Key Notes

- Ethereum leads with one of its strongest weeks in history.

- Bitcoin sees slight outflows amid past week’s price slowness.

- Analysts hint at a potential market peak forming by mid-September.

The cryptocurrency exchange-traded products (ETPs) market attracted $1.9 billion in inflows last week, marking the 15th consecutive week of gains.

This has pushed July’s month-to-date inflows to a record $11.2 billion, comfortably outpacing the $7.6 billion during December’s post-election surge.

As per a Monday report by CoinShares , Ethereum ETH $3 753 24h volatility: 3.5% Market cap: $452.94 B Vol. 24h: $38.75 B emerged as the top performer, drawing $1.59 billion in inflows, the second-largest weekly total in its history. Year-to-date inflows into ETH have now surpassed all of 2024’s combined.

This surge in institutional interest comes as Ether eyes $4,000 breakout in the near-term. In the past week, the second largest cryptocurrency has seen a 3% price gain, currently trading around $3,880.

Meanwhile, Solana SOL $181.7 24h volatility: 5.0% Market cap: $97.77 B Vol. 24h: $11.85 B and XRP XRP $3.11 24h volatility: 4.9% Market cap: $184.24 B Vol. 24h: $7.65 B also posted strong numbers, reflecting renewed interest regarding the next 1000x crypto .

However, Bitcoin BTC $117 945 24h volatility: 1.4% Market cap: $2.35 T Vol. 24h: $43.19 B saw minor outflows of $175 million as the largest cryptocurrency was mostly trading flat last week.

The inflow pattern also suggests a shift in investor capital allocation amid the anticipation of new ETF decisions.

Is Bitcoin Approaching a Turning Point?

Glassnode reports that Bitcoin’s $117,000 price level is acting as a key demand zone. Over 73,000 BTC are now held at this cost basis, an indication of strong buyer interest absorbing each price dip.

The $117K level continues to attract demand, with ~73K $BTC now held at this cost basis. Each dip is being absorbed, as investors steadily accumulate in this range: https://t.co/Z7YaRYAyAc pic.twitter.com/0klgr8Tvhs

— glassnode (@glassnode) July 28, 2025

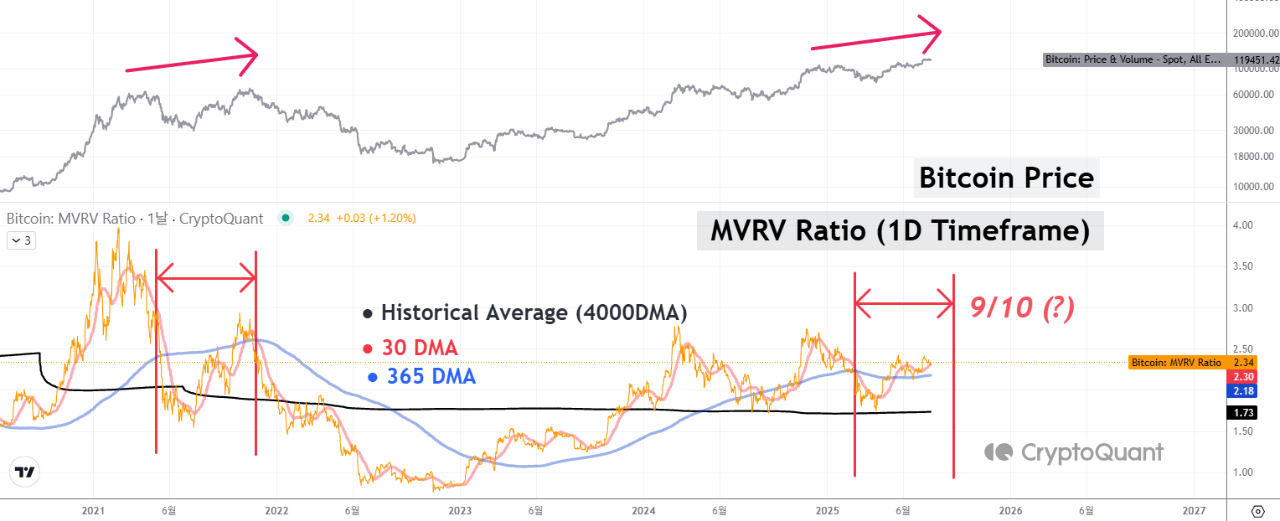

Meanwhile, a CryptoQuant analyst noted the MVRV Ratio’s 365-day moving average (365DMA) as a signal worth watching. Historically, this indicator has aligned closely with market cycle tops.

In 2021, it formed a camel-like double peak, with the second top arriving six months after the first, right before the bear market began. Interestingly, 2025 appears to be following a similar pattern.

Bitcoin MVRV Ratio’s 365DMA | Source: CryptoQuant

If history repeats, the next market top could land around September 10, according to the analyst. However, some experts caution that since MVRV is a lagging metric, Bitcoin’s actual price peak may come slightly earlier, perhaps by late August.

As macro narratives shift and hopes of a potential Fed rate cut grow, investors should balance bullish expectations with disciplined caution.

next