House Republicans failed to advance a key procedural motion that would have enabled debate on the GENIUS Act and other major crypto bills earlier today, Tuesday. The failed vote stalled the highly anticipated legislative push dubbed part of “Crypto Week,” dealing a setback to the digital asset industry.

The vote , which failed 196–222, prevented the House from beginning formal consideration of the GENIUS Act, a landmark bill aimed at establishing the first federal framework for U.S. stablecoins. The collapse of the motion also blocked debate on the annual defense spending bill and a related crypto clarity proposal.

With over a dozen Republican holdouts joining Democrats to oppose the rule, House GOP leadership was left scrambling to salvage what was billed as the most ambitious crypto policy package in U.S. history.

Discord within Republican ranks

While the crypto industry had hoped for a seamless passage of legislation that had already cleared the Senate, internal fractures among Republicans derailed the plan. Notably, Rep. Marjorie Taylor Greene, one of the GOP defectors, publicly criticized the GENIUS Act for lacking a provision to ban central bank digital currencies ( CBDCs ).

“I just voted NO on the Rule for the GENIUS Act because it does not include a ban on Central Bank Digital Currency,” Greene wrote on X . “Americans do not want a government-controlled Central Bank Digital Currency. Republicans have a duty to ban CBDC.”

Greene also faulted Speaker Mike Johnson for not allowing amendments to be introduced.

Speaker Mike Johnson and House leadership had attempted to bundle the crypto bills with the defense appropriations bill to streamline the legislative push and avoid political infighting. Instead, the strategy backfired.

While the GENIUS Act had previously cleared the Senate with bipartisan support in a 68–30 vote, House conservatives accused Johnson of denying them the chance to amend the legislation, including provisions to bar the Federal Reserve from issuing a CBDC.

Some, including Rep. Greene, insisted the bill should reflect President Trump’s January executive order banning CBDCs across federal agencies.

Other lawmakers, meanwhile, objected to the bundling itself, wanting each bill, especially the highly sensitive defense budget, to be considered on its own.

Vote triggers market reactions

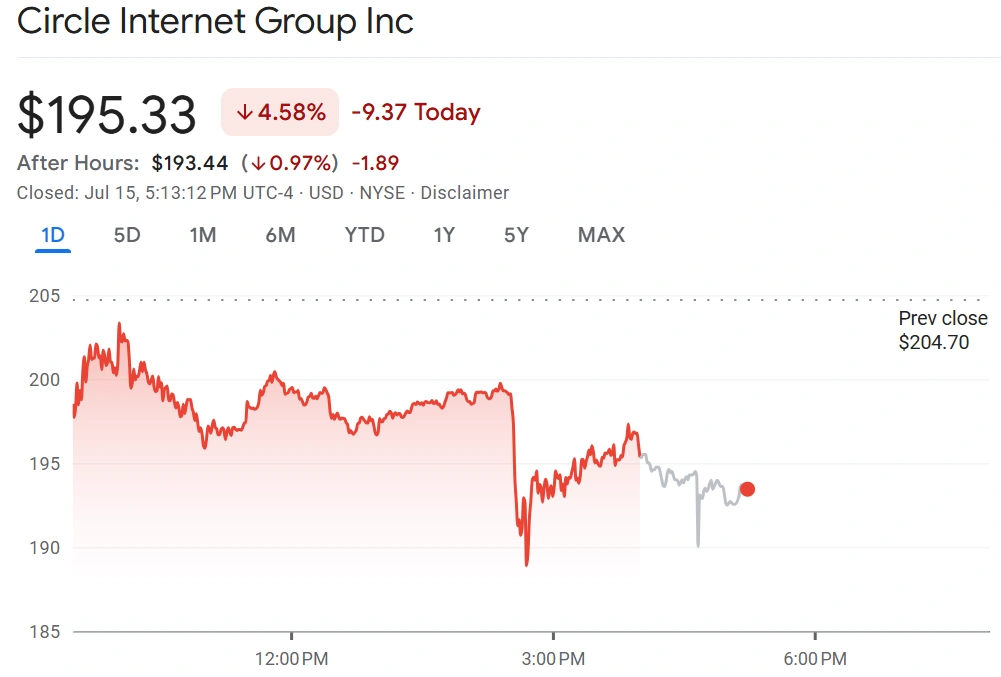

News of the failed vote quickly rippled across financial markets. Shares of Circle , the issuer of the USDC stablecoin and one of the bill’s main beneficiaries, fell by nearly 5%. Coinbase and MARA Holdings each dropped by about 2%.

CRCL stock price. Source: Google Finance

CRCL stock price. Source: Google Finance

Industry advocates, who had spent over $245 million during the 2024 election cycle to back pro-crypto candidates and policies, had framed this week as a major turning point for crypto’s future in Washington.

Fairshake, the crypto sector’s leading political action committee, recently disclosed $141 million in cash reserves to continue lobbying efforts and support crypto-friendly candidates ahead of the 2026 midterms.

The GENIUS Act’s passage was seen as a regulatory milestone and a potential economic boon. Treasury Secretary Scott Bessent previously stated that the U.S. stablecoin market could grow to over $2 trillion if the legislation is enacted. David Sacks, the White House’s AI and crypto czar, also said the bill could unlock “trillions of dollars in new demand” for U.S. Treasuries.

The House leadership is reportedly planning a second vote on the rule as early as Tuesday evening, although it’s tentative, and so far, no changes to the bill text or bundling approach have yet been confirmed.

Still, there is no clear path forward. To satisfy hardliners like Greene, Johnson may be forced to reopen the legislative process and allow amendments, including a formal CBDC ban, that could jeopardize bipartisan Senate support.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More