Traders Brace For Impact As Over $4 Billion in Bitcoin and Ethereum Options Expire

With $4.1 billion in crypto options expiring, BTC and ETH traders are bracing for price turbulence driven by macro risks and market sentiment.

The crypto market will witness $4.11 billion in Bitcoin (BTC) and Ethereum (ETH) options contracts expire today. This massive expiration could impact short-term price action, especially as both assets have recently declined.

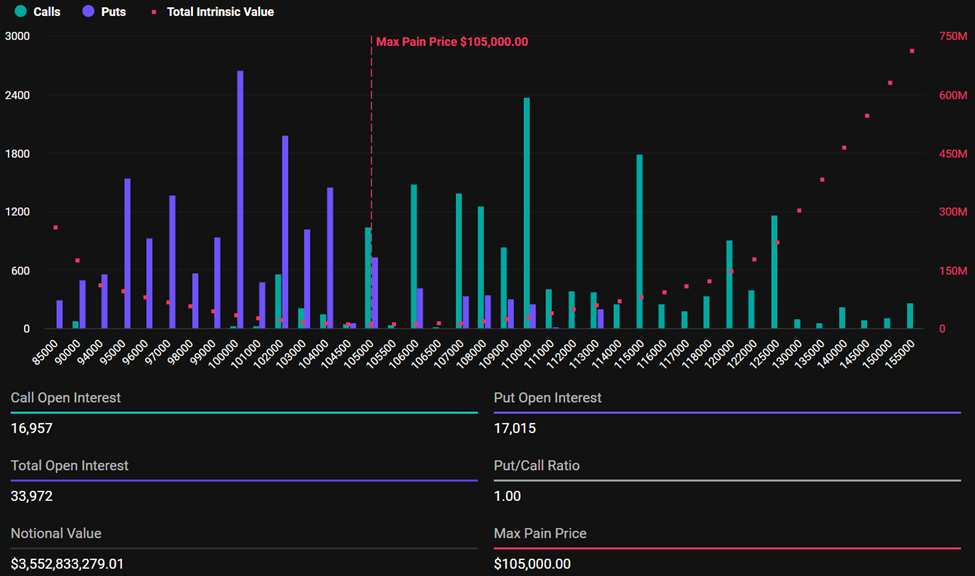

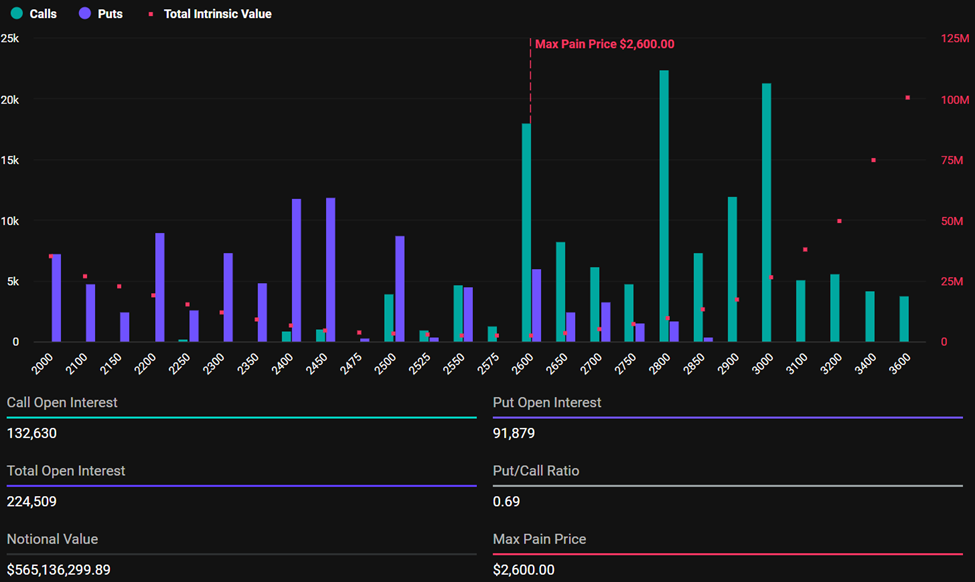

With Bitcoin options valued at $3.5 billion and Ethereum at $565.13 million, traders are bracing for potential volatility.

High-Stakes Crypto Options Expirations: What Traders Should Watch Today

According to Deribit data, Bitcoin options expiration involves 33,972 contracts, compared to 27,959 contracts last week. Similarly, Ethereum’s expiring options total 224,509 contracts, down from 246,849 contracts the previous week.

Expiring Bitcoin Options. Source:

Deribit

Expiring Bitcoin Options. Source:

Deribit

For Bitcoin, the expiring options have a maximum pain price of $105,000 and a put-to-call ratio of 1.00. This indicates traders might be equally divided between bearish (buying puts) and bullish (buying calls) outlooks.

It reflects uncertainty or a consolidation phase in the market, aligning with BeInCrypto’s recent report on Bitcoin’s resilience amid geopolitical tension. The pioneer crypto remains range-bound, with institutional support and low volatility bolstering its position.

Nevertheless, the call and put open interests indicate a slight lean toward puts, hinting at mild bearish sentiment or hedging.

In comparison, their Ethereum counterparts lean bullish with a put-to-call ratio of 0.69 and a maximum pain price of $2,600.

Expiring Ethereum Options. Source:

Deribit

Expiring Ethereum Options. Source:

Deribit

The maximum pain point is a crucial metric that often guides market behavior. It represents the price level at which most options expire worthless, inflicting maximum financial “pain” on traders.

Traders and investors should brace for volatility, as options expirations often cause short-term price fluctuations, which create market uncertainty. Based on the Max Pain Theory, asset prices tend to gravitate toward their respective max pain or strike prices.

Ethereum, trading below its max pain level at $2,506 as of this writing, means a bullish outlook and explains the call options as traders bet on price increases. On the other hand, though also below its max pain level, Bitcoin shows more balanced positioning with a put-to-call ratio of 1.0.

“BTC shows more balanced positioning near max pain, while ETH flows tilt bullish with calls dominating up the curve. How will the market respond this time?” analysts at Deribit posed.

However, markets usually stabilize soon after traders adapt to the new price environment. With today’s high-volume expiration, traders and investors can expect a similar outcome, potentially influencing crypto market trends into the weekend.

Geopolitical Risks and Fed Outlook Weigh on Sentiment

Elsewhere, analysts at Greeks.live note that market sentiment among crypto derivatives traders has turned notably bearish in the short term. This comes after the Federal Reserve Chair Jerome Powell’s latest FOMC statement.

The trading group is broadly positioning for downside risk through July, while maintaining long-term optimism into the fourth quarter (Q4).

“Traders are running negative delta for July positions while planning to add positive deltas for Q4,” Greeks.live wrote in a post.

Geopolitical tensions, particularly the rising risk of US involvement in the Middle East, are emerging as the dominant short-term catalyst. Several traders are reportedly positioning long puts ahead of potential US involvement and Iran tensions, hedging against a further market downturn.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu Holds $0.00001288 Support as $0.00001319 Resistance Limits Upside

Dogwifhat Trades at $0.88 as Price Holds $0.8771 Support While $0.9019 Resistance Caps Upside

Bitcoin ETF Inflows Hit $741M, Highest in 2 Months

Bitcoin ETFs saw $741M in inflows yesterday, marking the biggest surge in two months amid rising market optimism.Bullish Signals Amid Market VolatilityBitcoin ETFs Gaining Investor Trust