Bitcoin Drops Below $100,000 as Iran Moves to Close Strait of Hormuz

Bitcoin dropped below $100,000 as Iran moved to close the Strait of Hormuz, triggering nearly $1 billion in crypto liquidations and escalating market risk.

Bitcoin price dropped to $99,800 after Iran’s parliament approved a proposal to close the Strait of Hormuz. The move follows the US bombing of Iran’s nuclear sites yesterday.

With final approval pending at the Supreme National Security Council, markets brace for heightened energy disruption risk. As Hormuz is critical to the world’s oil supply, a macro shock of this level could notably disrupt the crypto market.

Impact of Potential Hormuz Shutdown

In addition to Bitcoin, Ethereum fell 4% under $2,200, and XRP dropped below $2 for the first time since April. Crypto liquidations hit $950 million in the past 24 hours, reflecting deep risk-off sentiment.

Bitcoin Price Drops Below $100,000. Source:

BeInCrypto

Bitcoin Price Drops Below $100,000. Source:

BeInCrypto

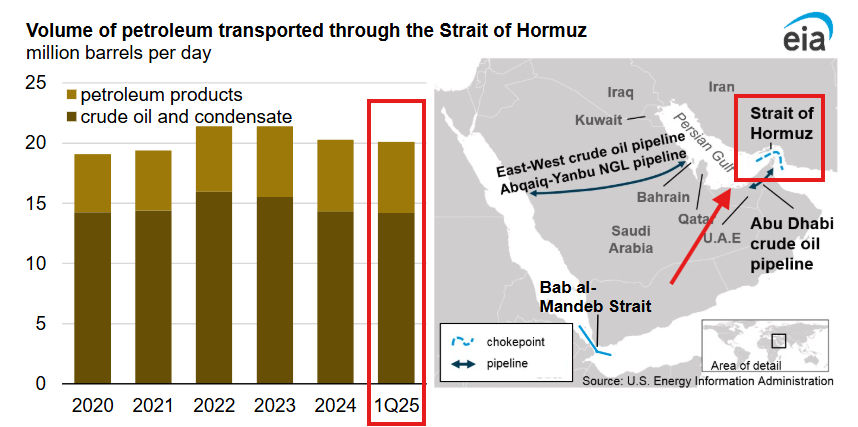

But why? The Strait of Hormuz channels nearly 25% of global oil shipments. Closing this chokepoint would tighten global energy supply immediately.

Oil prices could surge, stoking inflation and delaying central bank rate cuts.

Consequently, higher energy costs would ripple through economies. Consumers face steeper fuel bills, while businesses grapple with rising transport and production expenses.

In response, investors typically flock to safe-havens like US Treasuries and the dollar, draining capital from risk assets such as crypto.

Global Petroleum Supply Through the Strait of Hormuz. Source:

X/The Kobeissi Letter

Global Petroleum Supply Through the Strait of Hormuz. Source:

X/The Kobeissi Letter

Moreover, energy-driven inflation pressures would challenge the Federal Reserve’s 2% target. If the Fed signals further tightening, real yields could rise.

Historically, higher real yields weigh on Bitcoin by raising the opportunity cost of holding non-yielding assets.

Crypto Market Risks and Macro Linkages

Crypto’s recent sell-off reflects broader market stress. Liquidations concentrated in long positions across Bitcoin and Ethereum. Rising VIX and widening Treasury yield spreads signal tightening risk budgets.

Additionally, hedge funds and retail traders often use leverage in crypto. Sharp price moves trigger margin calls, amplifying declines.

With current leverage metrics elevated, further downside remains likely if uncertainty persists.

At the same time, dollar strength usually correlates with crypto weakness. A surge in the US Dollar Index could deepen Bitcoin losses, potentially pushing it towards $95,000.

Outlook and Key Indicators

Traders should watch three developments closely:

- SNSC Decision: Final vote on Hormuz closure.

- Oil Prices: Breaks above $100/barrel could exacerbate inflation.

- Fed Signals: Comments on rate policy in response to energy shocks.

In sum, Iran’s potential closure of the Strait of Hormuz elevates macro risks for crypto.

If approved, expect sustained pressure on Bitcoin and broader digital-asset markets until geopolitical clarity and energy stability return.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The largest IPO in history! SpaceX reportedly seeks to go public next year, aiming to raise over 30 billion and targeting a valuation of 1.5 trillion.

SpaceX is advancing its IPO plan, aiming to raise significantly more than $30 billion, which could make it the largest public offering in history.

DiDi has become a digital banking giant in Latin America

Attempting to directly replicate the "perfect model" used domestically will not work; we can only earn respect by demonstrating our ability to solve real problems.

Macroeconomic structural contradictions are deepening, but is it still a good time for risk assets?

In the short term, risk assets are viewed bullishly due to AI capital expenditures and affluent consumer spending supporting earnings. However, in the long term, caution is advised regarding structural risks brought by sovereign debt, demographic crises, and geopolitical restructuring.

a16z predicts four major trends will be announced first in 2026

AI is driving a new round of structural upgrades in infrastructure, enterprise software, health ecosystems, and virtual worlds.