Ethereum Tracks Bitcoin, But Can ETH Break $3,000 With Retail Selling?

Ethereum's price is climbing alongside Bitcoin, but retail traders’ selling behavior is slowing its momentum, keeping ETH from breaking $3,000 despite strong institutional backing.

Ethereum’s price has climbed steadily over the past week, rising nearly 10% as institutional players continue to pour capital into the leading altcoin.

This growing momentum comes amid broader optimism in the crypto market and a strengthening correlation with Bitcoin, which is itself edging closer to a new all-time high. Together, these trends suggest Ethereum may be poised for a significant breakout, but a familiar roadblock still stands in the way.

ETH/BTC Correlation Climbs

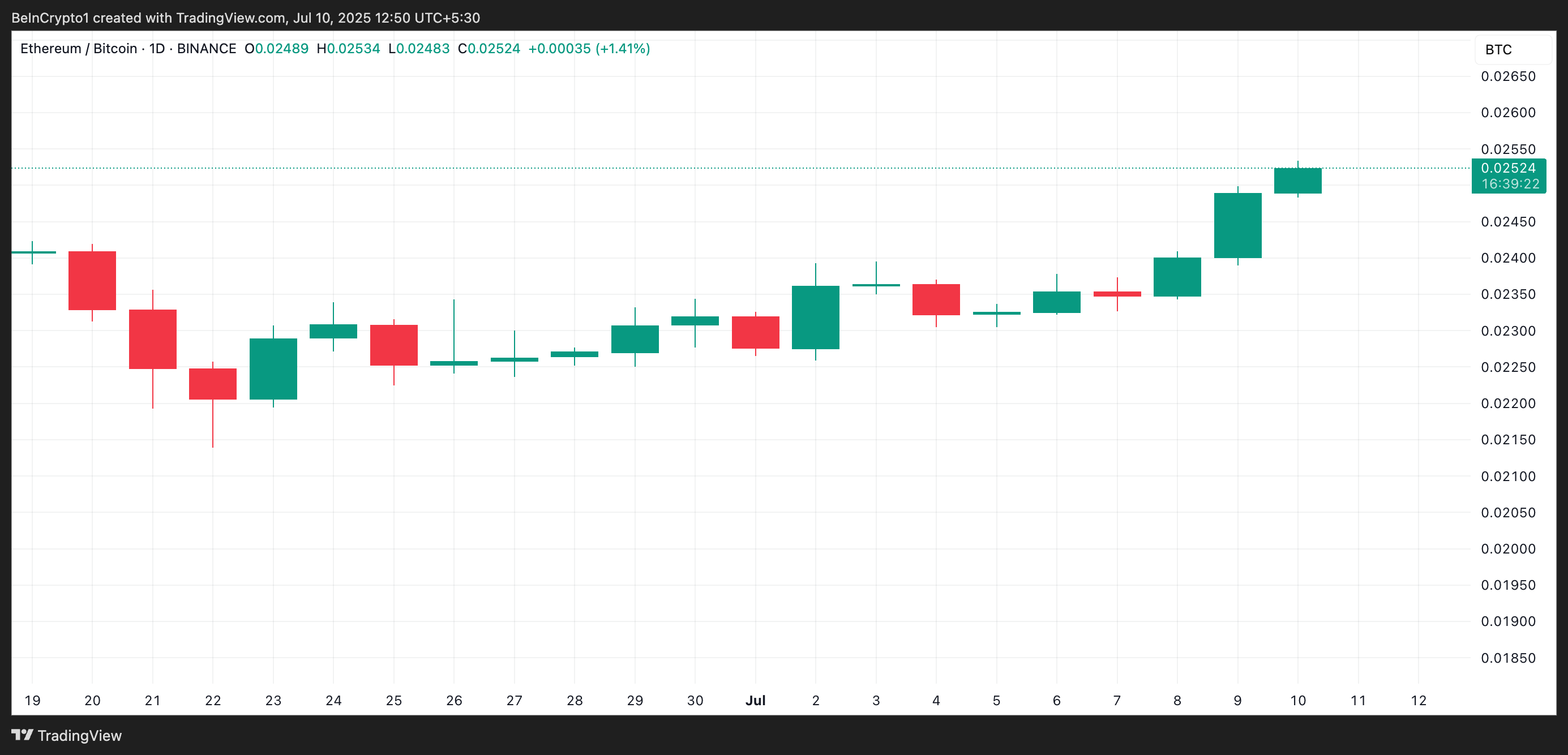

Ethereum’s correlation with Bitcoin has climbed sharply since late June. The ETH/BTC correlation coefficient, which measures how closely ETH’s price movements track those of BTC over a given period, now sits at 0.02.

ETH/BTC Correlation Coefficient. Source:

TradingView

ETH/BTC Correlation Coefficient. Source:

TradingView

A value close to 1 indicates that both assets move in the same direction, while a value near -1 means they move in opposite directions.

With BTC nearing its all-time high, ETH’s price could follow suit and rally. This is because, historically, high correlation in bull phases has preceded joint rallies for both assets.

ETH Targets $3,000 as Institutions Load Up

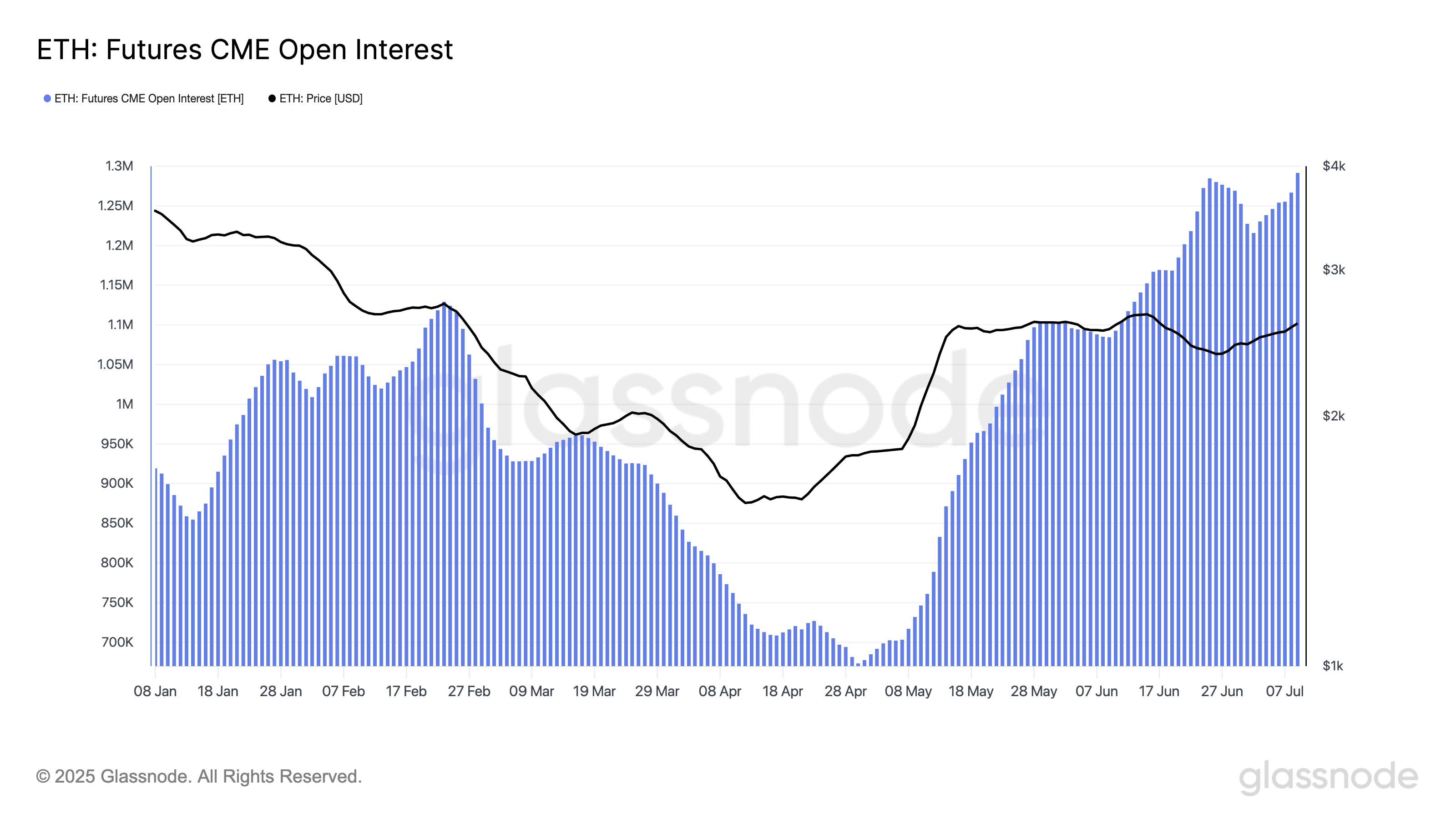

Ethereum’s institutional investors appear to be locking in positions as they take advantage of the climbing ETH/BTC correlation. With both assets historically rallying in tandem during bullish phases, this group is positioning for a likely breakout above $3,000.

According to on-chain data from Glassnode, open interest in ETH futures on the Chicago Mercantile Exchange (CME), measured by the 7-day simple moving average, has surged to a record high of $3.34 billion.

ETH: Futures CME Open Interest. Source:

Glassnode

ETH: Futures CME Open Interest. Source:

Glassnode

This reflects rising institutional positioning as key market players accumulate ETH in anticipation of further upside.

Open interest refers to the total number of outstanding futures contracts that have not been settled. When it surges like this, it indicates rising trading activity and increased capital entering the market.

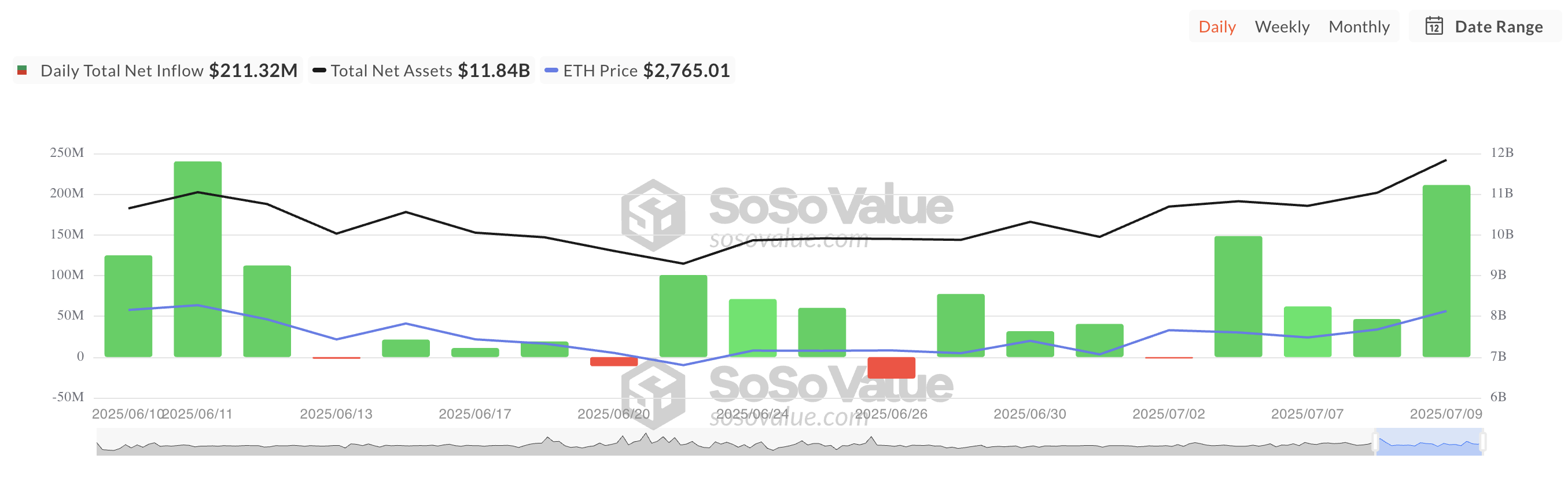

Furthermore, the consistent weekly inflows into spot ETH ETFs highlight the strengthening confidence in the altcoin among these key investors.

According to SosoValue, ETH-backed funds have recorded uninterrupted weekly inflows since May 9. Last week alone, over $219 million in capital flowed into ETH spot ETFs despite the coin’s largely sideways price action.

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

This sustained investment confirms the rising confidence in ETH’s long-term value as sophisticated investors position ahead of an anticipated breakout above $3,000.

However, there is a catch.

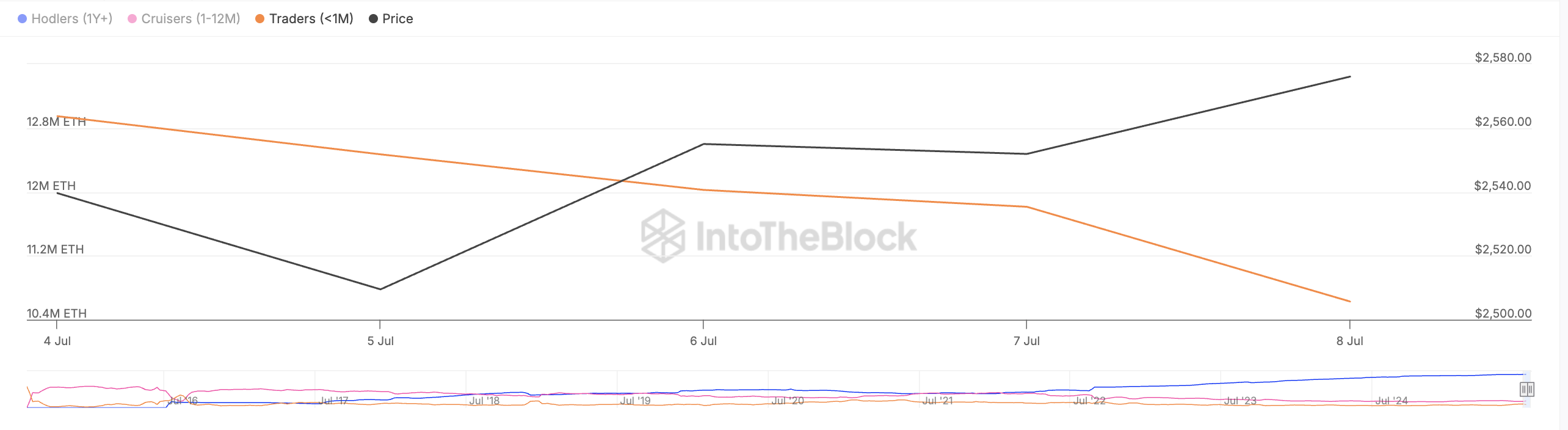

ETH Bulls Stall Below $3,000 as Retail Traders Tap Out

As key holders chase a rally above $3,000, ETH’s short-term price action continues to be weighed down by “paper hands.” These retail traders have held the coin for less than 30 days and are selling into its recent strength.

IntoTheBlock’s data shows that this group’s balance has dropped by 16% since July 4, slowing down the coin’s price growth amid strong institutional support.

Ethereum Balance by Time Held. Source:

IntoTheBlock

Ethereum Balance by Time Held. Source:

IntoTheBlock

Retail traders drive an asset’s short-term price performance through frequent, emotion-driven buying and selling. Unlike institutional investors who tend to hold through fluctuations, retail participants are more reactive to news, sentiment, and short-term price moves.

When they begin to sell, downward pressure increases, stalling rallies or triggering corrections.

Although institutional interest in ETH is a good sign of long-term confidence, retail traders are needed to catalyze a rally above $3,000 in the short term. If they remain aloof and demand falls, the coin could lose some of its recent gains and fall below $2,745.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, a resurgence in new demand could push ETH’s price above $2,851 and toward $3,067.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | The Federal Reserve is expected to cut interest rates on Wednesday, S&P Global assigns a "B-" credit rating to Strategy

S&P Global has assigned a "B-" credit rating to bitcoin treasury company Strategy, classifying it as junk debt but with a stable outlook. The Federal Reserve is expected to cut interest rates by 25 basis points, with a possible split in the voting. The Hong Kong Securities and Futures Commission has launched a tender for a virtual asset trading monitoring system. Citi is partnering with Coinbase to explore stablecoin payment solutions. ZEC surged significantly due to halving and privacy topics. Summary generated by Mars AI. The accuracy and completeness of this summary are still being refined and updated by the Mars AI model.

BTC Volatility Review (October 6 - October 27)

Key indicators (4:00 PM Hong Kong time on October 6 -> 4:00 PM Hong Kong time on October 27): BTC/USD -6.4...

Cathie Wood warns: As interest rates rise next year, the market will be "chilled to the bone"

AI faces adjustment risks!

2025 Trading Guide: Three Essential Trading Categories and Strategies Every Trader Must Know

Clearly identify the type of transaction you are participating in and make corresponding adjustments.