Date: Wed, July 30, 2025 | 06:55 AM GMT

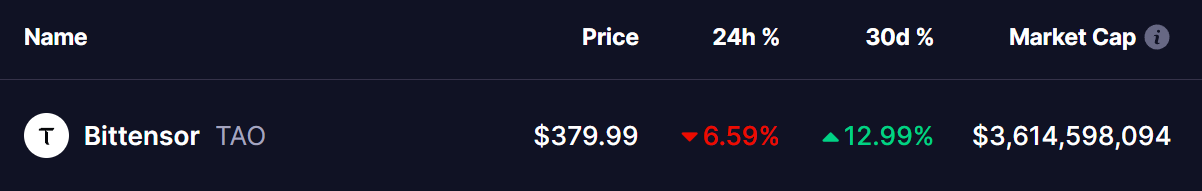

The broader cryptocurrency market is experiencing a pullback after Ethereum (ETH) tapped its multi-year resistance near $3,940 before easing to $3,825. This dip has led to a red day across many altcoins , including Bittensor (TAO), which is down 6% today, trimming its monthly rally to 12%.

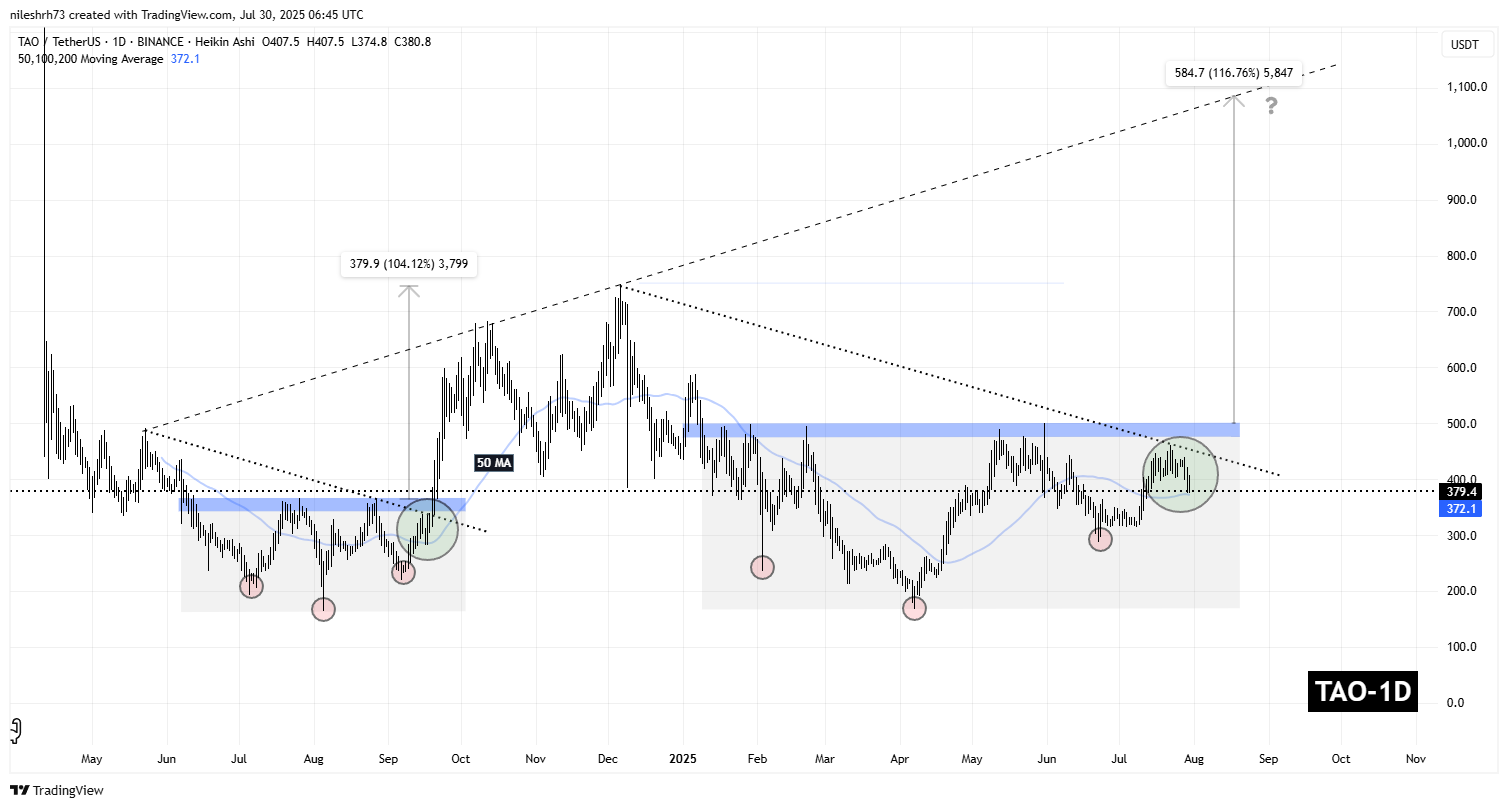

But beneath this short-term weakness, TAO’s daily chart reveals a promising setup that could hint at a bullish reversal. A familiar fractal pattern from late 2024 appears to be repeating itself — and if it plays out similarly, TAO might be on the verge of another explosive move.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Hints at a Bullish Reversal

On the daily timeframe, TAO is forming a nearly identical structure to the one that sparked a 104% rally in 2024. That rally was built off a classic inverse head-and-shoulders pattern. The breakout back then was triggered after a corrective move into the right shoulder, where TAO found strong support at the 50-day moving average. From that springboard, it shot upward and broke out cleanly above its neckline resistance.

Bittensor (TAO) Daily Chart/Coinsprobe (Source: Tradingview)

Bittensor (TAO) Daily Chart/Coinsprobe (Source: Tradingview)

Now, TAO seems to be staging a similar setup.

Once again, the pattern is there — an inverse head-and-shoulders formation, with the price currently pulling back into the right shoulder region. It is retesting the 50-day moving average, now at $372, while consolidating just beneath the blue neckline resistance zone — exactly where it launched from during the last rally.

What’s Next for TAO?

If TAO can maintain support above the 50-day moving average, and a breakout above the neckline could pave the way toward its upper target. If the fractal plays out again, the projected move from the neckline breakout could reach the ascending resistance near $1,000 — marking a potential 116% upside from the neckline region.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before making any investment decisions in the crypto market.