Bitget AI Trading Assistant Sees Surging User Demand

- Gracy Chen leads Bitget as CEO, overseeing GetAgent’s launch.

- GetAgent promotes smarter, user-led crypto trading.

- Market impact includes BTC and ETH trading velocity increase.

Bitget’s AI trading assistant, GetAgent, is witnessing significant demand, with around 20,000 individuals in line for testing. Users interact more than 15 times daily, indicating its potential to transform cryptocurrency trading activities on the platform.

Bitget’s AI trading assistant, GetAgent , attracts nearly 20,000 users vying for internal testing access, highlighting significant interest in innovative trading technologies.

Bitget’s AI initiative reflects industry momentum towards simplifying trading through advanced AI, enhancing user accessibility, and driving engagement.

The launch of Bitget’s new AI trading tool, GetAgent, garners strong interest with 20,000 users queued for testing, interacting over 15 times daily. Gracy Chen, CEO of Bitget, is at the helm, ensuring strategic execution. Bitget, a prominent name in crypto, strategically focuses on cutting-edge AI tools, reinforcing its market positioning in derivatives and spot trading.

“AI is shaping a new era of trading—more efficient, more informed, and more user-led. GetAgent takes away the stress of interpreting data and churns out insights that will help both novice and experienced traders move faster, smarter, and with greater clarity. Think of it like ChatGPT but specifically made for crypto trading.” — Gracy Chen, CEO, Bitget

GetAgent significantly impacts crypto markets by boosting activity with BTC and ETH among highly liquid assets traded on Bitget. The introduction promises not only increased trading volume but also heightened engagement with over 15 user interactions daily. Trading bot advancements have historically evolved, but Bitget’s shift towards conversational AI marks a noteworthy industry leap. Tokens affected primarily include BTC and ETH, leading to increased trading movements within Bitget’s ecosystem.

Potential outcomes extend to significant marketplace participation and liquidity dynamics shifts. Expected financial impacts feature token burn ranging $300,000 to $500,000 in the first 30 days, suggesting a proactive approach to value enhancement. This heavy interest underscores AI’s ongoing influence on trading practices and its capacity to democratize crypto access, bridging the gap between novice and seasoned traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SharpLink Appoints Ex-BlackRock Executive as Co-CEO

Ethereum Surge: ETF Inflows and Institutional Accumulation

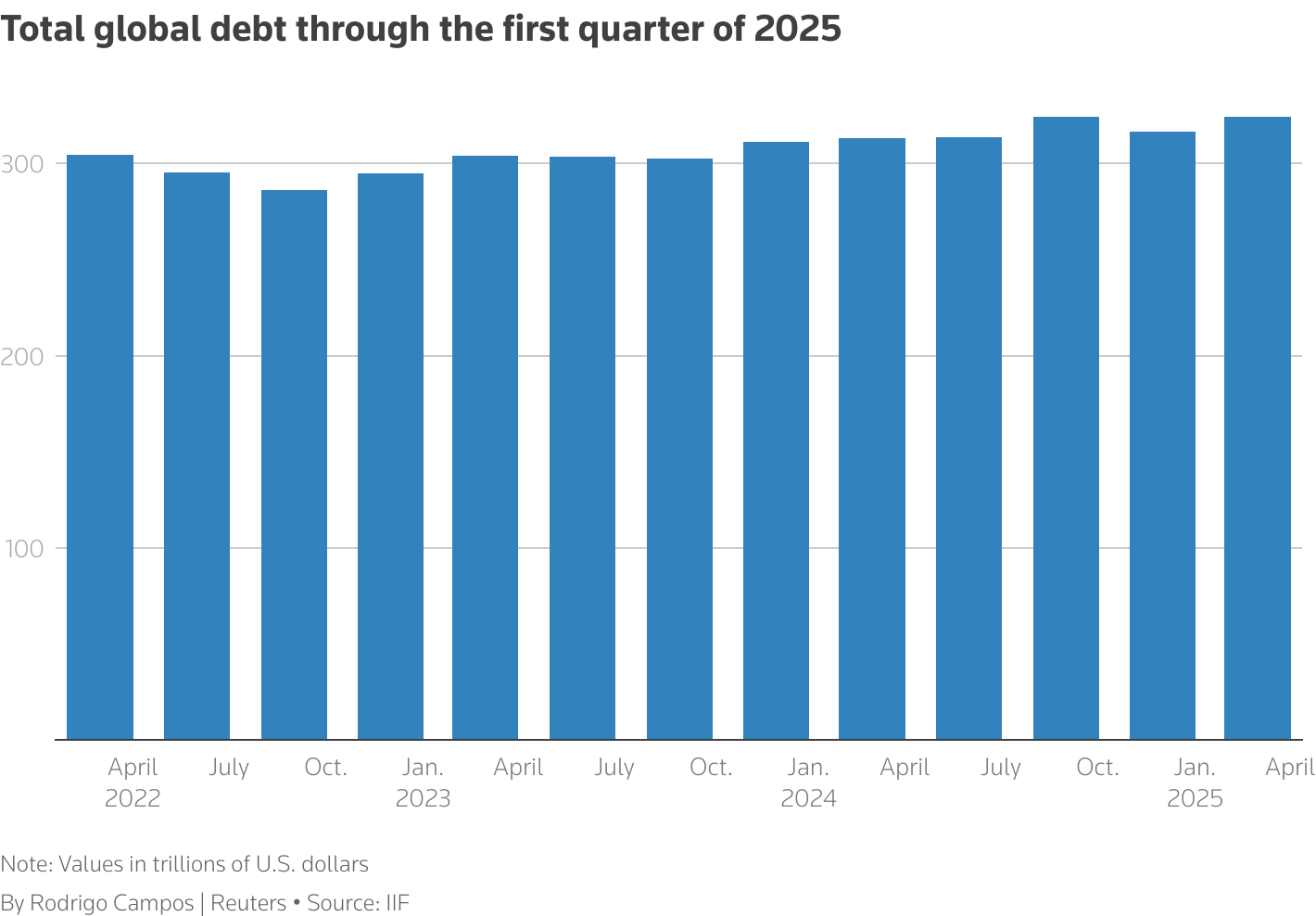

Crypto might protect you from a global debt crisis | Opinion

Wyoming's Stablecoin Billed as Yield-Bearing Alternative to CBDC Control