Michael Saylor’s Strategy has 91% chance of joining S&P 500 in Q2: Analyst

Michael Saylor’s MicroStrategy (MSTR), which trades as Strategy, has a high chance of qualifying for the S&P 500 as long as Bitcoin doesn’t drop more than 10% before the end of the second quarter, an analyst says.

“I believe there is about a 91% chance of MSTR qualifying for the S&P 500 in Q2,” financial analyst Jeff Walton said in a video on Tuesday.

MSTR needs cumulative positive earnings over the past four quarters

Walton explained that for this to happen, Bitcoin must not fall below $95,240 before June 30. He explained that if it drops below that, Strategy, which has the largest Bitcoin holdings among public companies at 592,345 Bitcoin, will not have “have the earnings in Q2 be more than the last three quarters combined.”

Bitcoin is trading at $106,200 at the time of publication. Source: CoinMarketCap

Bitcoin is trading at $106,200 at the time of publication. Source: CoinMarketCap

Walton explained that to be eligible for S&P 500 inclusion, a company must post positive total earnings across the past four quarters. Strategy has posted net losses in the past three quarters.

The S&P 500 is an index that tracks the stock prices of the 500 largest publicly traded companies in the US.

On Jan. 1, Strategy began applying accounting rule ASU 2023-08, which mandates that Bitcoin holdings be revalued at fair market value, with any gains or losses reflected in net income (or loss) each reporting period.

Walton bases his forecast on Bitcoin trading at $106,044 when he published his video and on the historical odds of a 10% Bitcoin drop over six days since Sept. 17, 2014. With the video released on Tuesday, six days remain in Q2, ending next Monday.

Jeff Walton says MSTR’s hopes of S&P 500 inclusion hinge on Bitcoin staying above $95,280. Source: Jeff Walton

Jeff Walton says MSTR’s hopes of S&P 500 inclusion hinge on Bitcoin staying above $95,280. Source: Jeff Walton

“Going back to September 17, 2014, over any 6-day period, the price of Bitcoin has dropped more than 10% 343 times; of those other 6-day periods, it has been 3,585 where it hasn’t dropped below 10%,” he explained.

“So 8.7% of those 6-day periods have dropped more than 10%, the other 91% of those periods have not dropped 10%,” he added.

MSTR’s chances improve as the quarter draws to a close

He said that as the end of June approaches, the probability of Bitcoin not dropping 10% increases. Over five days, there’s a 92.4% chance it won’t fall that much. That probability rises to 93.4% over four days, 94.5% over 3 days, 95.8% over two days, and 97.6% over one day.

Related: Michael Saylor’s Strategy premium is not ‘unreasonable’: Adam Back

However, recent rising geopolitical tensions between Iran and Israel caused Bitcoin’s price to drop below $100,000 on Sunday for the first time since early May. At the time of publication, Bitcoin is trading at $106,200.

If all this comes to fruition, Strategy would be the second crypto firm to join the S&P 500 this year. In May, crypto exchange Coinbase joined the S&P 500 , and crypto executives said this marks a significant step toward broader acceptance of the industry.

Meryem Habibi, chief revenue officer of Bitpace, told Cointelegraph, “It cements the legitimacy of an entire asset class.”

In December 2024, Nasdaq announced that Strategy would be included in the Nasdaq-100 Index, which features the 100 largest stocks by market capitalization on Nasdaq.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SoftBank shares drop 5%, snapping 9-day rally after $2 billion Intel deal

Share link:In this post: SoftBank shares fell over 5% after it announced a $2 billion deal to buy Intel stock at $23 per share. Asian markets dropped across the board as investors waited for the U.S. Fed’s Jackson Hole meeting. Jerome Powell is expected to signal a possible rate cut, with futures showing an 83% chance for September.

Texas judge sides with Logan Paul’s effort to dismiss CryptoZoo lawsuit

Share link:In this post: Judge Ronald Griffing said Logan Paul’s bid to remove a lawsuit over the collapse of CryptoZoo should be allowed. Griffin also urged the class-action plaintiff to update all but one of its 27 claims against Paul, the one linking him to commodity pool fraud. The judge dismissed Paul’s bid to accuse CryptoZoo co-founders of the project’s failure.

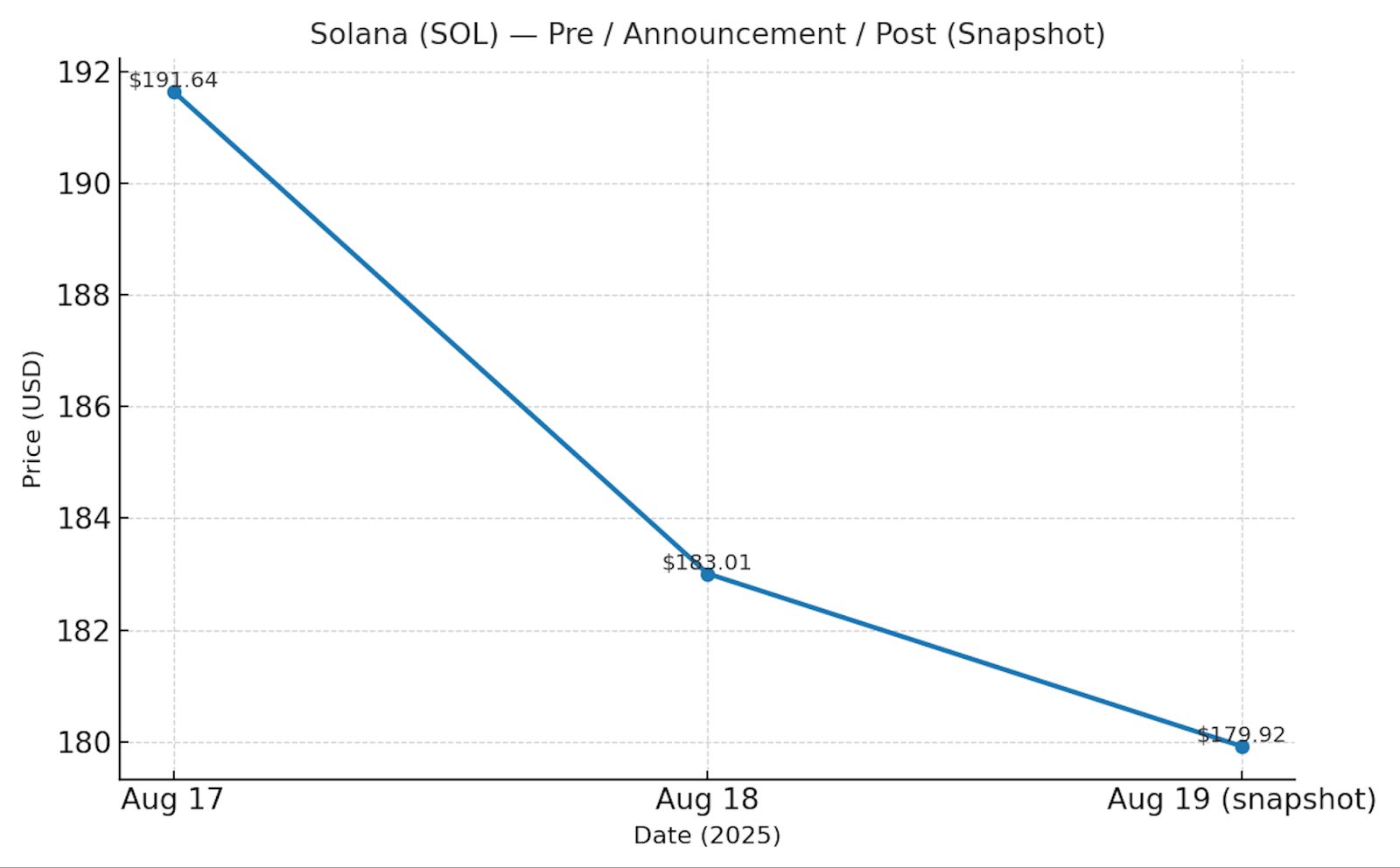

XRP & Solana ETF delays spark volatility – Stay or exit before October?

Share link:

Ethereum ETFs supply holdings to exceed BTC ETF’s holdings by September

Share link:In this post: Ethereum ETFs now hold over 6.5M ETH, with projections showing a September flip as they close in on Bitcoin ETFs’ share of the circulating supply. US spot ETH ETFs saw $59M in outflows on August 15 after record weekly inflows of 649,000 ETH pushed totals above $3.7B. Institutional investors dominate Ethereum with 19.2M ETH, while retail holdings fall sharply, highlighting shifting market influence amid price swings near $4,450.