Date: Thu, July 31, 2025 | 02:34 PM GMT

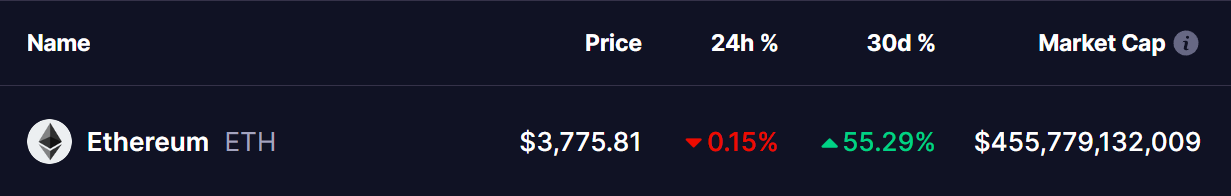

The cryptocurrency market is currently undergoing a moderate pullback. After Ethereum (ETH) tested a multi-year resistance level near $3,940, it has cooled off to $3,775 — dragging down much of the altcoin sector in the process. Yet despite the short-term weakness, a deeper look under the hood reveals something potentially far more bullish for altcoins.

A key technical fractal forming on the “OTHERS” chart — representing the total market cap of cryptocurrencies excluding the top 10 — is now signaling a possible upside breakout.

Source: Coinmarketcap

Source: Coinmarketcap

“OTHERS” Chart Hints at Major Altcoin Rally

Crypto analyst Sykodelic has drawn attention to a striking pattern on the OTHERS chart. The setup appears to mirror a previous breakout that led to a powerful altcoin rally late last year.

Back then, the chart formed a golden cross — where the 50-day moving average crossed above the 200-day moving average — followed by a short period of sideways consolidation. That pause gave way to an explosive rally, driving altcoins sharply higher.

Now, history might be repeating itself.

OTEHRS Fractal Chart/Credits: @Sykodelic_(X)

OTEHRS Fractal Chart/Credits: @Sykodelic_(X)

In late July, the OTHERS chart once again triggered a golden cross. Since then, the market cap has been consolidating just above a key horizontal support zone near $280B — the same technical area where the previous rally ignited.

The current structure echoes the earlier breakout almost perfectly, with price stabilizing after the moving average crossover. This fractal alignment is strengthening the bullish case.

What to Expect Next?

If the current fractal pattern continues to track its historical counterpart, the altcoin segment may be poised for a significant upside move. The key level to watch is the $280B support. As long as it holds, the technical setup favors a breakout — possibly initiating a multi-week rally across mid- and small-cap cryptocurrencies.

However, a decisive breakdown below the $280B support could delay the move or invalidate the pattern. Traders and investors should closely monitor momentum signals and volume trends in the coming days.