Shiba Inu’s Summer Surge Ends—Price Dips as Big Holders Exit

Shiba Inu's summer surge ends as whales offload their holdings, driving prices below key support levels. A dip in market sentiment signals a bearish trend.

Top meme coin Shiba Inu is showing signs of an extended bearish trend as large investors ramp up profit-taking activities.

This wave of selling pressure has triggered a decline in the meme coin’s value, pushing it below its ascending parallel channel—a key structure that had supported its price action from June 22 through July 27.

SHIB Bulls Lose Grip as Large Holders Trigger Breakdown

Leading meme coin SHIB has broken below the lower trend line of the ascending parallel channel within which it traded for over a month.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

SHIB Ascending Parallel Channel. Source:

TradingView

SHIB Ascending Parallel Channel. Source:

TradingView

Such breakdowns are interpreted as early signs of trend reversals, especially when accompanied by weakening demand and increased selling volume.

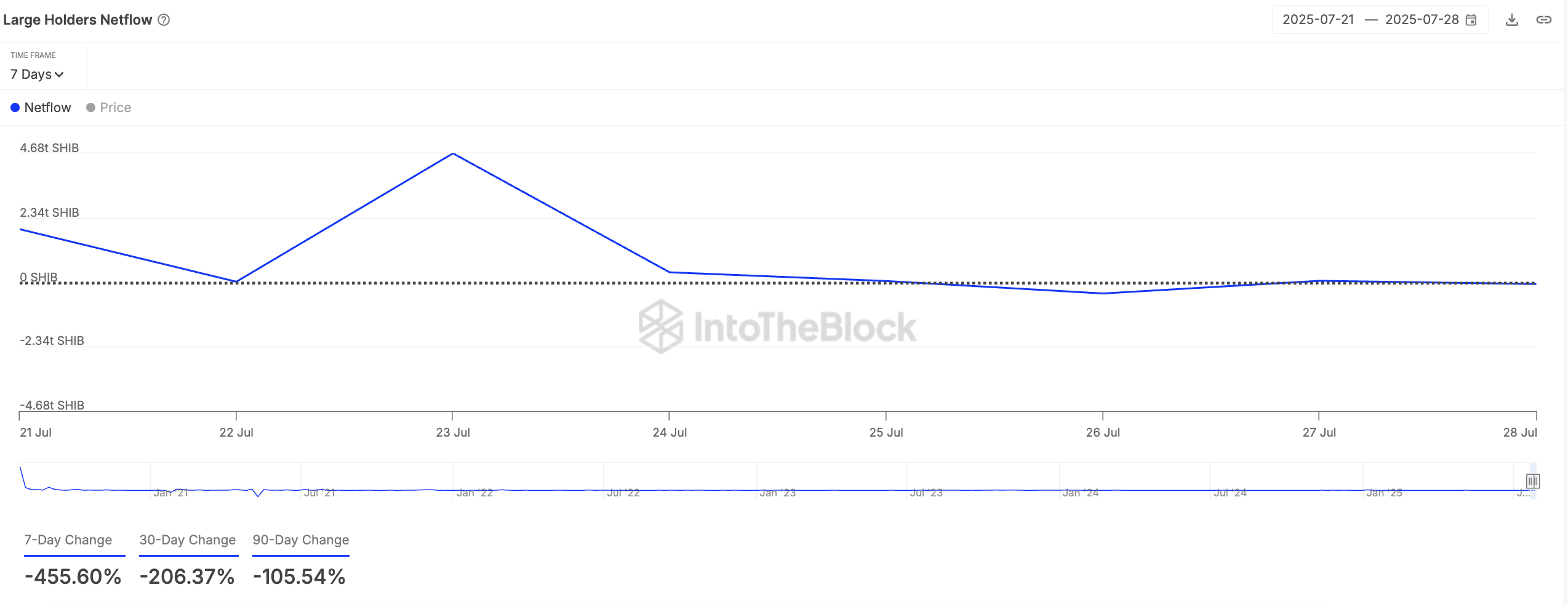

For SHIB, the breakdown coincides with a sharp surge in whale sell-offs. On-chain data from IntoTheBlock reveals a 456% dip in large holders’ netflow over the past week, confirming that major investors are exiting their positions and realizing profits.

SHIB Large Holders Netflow. Source:

IntoTheBlock

SHIB Large Holders Netflow. Source:

IntoTheBlock

Large holders are whale addresses that hold more than 1% of an asset’s circulating supply. Their netflow tracks the difference between the coins they buy and the amount they sell over a specific period.

When an asset’s large holders’ netflow dips this way, more tokens flow out of whale wallets than into them. This signals increased profit-taking, often a precursor to price weakness.

In SHIB’s case, the sharp decline in netflow confirms that major investors are offloading their holdings. This reduces market confidence and adds downward pressure on the token’s value.

Futures Market Retreat Hints at Deeper Losses

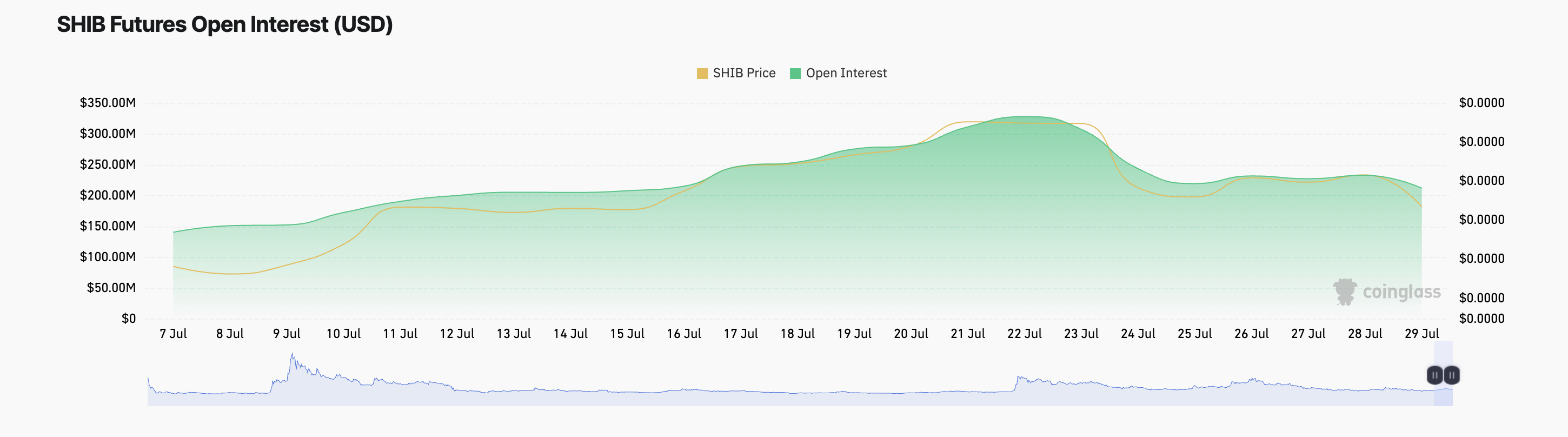

Sentiment in the derivatives market mirrors the weakness seen on-chain. SHIB’s open interest in futures contracts has been steadily declining since July 22, plunging by 35% to stand at $212.48 million at the time of writing.

SHIB Futures Open Interest. Source:

Coinglass

SHIB Futures Open Interest. Source:

Coinglass

This sustained drop suggests that traders are increasingly unwinding their positions, with fewer participants willing to bet on the token’s short-term upside.

When open interest falls alongside price, it is an overall sign of cooling momentum. In SHIB’s case, this drop reinforces the bearish outlook and suggests that conviction and capital are leaving the market.

SHIB Bulls Eye $0.00001467, But Whale Activity Clouds the Path

SHIB trades at $0.00001351 at press time, facing strong resistance at $0.00001362. If whale selloffs persist, this price barrier could strengthen and force SHIB’s price to trend downward to the support floor at $0.00001239.

SHIB Price Analysis. Source:

TradingView

SHIB Price Analysis. Source:

TradingView

However, if new demand rockets, the meme coin could breach $0.00001362 and soar to $0.00001467.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Trading Club Championship (Phase 2) – Grab a share of 50,000 BGB, up to 500 BGB per user!

Subscribe to UNITE Savings and enjoy up to 15% APR

Subscribe to UNITE Savings and enjoy up to 15% APR

New spot margin trading pair — TREE/USDT!