South Korea Reclassifies Crypto Companies as Startups

- Policy change boosts crypto firms with tax benefits.

- Shift driven by Ministry of Small Enterprises.

- Potential increase in crypto adoption in South Korea.

South Korea is planning to classify cryptocurrency firms as startups, offering policy benefits such as tax breaks and financing support. This move is driven by the Ministry of Small-Medium Enterprises and Startups to foster innovation in the industry.

The reclassification is significant as it aligns crypto regulations with global trends, encouraging innovation and potential investment. It may also positively influence the local crypto market.

The proposal by South Korea’s Ministry of Small-Medium Enterprises and Startups includes amendments to the Special Act on Promoting Venture Businesses . The policy seeks to promote rapid innovation and support emerging technologies. Initially, crypto firms were excluded, like gambling enterprises, marking a major shift in policy.

“The amendment will activate and expand the venture ecosystem, promoting the virtual asset industry” — Ministry of SMEs and Startups, South Korea.

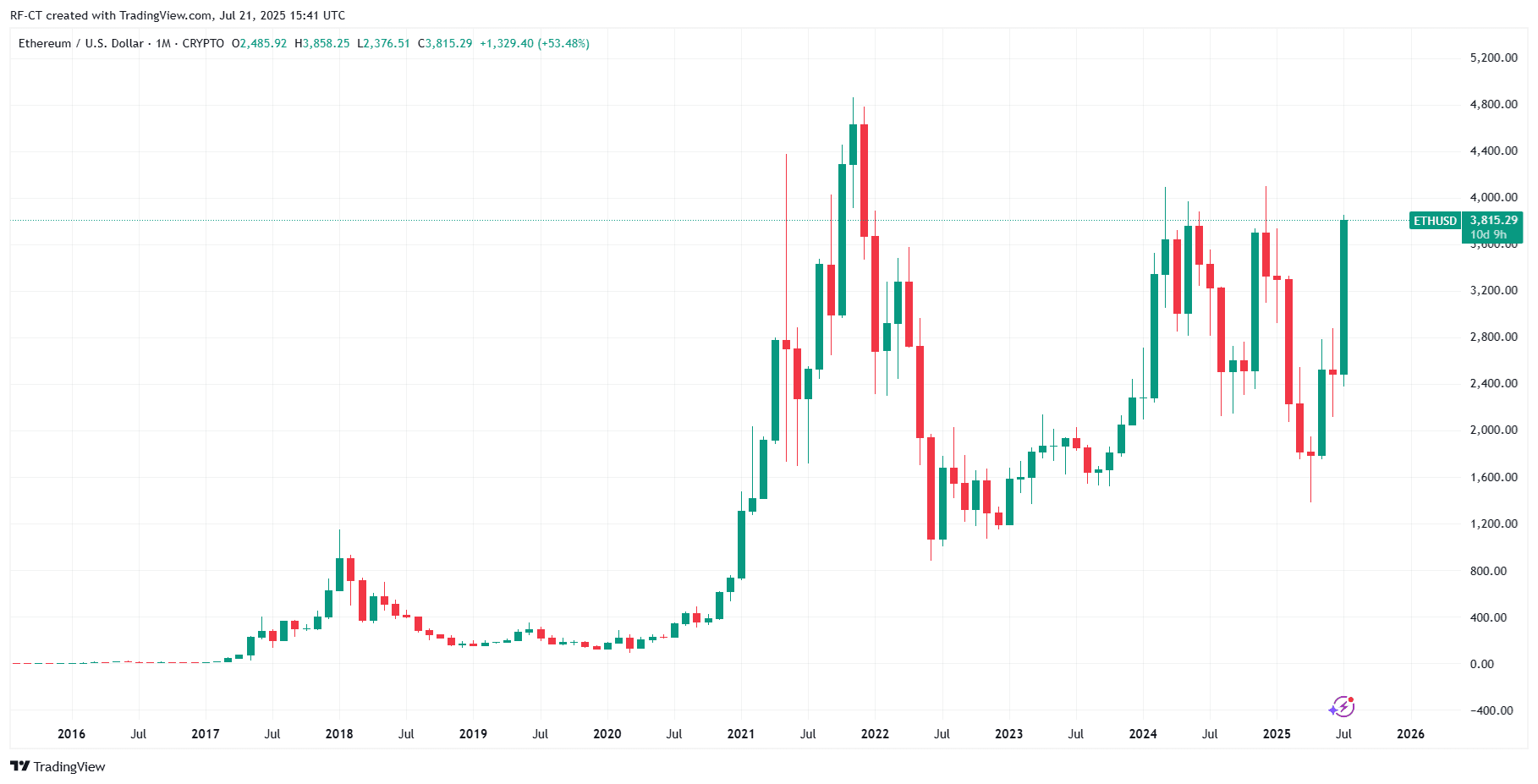

By offering these companies access to government subsidies, the reclassification potentially impacts broader markets, including significant cryptocurrencies like Bitcoin and Ethereum. Financial support is expected to increase adoption in South Korea.

The broader market impact is seen as a step towards integrating crypto industries into regular business frameworks. Politically, it reflects a move to modernize regulations. Socially, increased investment could drive further innovation.

While specific financial gains are unspecified, expected outcomes include increased crypto firm activities and regulatory support. In 2018, similar exclusions led to financial strain for major firms, highlighting the potential benefits of this policy shift.

The potential outcomes extend to regulatory clarity and heightened investment interest. Historical trends suggest increased corporate acceptance of crypto may follow, expanding the technological landscape in South Korea.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arbitrum leads with $1.9 billion inflows, outpaces Avalanche and Unichain in DeFi liquidity race

Justin Sun’s Epic Leap: Tron Founder Soars to Space with Blue Origin

3 Major Risks If Ethereum Continues To Increase Its Gas Limit

Solana vs Ethereum: The ATH Race Begins — Which Coin Will Break Records First?