Ethereum Long-Term Holders are Selling Again: Are Bears Taking Over?

Ethereum’s long-term holders are increasingly selling off their assets, reflected by a record-high Liveliness metric. This trend, combined with weak market demand, points to possible further price declines.

On June 20, a key on-chain metric tracking the behavior of ETH’s long-term holders (LTHs) closed at its all-time high, signaling mounting selling pressure from this cohort.

This comes at a time when broader market momentum has cooled significantly. With demand for ETH weakening and investors largely sidelined amid a persistent market lull, bearish sentiment is growing.

Ethereum Liveliness Hits Record High

According to Glassnode, ETH’s Liveliness spiked to an all-time high of 0.69 during Friday’s trading session. This metric tracks the movement of long-held/dormant tokens. It does this by measuring the ratio of an asset’s coin days destroyed to the total coin days accumulated.

ETH Liveliness. Source:

Glassnode

ETH Liveliness. Source:

Glassnode

When this metric falls, the LTHs of an asset are moving their assets off exchanges, a move seen as a signal of accumulation. On the other hand, as with ETH, when it climbs, LTHs are moving their coins to exchanges to sell them.

This spike in ETH’s Liveliness to 0.69 suggests that its LTHs are increasingly liquidating their positions as uncertainty grows. It reflects the growing lack of confidence in the coin’s near-term price recovery.

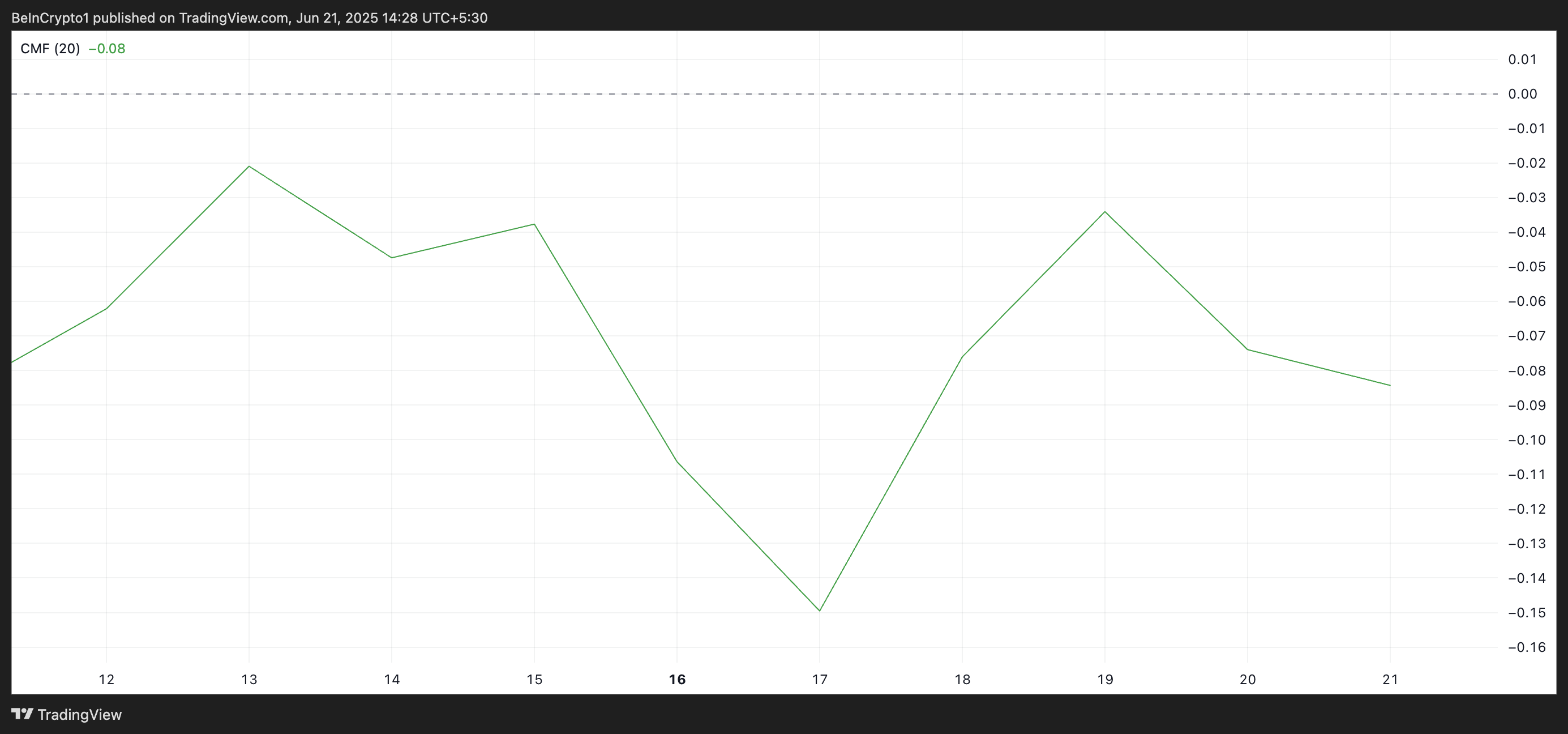

Additional confirmation of this bearish trend can be found on ETH’s daily chart, where the coin’s Chaikin Money Flow (CMF) is negative and is trending downward. As of this writing, ETH’s CMF stands at -0.08, indicating a drop in capital inflows.

ETH CMF. Source:

TradingView

ETH CMF. Source:

TradingView

The CMF indicator measures the flow of money into and out of an asset. When its value is negative, it signals low buying interest and validates the shift toward distribution rather than accumulation.

ETH Eyes Drop to May Lows

Persistent offloading by ETH’s long-term holders, combined with falling market-wide demand for the coin, could cause it to see a deeper correction in the near term.

At press time, the leading altcoin trades at $2,429. If selloffs persist among ETH’s seasoned holders, the coin could drop toward $2,185. If this price floor fails to hold, the coin could dip further to $2,027, a low it last reached in May.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

Conversely, a resurgence in new demand for the altcoin will invalidate this bearish outlook. In that scenario, its price could reverse its downtrend and climb toward $2,745.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin Discusses Ethereum Treasury Companies, Risks, and Humorously Praises US Government

BitMine Expands Ethereum Holdings, Plans Major Stock Issuance

Solana’s Trading Plunge Amid Strengthened Network Metrics

U.S. Authorities Seize $2.8M in Crypto from Ransomware Operator