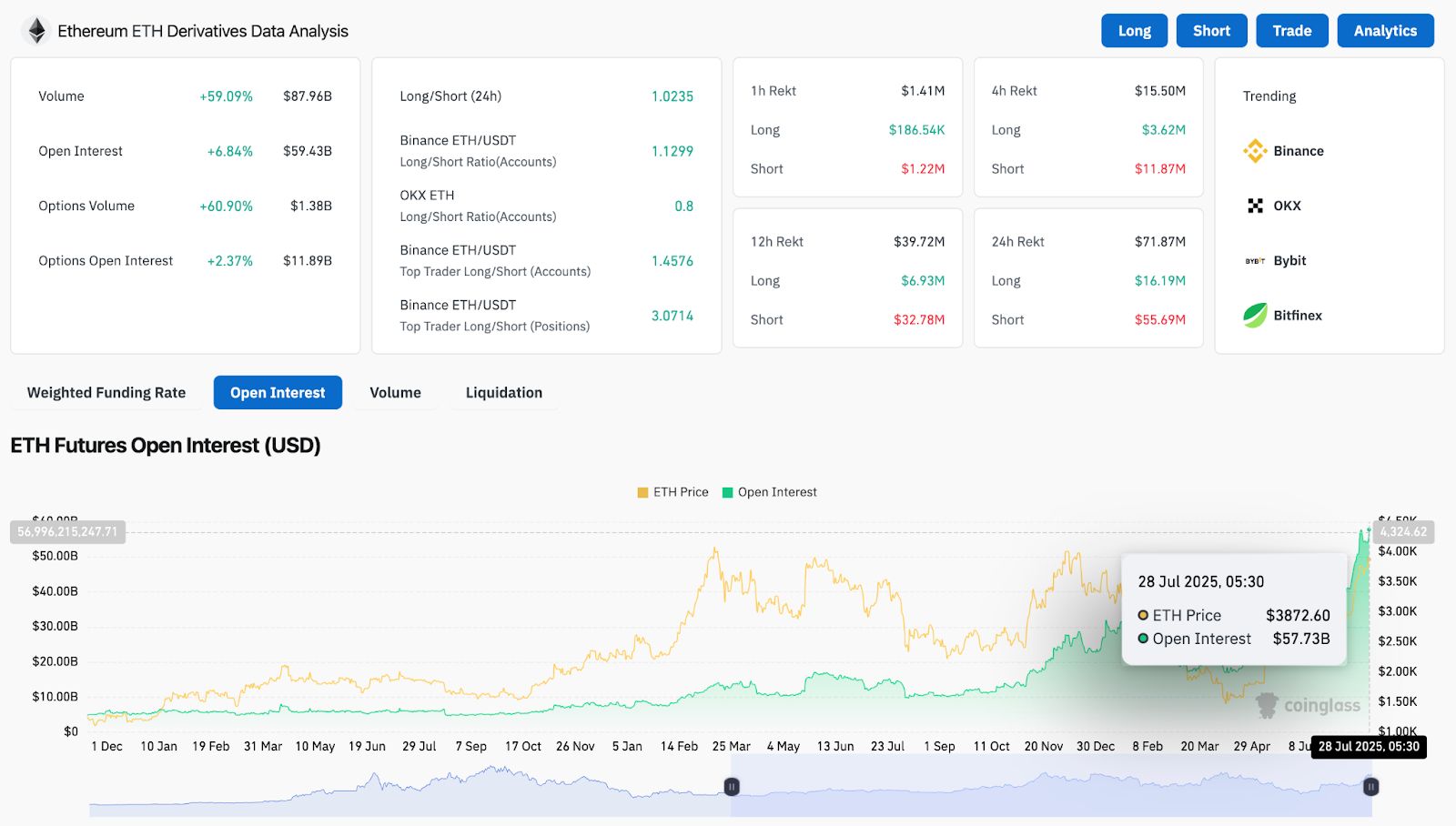

Although Cantor analysts said they don’t view Solana as a reserve asset akin to Bitcoin, they see SOL as superior to its main rival, Ethereum, despite Ethereum having a longer track record and a larger total value locked (TVL).

"Developer growth on SOL has far exceeded that on ETH recently, and we expect this to continue," the analysts said in their note. "Using SOL over ETH as a treasury asset makes sense: these businesses think that SOL can overtake ETH, which currently has a market cap that is ~259% higher."

"If BTC has solidified itself as the foundational reserve currency, or asset, for the digital economy, Solana aims to be the technology that powers transactions and marketplaces in the digital economy," the analysts also said. "We believe SOL treasury companies are betting the future of finance will be on-chain and that the chain of choice will be Solana."

Some smaller companies announcing ambitious plans to accumulate large amounts of cryptocurrency, however, might not have legitimate intentions , Matthew Sigel, VanEck's Head of Digital Assets, said last week.

Solana treasury companies

DeFi Development Corp., which began buying Solana in April, has acquired more than 620,000 SOL since adopting its new strategy, Cantor noted. The company has also developed a liquid-staking token, acquired two validators, and formed new partnerships to embed itself in the Solana ecosystem further. Cantor set a $45 price target on the company’s shares, which were up more than 20% to $31.25 as of 3:46 p.m. ET, according to Yahoo Finance.

Upexi, another firm now under Cantor’s coverage, had fallen nearly 3% to $9.76 per share by the same time. Cantor’s target for Upexi is $16.

The final company, Canada-based SOL Strategies, is expected to rise from about C$2 to C$4, according to Cantor.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether Mints Another 1B USDT, Total Hits 8B in July

Tether has minted 8 billion USDT since July 1, with the latest 1 billion minted recently. What’s driving this massive expansion?Tether’s Rapid USDT Expansion Raises EyebrowsWhat’s Fueling This USDT Surge?Transparency and Impact on the Market

Bitcoin Hashrate Reaches New All-Time High 🚀

Bitcoin’s hashrate hits a new all-time high, showing strong network health and miner confidence.Why the Bitcoin Hashrate MattersWhat This Means for Investors and Miners

Bitcoin Surpasses $121,000: Major Liquidation Pressure

Ethereum (ETH) Price Prediction for July 28, 2025: ETH Blasts Past $3,900 As Bulls Eye $4,089 Liquidity Zone