US Ethereum ETFs Set For Their Best Month Since SEC Approval

Ethereum ETFs are having a standout performance in 2025, driven by record inflows, corporate demand, and surging interest in ETH. This could mark a key turning point for the crypto asset.

Ethereum ETFs are showing strong performance right now, with yesterday’s inflows marking the asset category’s eighth-best day in history. Depending on today’s performance, July might be the most profitable month for the assets in 2025, only after 11 days.

Corporate holders are consuming ETH at incredible rates, splitting attention between ETF issuers and regular whales. Meanwhile, Ethereum’s price has risen nearly 20% in a week, reflecting strong demand after Bitcoin’s all-time high.

Ethereum ETFs Boom On Wall Street

Ethereum has been doing well lately, crossing the $3,000 price point for the first time since February as corporate investment surges. This good performance is reflected in ETH’s various derivatives, which are also receiving huge cash inflows.

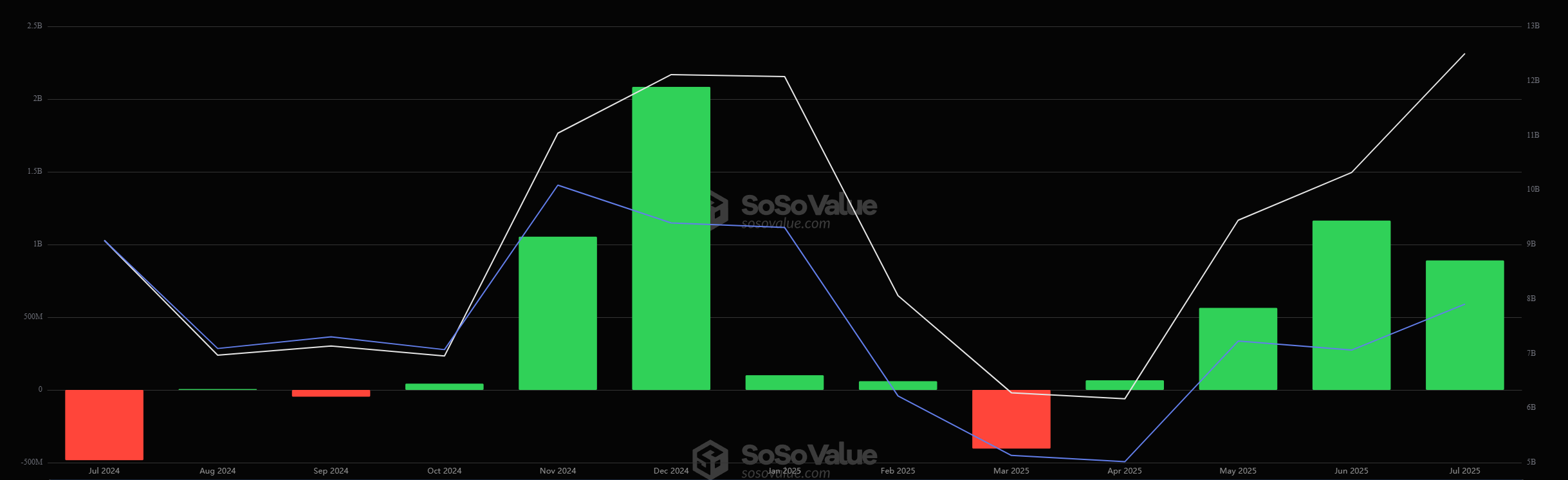

US spot Ethereum ETFs are on a roll right now, seeing $890 million in monthly inflows on top of two straight months of massive gains:

With net inflows of $564.2 million in May, $1.17 billion in June, and an additional $507.4 million so far in July, the U.S. Ethereum ETFs have shown strong recent performance.Yesterday’s net inflow of $211.3 million marked the eighth-best day on record.

— Mads Eberhardt (@MadsEberhardt) July 10, 2025

Indeed, depending on how these products perform today, July might become ETH ETFs’ most profitable month in 2025. The Ethereum ETFs have existed in the US for less than a year, but they’re resurgent right now.

If this trend continues, this asset category will enter its biggest bull run since its inception in July 2024.

Spot Ethereum ETF Monthly Inflow Since Approval. Source: SoSoValue

Spot Ethereum ETF Monthly Inflow Since Approval. Source: SoSoValue

Most notably, the demand for Ethereum is seemingly outpacing Bitcoin ETFs, which have been the far superior asset choice among US institutional investors.

Over the past nine days, ETFs have bought nearly 380,000 ETH tokens, more than the net newly issued tokens since the 2022 Ethereum Merge.

Furthermore, regular corporate holders are buying nearly the same amount, further running up the demand for ETH.

Additionally, some Ethereum ETF issuers are acting particularly ravenous in their consumption habits. BlackRock alone holds 1.5% of circulating ETH tokens, representing nearly $4.5 billion in total holdings.

BlackRock’s firm commitment is therefore affecting supply and demand from both ends, consuming all available tokens to offer more indirect exposure.

It will be interesting to see how these market dynamics mature in the coming weeks. If these ETF trends continue, it could help guarantee a sustainable price rally for ETH in the short term and potentially strengthen the chances for an altcoin season in Q3.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP price staggers as Ripple moves 200 million tokens

AI and Digital Payments Drive Cryptocurrency Adoption Boom in 2025

EU Trade Defense Hits €93 Billion Milestone

Chris Larsen Under Pressure After A Massive Transfer Of XRP – Is It Disguised Dumping?