Multiple altcoins have finally hit new all-time highs. Is the crypto market going to continue rising or experience a pullback?

How are traders operating at this stage?

Against the backdrop of the Federal Reserve signaling a rate cut and the continued favorable cryptocurrency policy, market liquidity has fully recovered, and the crypto assets have seen a surge. Bitcoin has forcefully surpassed $120,000, once again hitting a new all-time high; Ethereum is approaching $4,000, reaching a high point in almost six months. Altcoins' micro-strategies continue to spread, overlaid with ETFs and macro policy resonance, rapidly warming market sentiment, and FOMO spreading.

After experiencing this fierce rally, where will BTC and ETH go next? Let's take a look at the latest views of top traders in the market.

Macro Analysis Camp

@CryptoHayes

ETH is gradually breaking free from consolidation and becoming the core infrastructure for Wall Street asset tokenization and stablecoin expansion. With the rising demand for stablecoins like USDC, USDT, and the continuous deployment of real-world assets (RWA) on Ethereum, ETH's utility value and on-chain activity have significantly revived. At the same time, the resurgence of risk appetite and the expectation of a Fed rate cut are driving liquidity back, accelerating the uptrend of ETH. The structural bullishness of ETH is also spreading to its ecosystem, with DeFi protocols seeing a rebound in trading and staking demand, the NFT sector activity rising in sync, and the entire Ethereum ecosystem regaining growth momentum.

Technical Analysis Camp

@Cato_CryptoM

From a technical perspective on BTC, the hourly price has continuously risen, approaching the breakout range limit, and a clear deviation appeared in the hourly range; the four-hour price is at the resistance position of the upper range, showing a strong trend with no deviation; the daily price has once again broken through the MA7, maintaining a bullish trend.

Support: short-term reference 117,000 4-hour support, key support at 113,700. Expand the support range to guard against potential large fluctuations tonight. Resistance: short-term resistance at 119,000, key resistance at the previous high of 121,000, if this level is broken again and held, one can consider aiming for a new high.

@biupa

The second round of Bitcoin's uptrend may be starting. Currently, Bitcoin has been ranging for eight days after coming down from the recent high. There are signs of a breakout from the symmetrical triangle pattern, and once the resistance at 121,000 and 123,200 is broken, the price may target the range between 126,000 and 130,000. If Bitcoin breaks out, the focus in the market may shift back to Bitcoin, while Ethereum may enter a period of consolidation, and altcoins may continue to follow Bitcoin's upward trend (excluding E-series coins). Therefore, attention can be paid to SOL-related projects.

@market_beggar

Currently, the unfilled gap of URPD is located approximately between 111,000 and 115,000, which aligns on the price chart around 112,000 to 115,000. As shown in the chart, if the current minor consolidation range is broken to the downside, the gap area, due to weak support, may not effectively stop the decline. Therefore, when determining the first support level, I personally would refer to 112,000.

The logic behind this 112,000 is simple: it was the top of the consolidation range from May 9 to July 9, and on July 10, the price strongly broke above this area. We can temporarily assume that this consolidation zone was where the main funds were accumulating.

The second noteworthy level is 104,059, which corresponds to the average cost of short-term holders (STH-RP) and is also located within the aforementioned consolidation zone.

Data Analysis Enthusiast

@Murphychen888

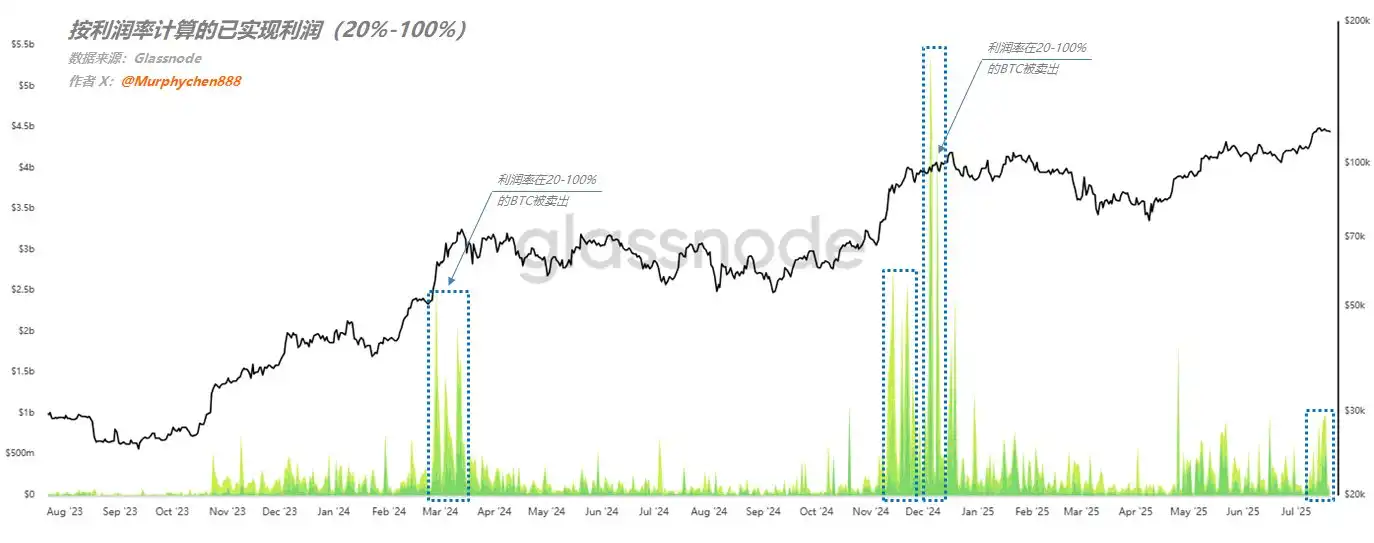

What truly represents the overall market sentiment is the more significant proportion of active investors, whose BTC holdings do not yield such high profit margins when sold, mostly ranging between a reasonable 20% to 100%. From figure 2, we can observe that whenever this group exhibits intensive profit-taking, it signifies the hottest market sentiment. However, the current data appears to have a considerable gap compared to the previous two bullish cycles.

Therefore, even though we have seen a significant realized profit after Bitcoin broke the historical high of 120,000 USD, if we look more closely, some individual ancient whales' sell-off behavior has had a significant impact on this data. Yet, overall sentiment has not reached its peak FOMO state, indicating that the market pressure is not as intense.

@CryptoPainter_X

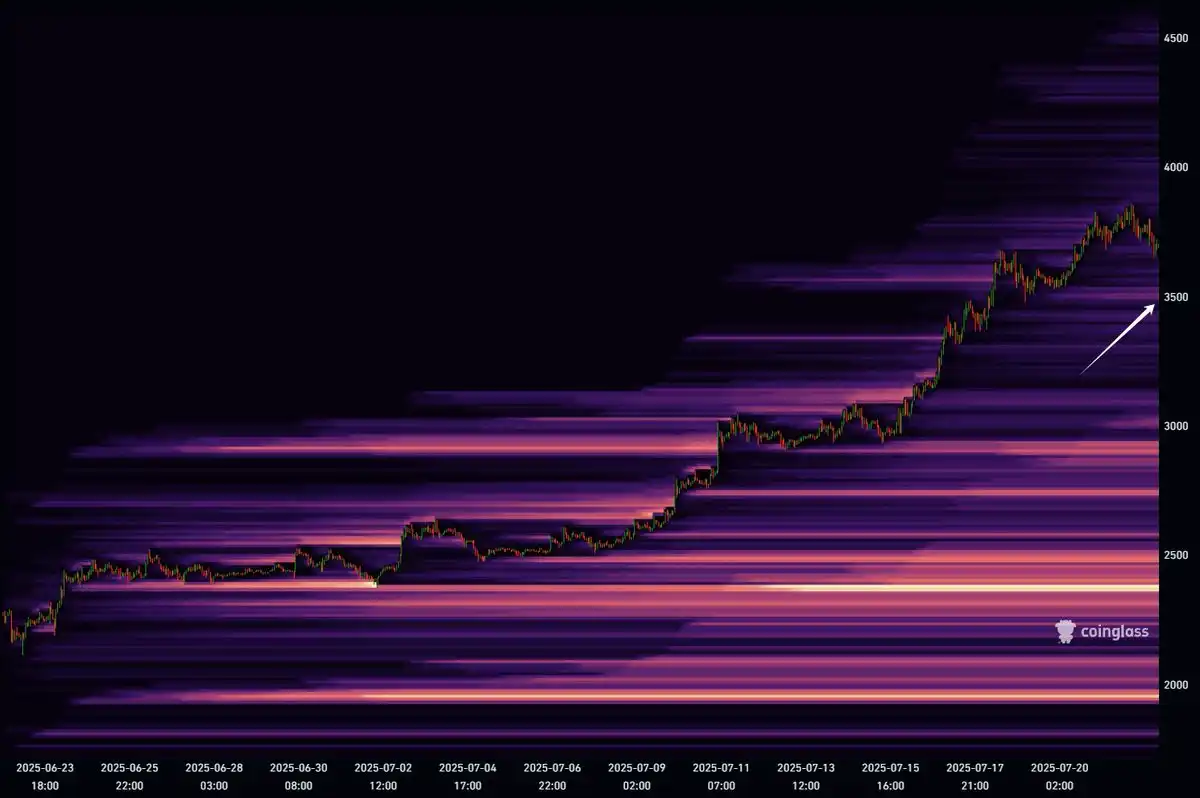

ETH has currently encountered a small liquidation area around 3500. If there is continued downward pressure this week, then 3500 will be the spot to catch the dip.

As previously emphasized, the driving force behind this strong bullish trend in ETH comes mainly from spot buying, likely associated with coin stockpiling, which brings about a significant demand for spot.

However, the subsequent issue is whether these coin holders have the capability, like MicroStrategy, to obtain sustainable financing. If the strategy is merely to pump up the coin and stock prices and then opportunistically issue more shares to cash out, then ETH will lose its continuous spot demand and likely begin oscillating at this level.

Once the oscillation begins, the futures market's liquidity will dictate price action...

Therefore, besides watching for a long position entry at the 3500 support level, attention should also be paid to the stock prices of companies leveraging ETH-based coin financing, whether their behavior is sustainable, and whether they can hold onto the spot, as this will determine the ultimate peak of this ETH cycle!

Overall, the trend structure of ETH remains a strong bullish trend. Therefore, even on a pullback, shorting is not recommended. Instead, wait for an opportunity to go long.

@AxelAdlerJr

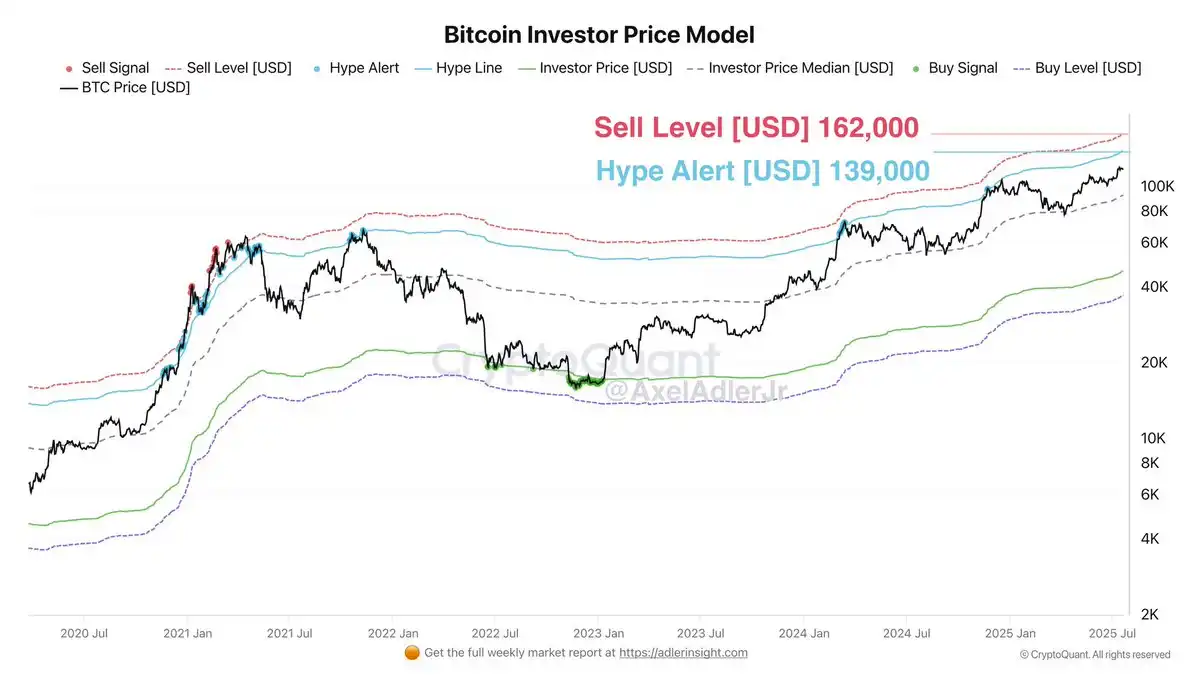

At today's price of $117,000, Bitcoin is currently in the growth range between the investor median price ($92,000) and the hype alert level ($139,000). This indicates that buying activity is still supported by market participants: as long as the price remains above their comfort zone, they are willing to hold or increase their positions. At the same time, we have not yet entered the overly optimistic stage, and unless there is a serious risk of overheating, Bitcoin still has room to rise further to $139,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin treasuries add 630 BTC while ETFs shed $300M as price ranges

Will XRP repeat its 70% rally? Price nears classic fractal breakout

Shiba Inu Whale Outflows Surge 12,887% Amid Price Rejection and Market Uncertainty

XRP Technical Patterns Suggest Possible Rally Toward $3.75–$4 Amid Growing XRPL Adoption