Animoca Brands Partners with DDC in $100M Bitcoin Deal

- Animoca Brands allocates $100M for Bitcoin yield growth.

- Yat Siu joins DDC’s Bitcoin Visionary Council.

- Strengthening Bitcoin as a modern treasury asset.

Main Content

Animoca Brands and DDC Enterprise Limited have entered into a notable $100 million Bitcoin partnership , announced recently at a strategic event where both organizations foresee mutual benefits.

This partnership signifies a pivotal movement in the cryptocurrency industry, enhancing Bitcoin’s role in corporate treasuries and setting new benchmarks for financial asset management.

Animoca Brands, a leading Web3 company, has enlisted a significant partnership with DDC Enterprise Limited, to allocate $100 million in Bitcoin for strategic purposes. Norma Chu, CEO of DDC, and Yat Siu, a key figure at Animoca, are central to this initiative. “This partnership with Animoca Brands marks a transformative step for DDC and reflects our shared vision to accelerate Bitcoin’s role as a pristine monetary asset.” This close collaboration targets significant advancements in Bitcoin-related treasury operations.

The immediate effects on the market include a strengthened perception of Bitcoin as a serious treasury asset. This strategic partnership may inspire other corporations to adopt similar strategies, promoting wider institutional acceptance of Bitcoin.

Finance and industry stakeholders now face potential shifts as Bitcoin becomes entrenched in more corporate treasuries. This development could elicit new regulatory scrutiny or adjustments, particularly as companies seek to extend Bitcoin-centric investment strategies.

Confidence in Bitcoin as a mainstream financial instrument shows a growing trend, backed by Animoca and DDC’s strategic partnership. This collaboration may propel regulatory dialogues and can also signal increased adoption of similar corporate treasury models. As this partnership progresses, monitoring regulatory responses and industry impacts will be key metrics for broader market interpretations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AiCoin Daily Report (August 26)

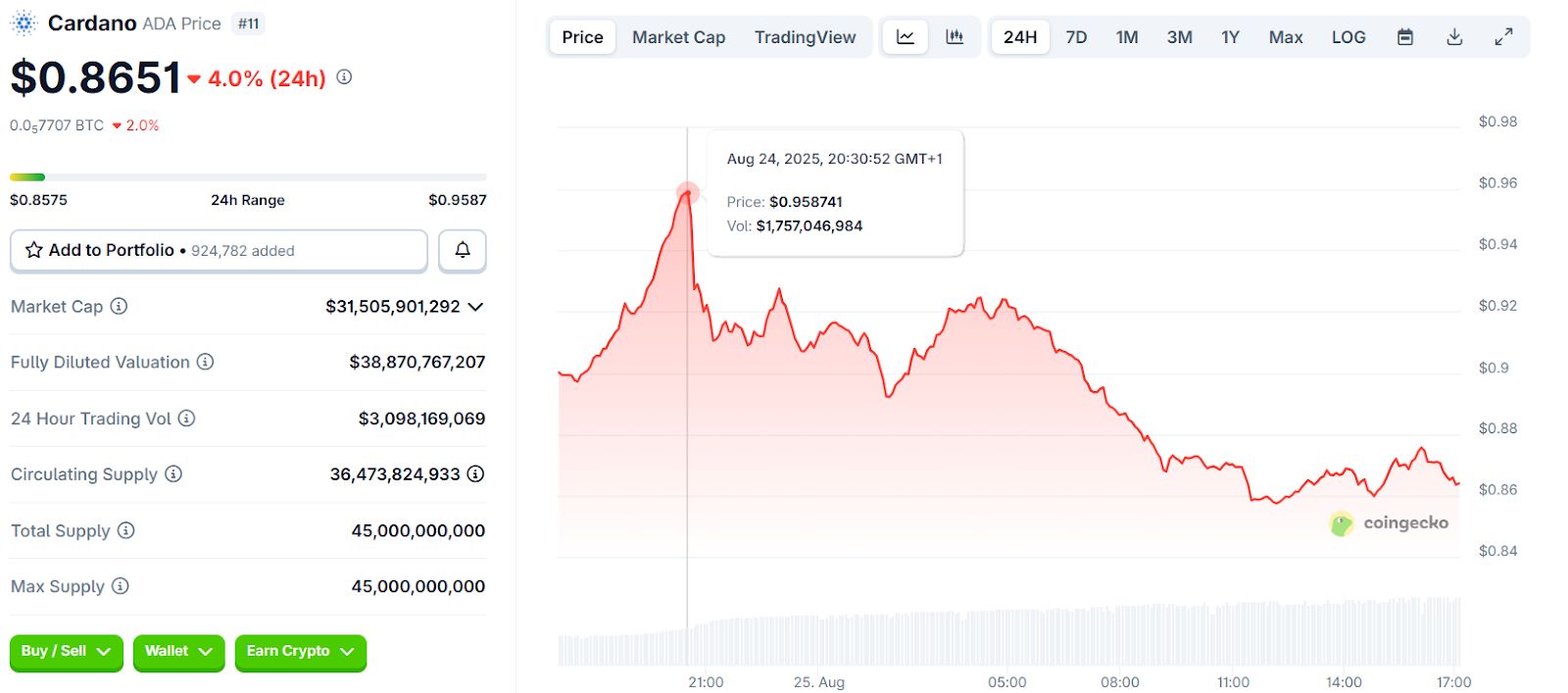

Cardano Latest News: Why ADA Holders Are Seeing Traction Moving Into Trending Altcoin Remittix

Disrupting the Price Mystery: Where Does Blockchain’s Enduring Value Come From?

If we measure success by speculation, we are building sandcastles. If we measure success by infrastructure, we are laying the cornerstone.