Ethereum Faces $1.3 Billion Unstaking Wave — Here’s What It Could Mean for ETH

Ethereum's $3,600 rally prompts $1.3 billion in ETH unstaking, raising market questions. But soaring staking demand and whale buys suggest long-term strength.

As capital continues to flow strongly into Ethereum in 2025—pushing its price above $3,600—the amount of ETH queued for unstaking has also surged unexpectedly.

What could this mean for Ethereum’s price trend? Here are some expert insights.

Over 350,000 ETH Waiting to Be Unstaked—What’s the Implication?

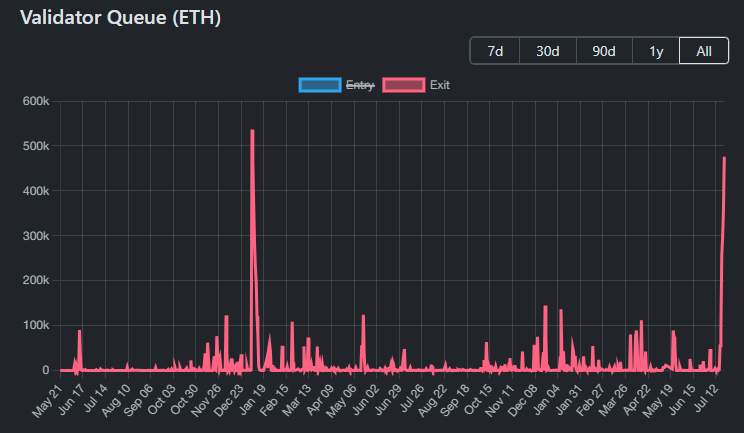

Udi Wertheimer, a prominent investor in the crypto community, raised concerns after discovering that more than 350,000 ETH—worth approximately $1.3 billion—are currently waiting in the unstaking queue.

Ethereum Validator Queue. Source:

ValidatorQueue

Ethereum Validator Queue. Source:

ValidatorQueue

“There’s 350,000 ETH queued up to unstake. About $1.3 billion. The last time that much ETH was being unstaked was in January 2024, following a 25% rally in ETH/BTC in a single week. [price] went down only from there,” Udi Wertheimer said.

Unstaking allows users to withdraw their ETH from staking smart contracts, turning it back into freely usable assets.

A large wave of unstaking could signal potential selling pressure. This is especially true if investors are looking to take profits after ETH’s 160% rally since its April lows.

Earlier in 2024, more than 500,000 ETH were unstaked before ETH surged from $2,100 to over $4,000, and later dropped back to $2,100.

Where Might This Unstaked ETH Go?

Viktor Bunin, OG Protocol Specialist at Coinbase, suggested that this ETH might be moved into internal treasury funds. These funds could serve financial strategies like long-term investment or portfolio diversification.

If that’s the case, this isn’t a sign of panic selling—it’s more likely a form of asset management. This could actually help stabilize the market in the long term.

Meanwhile, a report from Lookonchain shows that on-chain data indicates around 23 whales or institutions have accumulated 681,103 ETH (worth $2.57 billion) since July 1.

And the accumulation hasn’t stopped. In the fourth week of July, more institutions continued to add billions of dollars worth of ETH.

“The new ETH treasury—The Ether Machine—announced $1.5 billion in ETH this morning. That’d be the biggest yet. But then last week, Tom Lee from Fundstrat Capital said he was going to buy $20 billion in ETH, and Joseph Lubin said he was in for at least another $5 billion. I have no idea who’ll end up as the biggest. But I do know this—there’s not enough ETH to go around,” crypto investor Ryan Sean Adams said.

What About ETH Being Staked?

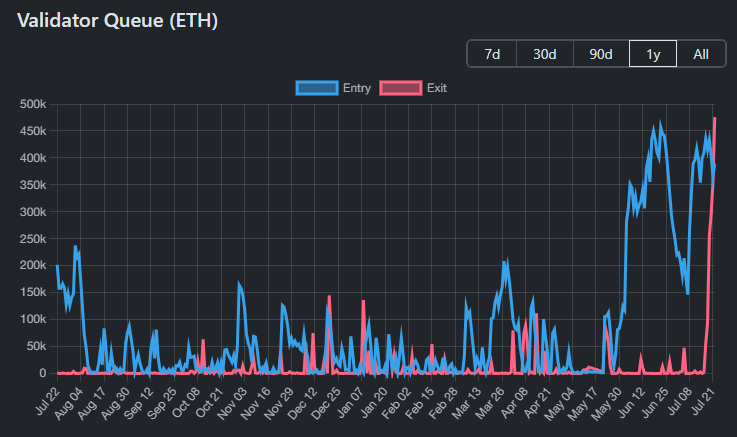

Udi Wertheimer’s concern may sound alarming, especially when compared to historical patterns. However, it lacks a key perspective: the amount of ETH currently waiting to be staked.

Ethereum Validator Queue. Source:

ValidatorQueue

Ethereum Validator Queue. Source:

ValidatorQueue

Data from ValidatorQueue shows that the ETH queued for staking actually far exceeds the amount queued for unstaking. Since June, this queue has surged, with over 450,000 ETH waiting to be staked on certain days.

This reflects continued investor interest in participating in the Ethereum network through staking.

“Also, there’s a healthy amount of ETH queued up for staking at this time,” Wertheimer added.

Data from beaconcha.in shows that over 35.7 million ETH is currently staked across various protocols. This accounts for 29.5% of the circulating supply.

Ultimately, the balance between ETH entering and leaving staking protocols is a critical factor. It helps determine whether the market is facing real selling pressure or simply witnessing strategic reallocation by institutions and individual investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

xTAO Dominates with Massive TAO Coin Holdings

In Brief xTAO holds 41,538 TAO coins, valued at $15.8 million. The company focuses on staking income to acquire altcoins and validator nodes. xTAO shares recently dropped, closing at 1.49 Canadian dollars on the TSX Exchange.

Altcoin Index Stalls at 41 as 2025 Resistance Retest Mirrors 2019 and 2021 Cycles

DOJ Clears Dragonfly from Tornado Cash Probe as Roman Storm Trial Nears End

Ether Machine Overtakes Ethereum Foundation After New Purchase of 15.000 ETH