Bitcoin Mining Cost Surges Over 34% as Hashrate Hits New Highs

Bitcoin mining costs jumped 34% amid record hashrate and falling rewards. Miners now turn to AI and yield strategies to stay afloat.

The Bitcoin mining industry is undergoing a turbulent period, marked by soaring production costs and a record-breaking network hashrate.

This surge reflects not only the pressure from the all-time high network difficulty but also rising energy costs and fierce competition among mining companies.

How Much Does It Cost to Mine One Bitcoin in 2025?

According to the latest report from TheMinerMag, the average cost to mine one Bitcoin rose from $52,000 in Q4 2024 to $64,000 in Q1 2025. It continued to climb past $70,000 in Q2 2025, a jump of over 34% in just two quarters.

“First-quarter filings from major Bitcoin mining companies highlight a rising cost of production, driven by both the surging network hashrate and, in some cases, higher energy prices,” the report explained.

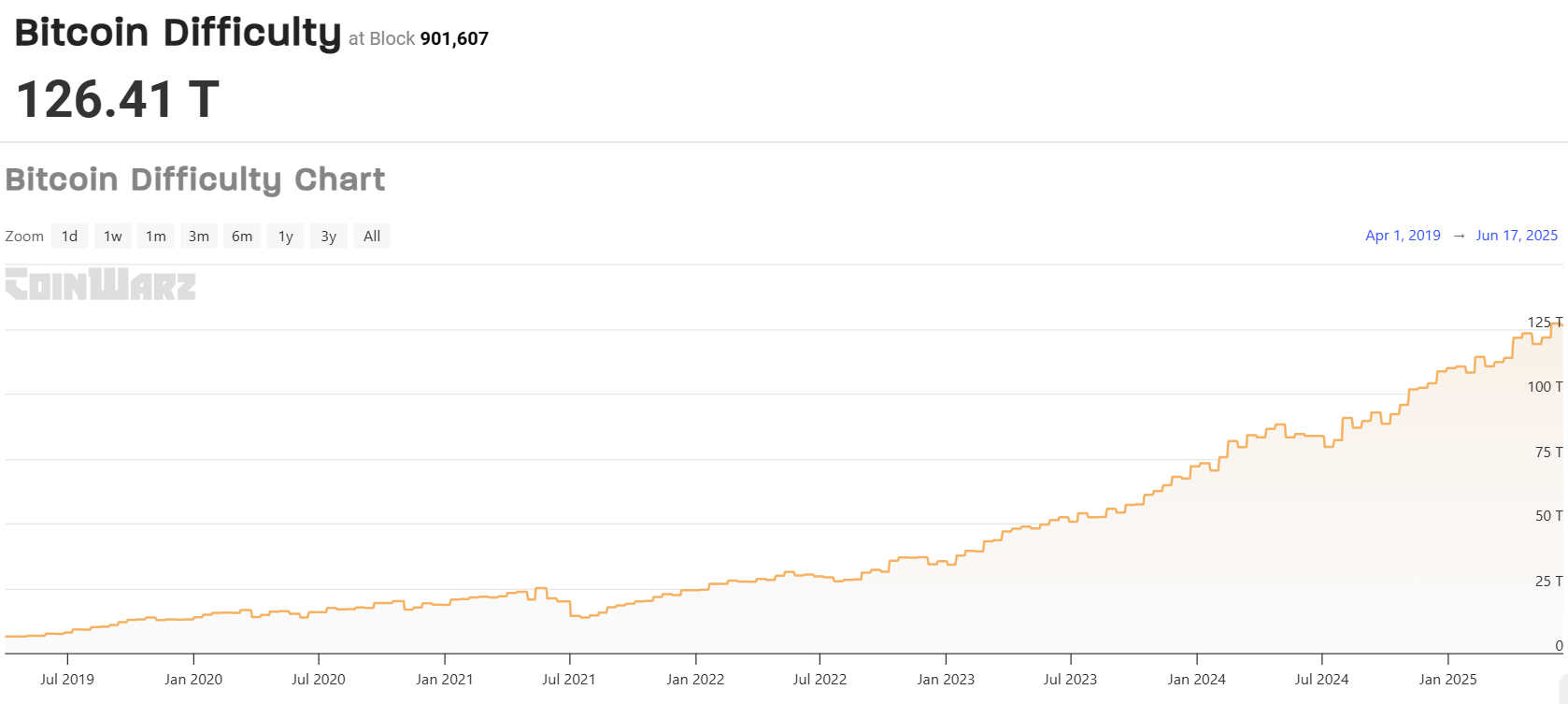

TheMinerMag noted that Bitcoin’s mining difficulty has exceeded 126 trillion. Data from Coinwarz supports this, with charts showing a sharp increase in recent years.

Bitcoin Mining Difficulty. Source:

Coinwarz

Bitcoin Mining Difficulty. Source:

Coinwarz

Bitcoin mining difficulty measures how hard it is to find a valid block on the Bitcoin network. It doesn’t have a specific physical unit. Instead, it’s a relative index compared to Bitcoin’s original difficulty when the genesis block was mined in 2009. A difficulty of 126 trillion means it is now 126 trillion times harder than at the beginning.

What’s Driving This Difficulty Surge?

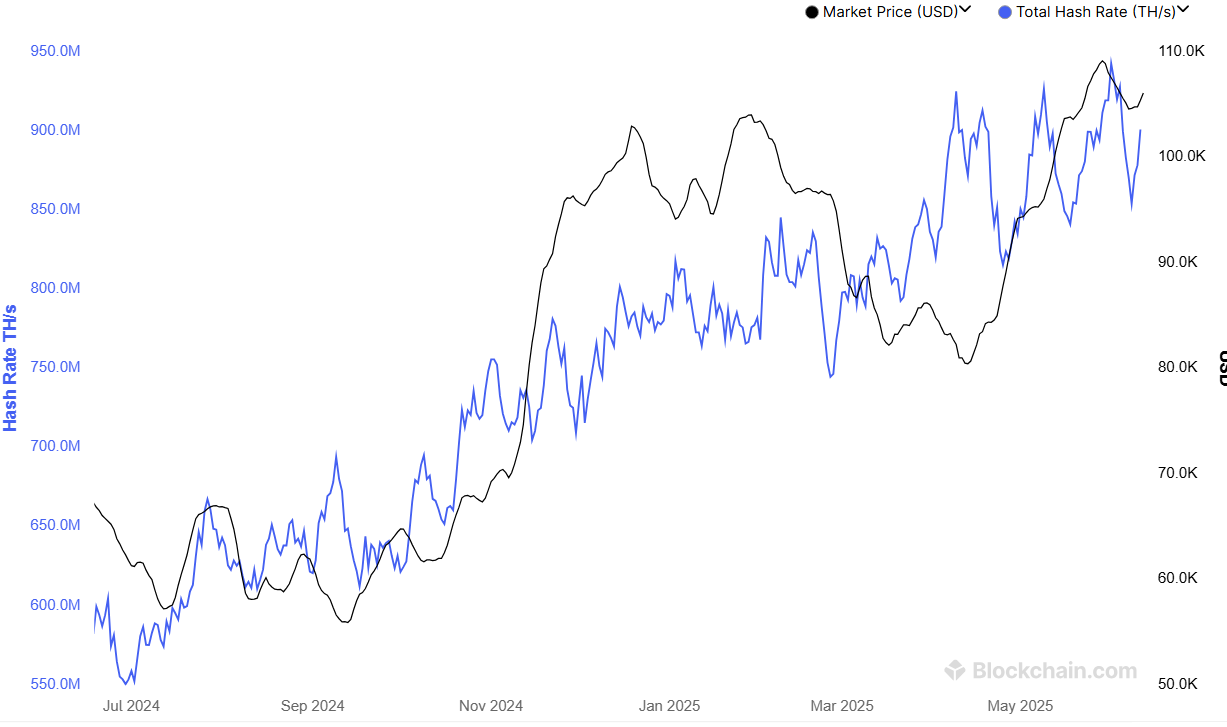

The increase in difficulty is fueled by a 14-day average hashrate reaching 913.54 EH/s, just 10% short of the zetahash milestone (1,000 EH/s).

Bitcoin Hashrate. Source:

Blockchain.com

Bitcoin Hashrate. Source:

Blockchain.com

Hashrate represents the computing power of the entire network to perform hash operations and find valid blocks. A higher hashrate means more miners, tougher competition, and smaller profit margins.

TheMinerMag attributes the rising hashrate to rapid expansion by large mining firms.

“The recent rise in Bitcoin’s network hashrate has been driven largely by public mining companies scaling and energizing new capacity. Leading firms such as MARA, CleanSpark, IREN, and Riot have all reported increases in realized hashrate,” the report added.

However, while hashrate growth strengthens the network, it comes at a cost. Hashprice — a metric that measures how much a miner can earn per unit of hashrate — has dropped to just $52 per PH/s.

Bitcoin Hashprice Index. Source:

Hashrateindex

Bitcoin Hashprice Index. Source:

Hashrateindex

More concerningly, TheMinerMag revealed that Bitcoin transaction fees have plummeted. Fees made up only 1.3% of block rewards in May and fell below 1% in June — a historic low. This puts added financial pressure on miners, who rely heavily on block rewards to cover costs.

Bitcoin Mining Firms Diversify Amid Rising Competition

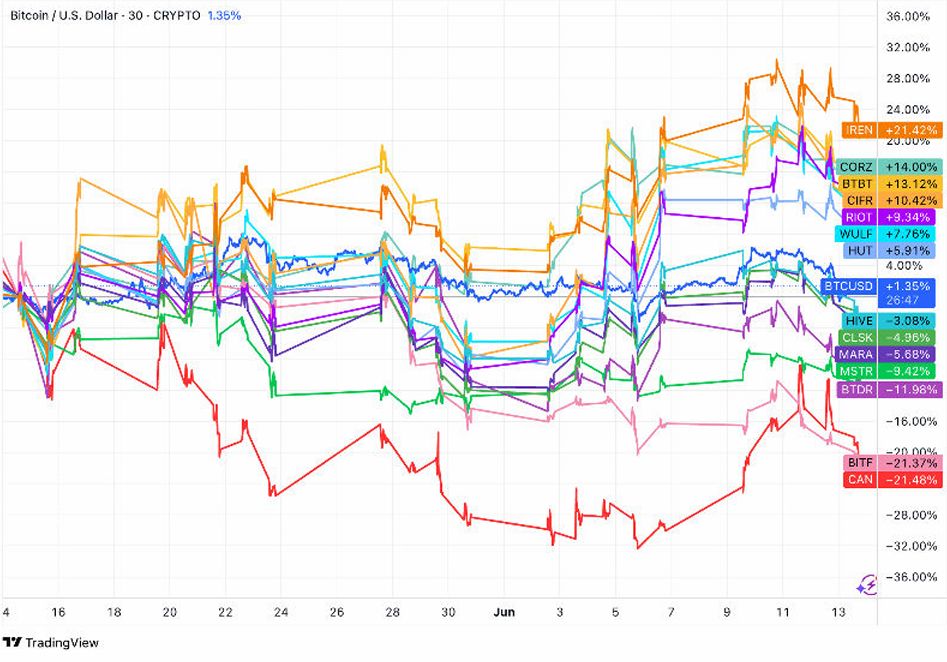

Mining stocks don’t necessarily track Bitcoin’s price. TheMinerMag’s report highlighted a growing divergence in miner stock performance, reflecting differences in how companies adapt.

The Difference in Stock Performance of Bitcoin Mining Companies. Source:

TheMinerMag report

The Difference in Stock Performance of Bitcoin Mining Companies. Source:

TheMinerMag report

“The growing divergence comes despite Bitcoin’s relatively stable price, highlighting a decoupling between BTC and mining stocks. This trend suggests that equity investors are increasingly evaluating miners based on their adaptability in the post-halving environment — particularly their ability to pursue new narratives — rather than simply mirroring Bitcoin’s price movements,” the report said.

In response, major mining firms are diversifying their revenue streams to reduce reliance on Bitcoin’s price.

For instance, Riot doubled its Bitcoin-backed credit line with Coinbase to $200 million. Meanwhile, MARA allocated 500 BTC to Two Prime to expand its yield strategy. Other firms are shifting into high-performance computing (HPC) and AI hosting to counter shrinking mining profits.

As the cost of mining Bitcoin continues to rise and profitability narrows, mining companies face a tough decision: adapt or fall behind.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Unveiling Solana's "Invisible Whale": How Proprietary AMMs Are Reshaping On-Chain Trading

The rapid rise of proprietary AMMs on Solana is no coincidence; rather, it is a logical and even inevitable evolution as the DeFi market pursues ultimate capital efficiency.

XRP Reenters Global Top 100 With Market Cap Near HDFC

Quick Take Summary is AI generated, newsroom reviewed. XRP has entered the Top 100 Global Assets at $181.8B XRP trades at $3.05 showing strong annual growth and volume activity XRP has surpassed companies like Adobe, Pfizer, and Shopify in valuation ETF filings and Ripple’s U.S. banking license could boost XRP adoption Japan’s banks and RippleNet partners highlight growing global use of XRPReferences $XRP reenters the top 100 global assets by market cap.

Solana Treasury Fund, operated by Sharps Technology, and Pudgy Penguins have announced a strategic partnership

Through this partnership, Pudgy Penguins' top-tier IP will be combined with STSS's institutional-grade Solana vault, creating a brand-new interactive opportunity for retail and institutional users.

Magma Finance Officially Launches ALMM: Sui's First Adaptive & Dynamic DEX, Pioneering a New Liquidity Management Paradigm

Magma Finance today officially announced the launch of its innovative product ALMM (Adaptive Liquidity Market Maker), becoming the first Adaptive & Dynamic DEX product on the Sui blockchain. As an improved version of DLMM, ALMM significantly enhances liquidity efficiency and trading experience through discrete price bins and a dynamic fee mechanism, marking a major upgrade to the Sui ecosystem's DeFi infrastructure.