BaFin Closes Case Against Ethena GmbH Over USDe Stablecoin

- Ethena and BaFin settle USDe dispute.

- 42-day window for claims.

- Ethena GmbH exits European market.

The settlement marks a significant regulatory step that highlights compliance challenges in the EU crypto space, mirroring other MiCA enforcement cases.

Ethena Labs‘ German subsidiary, Ethena GmbH, has settled with BaFin to implement a redemption plan for USDe holders. This allows users a 42-day period for redemption overseen by a BaFin-appointed representative, marking a formal conclusion of the case. BaFin had previously enforced actions, including freezing USDe reserve assets and shutting down Ethena GmbH’s website, constraining liquidity and performance of related tokens like sUSDe. The settlement involves halting USDe operations in the EU, reflecting consequences of regulatory breaches on associated tokens and organizational operations within the MiCA framework.

“The German Federal Financial Supervisory Authority (BaFin) has concluded its case against Ethena GmbH, the German subsidiary of Ethena Labs, regarding the issuance of the USDe stablecoin. The regulator and Ethena GmbH have agreed on a redemption plan that will allow USDe stablecoin holders to declare redemption claims directly against Ethena GmbH until August 6. This process will be overseen by a special representative appointed by BaFin.” — Cointelegraph

Immediate effects include liquidity constraints and exit from the EU market for Ethena GmbH, impacting USDe and sUSDe holders. Regulatory actions also impact the broader crypto sector within Europe, emphasizing necessary compliance with emerging frameworks. Financial outcomes involve completing user redemptions within a specified period while ceasing local operations permanently. The political implications underscore regulatory consistency, with BaFin reinforcing the message of strict adherence to financial regulations within the EU market framework.

On a broader scale, the settlement could set historical precedents affecting how similar stablecoin issuance cases are regulated under MiCA. The focus remains on compliance challenges and potential opportunities for realignment in technological and regulatory strategies adopted by cryptocurrency firms adapting to EU markets. Ethena’s compliance with the redemption plan signifies a strategic pivot in operational geography, redirecting focus beyond the EU and EEA regions. Insights indicate a trend towards future regulatory alignments necessary for operations in the European crypto market landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SharpLink Appoints Ex-BlackRock Executive as Co-CEO

Ethereum Surge: ETF Inflows and Institutional Accumulation

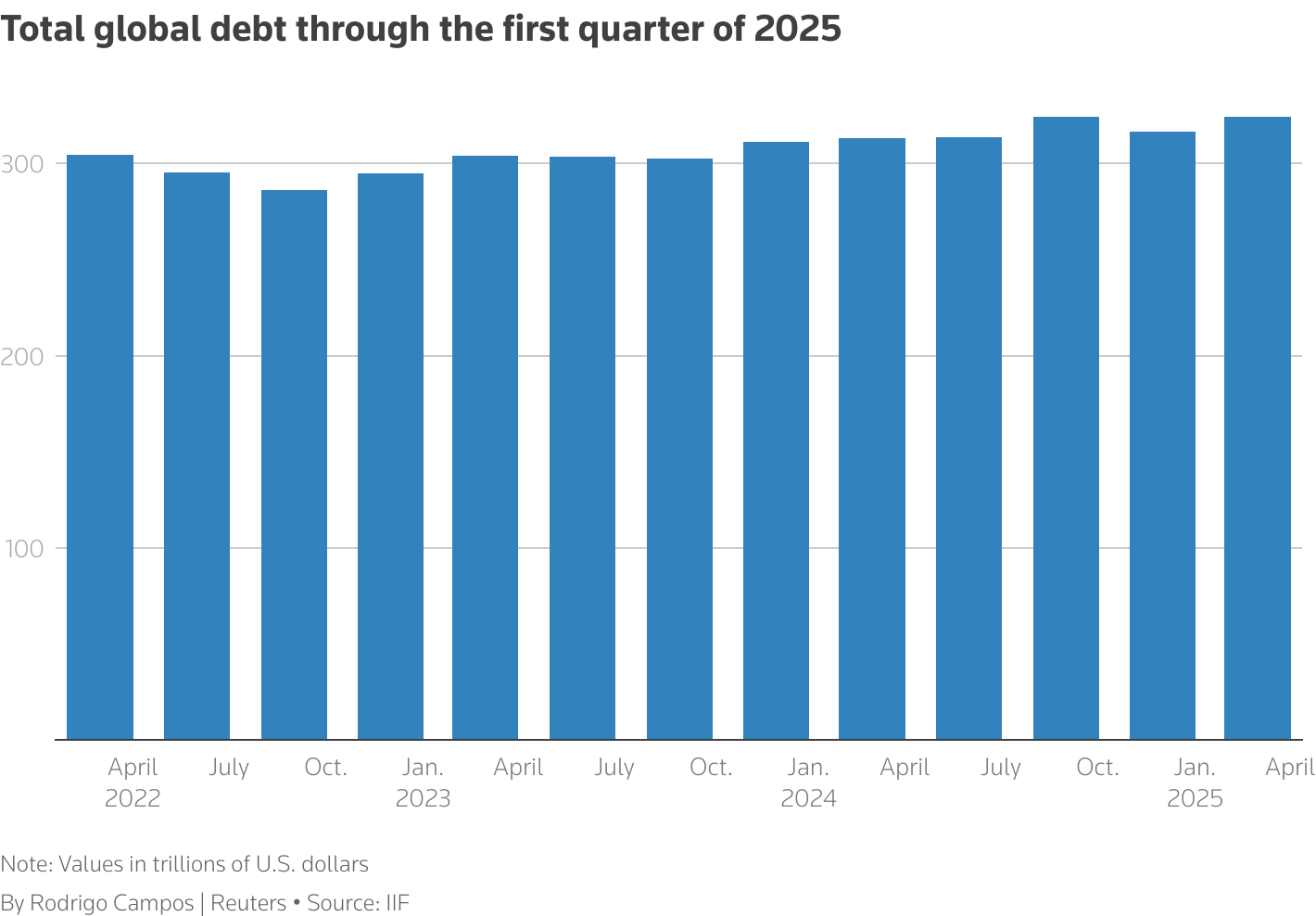

Crypto might protect you from a global debt crisis | Opinion

Wyoming's Stablecoin Billed as Yield-Bearing Alternative to CBDC Control