HBAR Price Forms 5-Month High – What’s Next?

HBAR breaks past $0.30 after months of sideways action, backed by bullish indicators. Holding support is critical as it eyes further gains or risks a reversal.

HBAR has recently made significant gains, crossing the $0.30 mark after a long period of stagnation.

Although the altcoin had posted sideways movement for some time, it seems to be picking up momentum again. The positive price action signals the potential for continued growth in the near term.

HBAR is Forming a Bullish Pattern

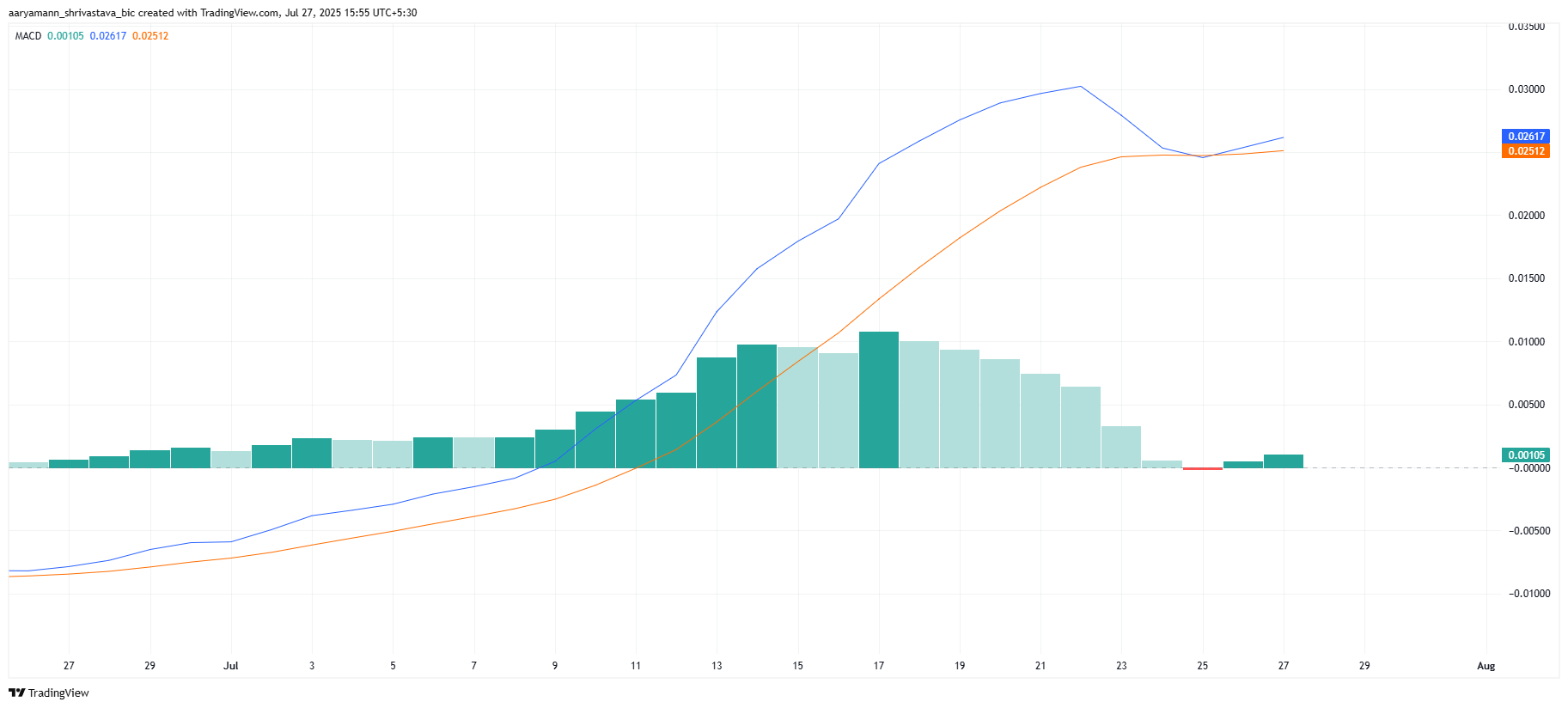

The MACD indicator for HBAR shows signs of bullish momentum picking up strength. Earlier this week, the MACD recorded a bullish crossover, suggesting that positive market forces are at play.

This is crucial for HBAR’s price movement, as it indicates that the altcoin is aligning with broader market cues, which could propel it higher.

As the MACD continues to show an upward trend, the likelihood of further price gains for HBAR increases. This technical signal suggests that the altcoin is gaining traction and may continue on its upward trajectory, driven by investor optimism and a generally bullish market sentiment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

HBAR MACD. Source:

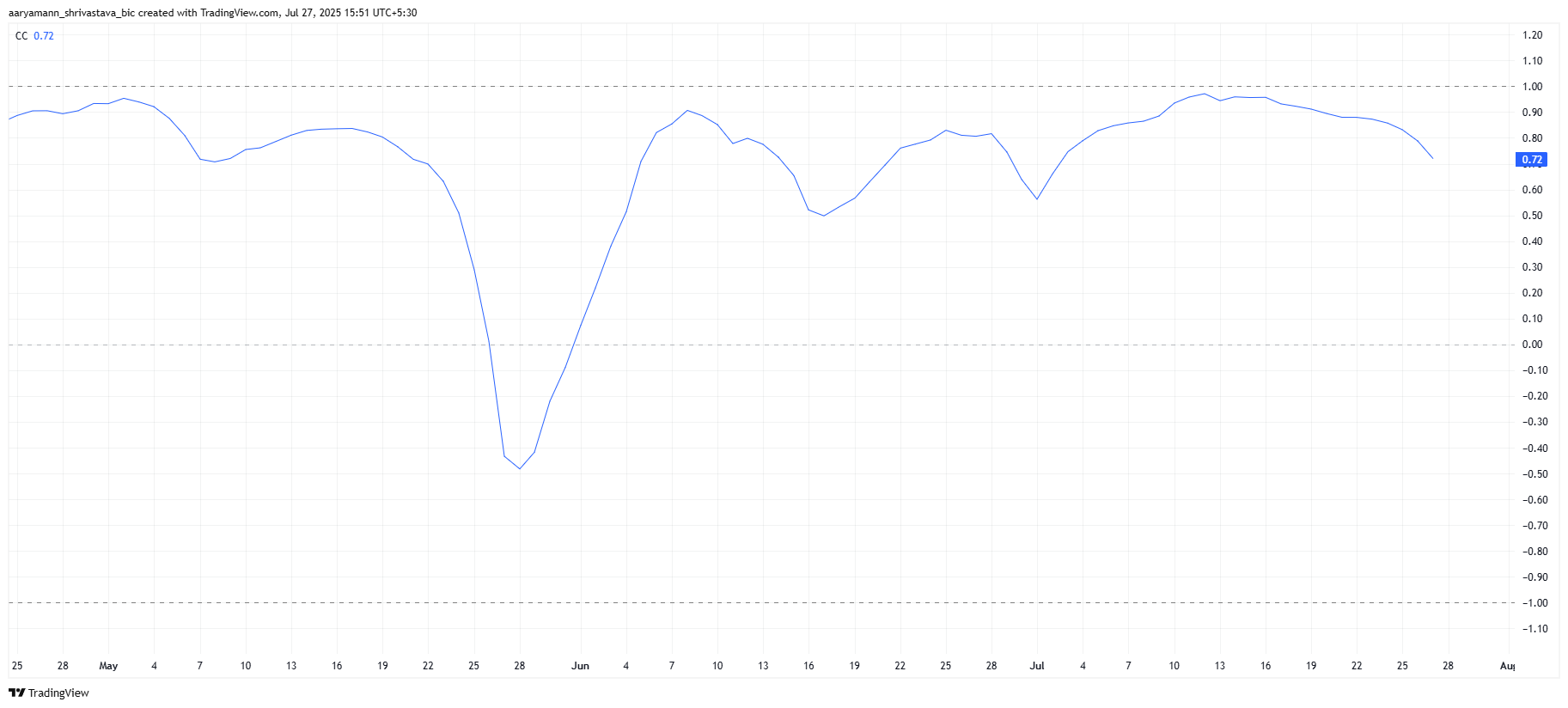

HBAR’s correlation with Bitcoin currently stands at 0.72, which can be both beneficial and problematic for its price movement. As Bitcoin has been relatively stagnant, it has allowed HBAR to experience some independence in its price action.

HBAR MACD. Source:

HBAR’s correlation with Bitcoin currently stands at 0.72, which can be both beneficial and problematic for its price movement. As Bitcoin has been relatively stagnant, it has allowed HBAR to experience some independence in its price action.

This can help HBAR continue to climb, even as Bitcoin remains in consolidation.

However, if Bitcoin begins to rally and the correlation between the two assets continues to decline, HBAR could face challenges. A strong BTC rally might overshadow HBAR’s price movement, pulling it down despite its positive momentum. Therefore, the continued stagnation of Bitcoin may play a pivotal role in HBAR’s short-term performance.

HBAR Correlation To Bitcoin. Source:

HBAR Correlation To Bitcoin. Source:

HBAR Price Is On A Rise

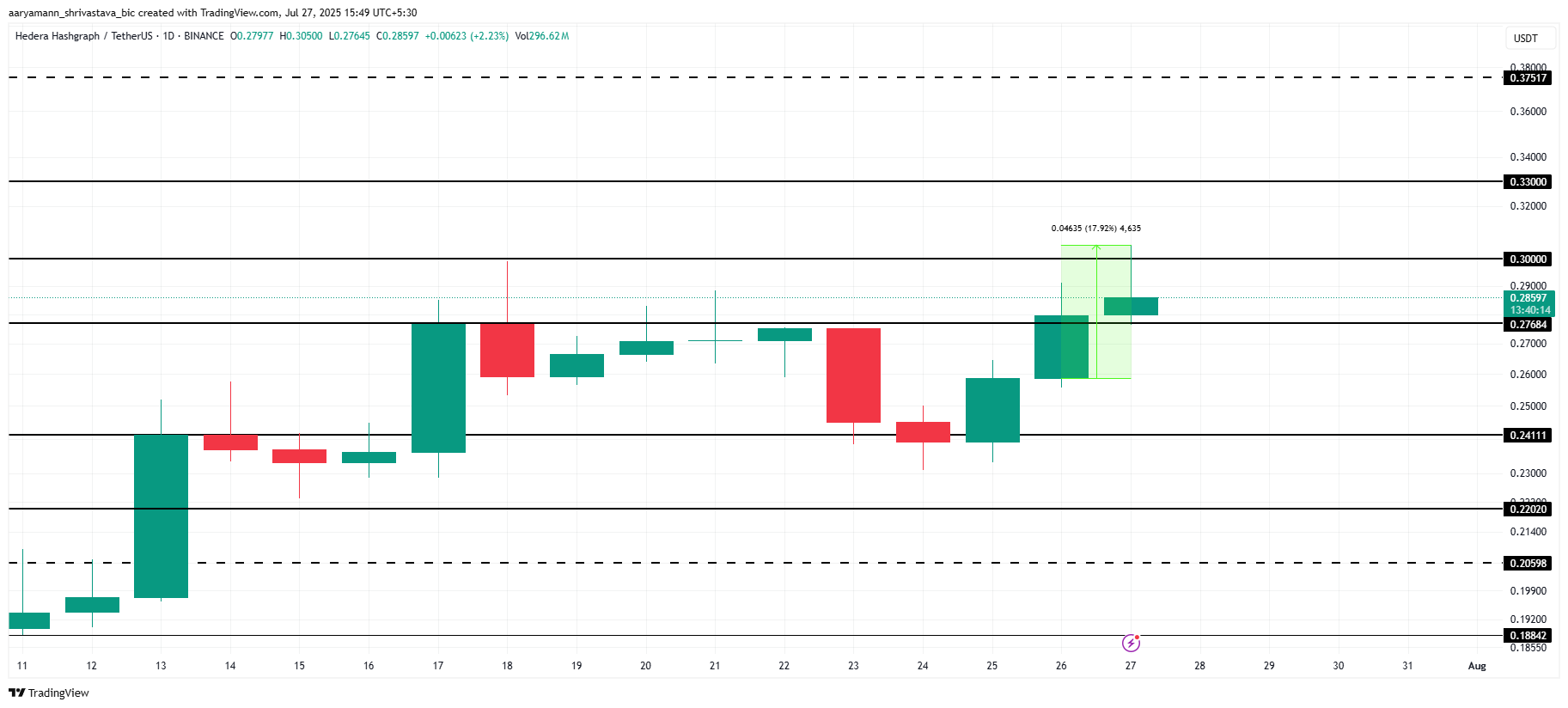

HBAR price is currently up, trading at $0.28, following an 18% increase during the intraday rise. The altcoin reached $0.30 briefly, marking a significant milestone for the cryptocurrency.

With the momentum behind it, HBAR could continue its positive trajectory if the broader market cues remain favorable.

If HBAR can secure $0.30 as support, this key psychological level could drive further inflows, propelling the altcoin higher. In this scenario, HBAR could move towards $0.32 or higher, marking the next target for investors.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

On the other hand, if Bitcoin surges unexpectedly, HBAR could see a reversal. If the altcoin falls below the $0.27 support, it might drop to $0.24, invalidating the bullish thesis. In such a case, HBAR would face a significant price correction before it can regain upward momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jack Dorsey's decentralized messaging app Bitchat launches on App Store

Dive into Liquid Crypto Funds’ Struggle with Market Waves

In Brief Asymmetric Capital's Liquid Alpha Fund closed after losing 78% of its value. Bitcoin rose 28%, yet many altcoin portfolios experienced losses. Experts blame poor asset choice and inadequate risk management for the decline.