Ethena (ENA) Kicks Off August With Bullish Rally and $1.4 Billion Volume Spike

Ethena’s ENA token continues its impressive performance, with a 14% rise in the past 24 hours, fueled by strong demand and growing market confidence heading into August.

Ethena’s native token, ENA, has extended its month-long winning streak with a 14% surge over the past 24 hours, trading at $0.670 at press time.

The price spike brings ENA’s total monthly gains to over 155%, making it one of the standout performers in the crypto market this July.

ENA’s Market Conviction Strengthens With $1.42 Billion Weekly Volume

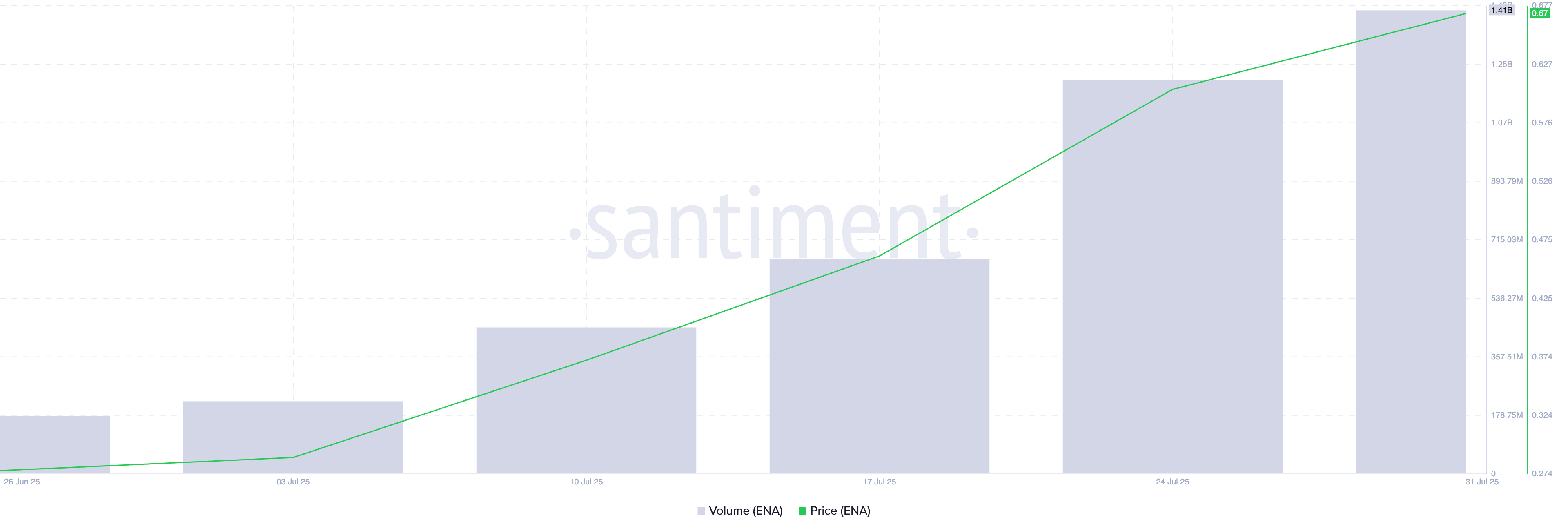

On-chain data suggests that ENA’s recent rally is driven by genuine demand rather than short-term speculative hype. According to Santiment, the altcoin’s weekly trading volume has surged by over 700%, reaching $1.41 billion this week—its highest weekly total in over a year.

ENA Price and Trading Volume. Source:

Santiment

ENA Price and Trading Volume. Source:

Santiment

When an asset’s price and trading volume rise sharply, it signals strong market conviction behind the rally. High trading volume means more participants are buying (and selling), which lends credibility to the price movement.

For ENA, the combination of rising prices and soaring volume strengthens the case for a sustained bullish momentum as the market enters a new trading month.

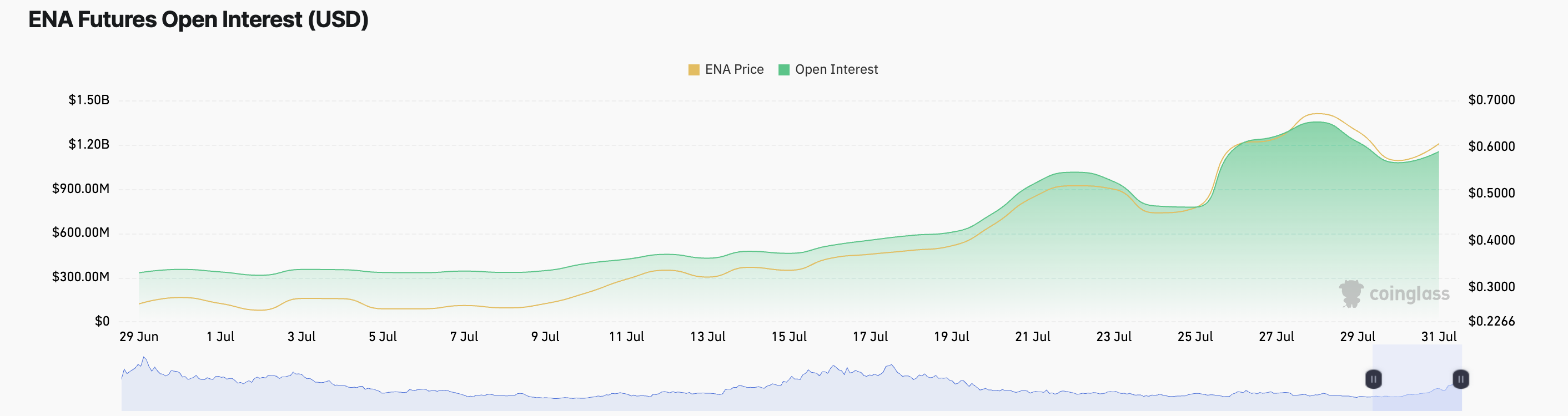

Furthermore, futures market data reflects growing investor confidence. ENA’s open interest has climbed more than 30% in the past 24 hours and stands at $1.15 billion as of this writing.

ENA Futures Open Interest. Source:

Coinglass

ENA Futures Open Interest. Source:

Coinglass

Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not yet been settled. When futures open interest rises alongside an asset’s price, new money is flowing into the market, indicating growing bullish sentiment.

In ENA’s case, the 30% jump in open interest suggests that traders are increasingly positioning for further upside.

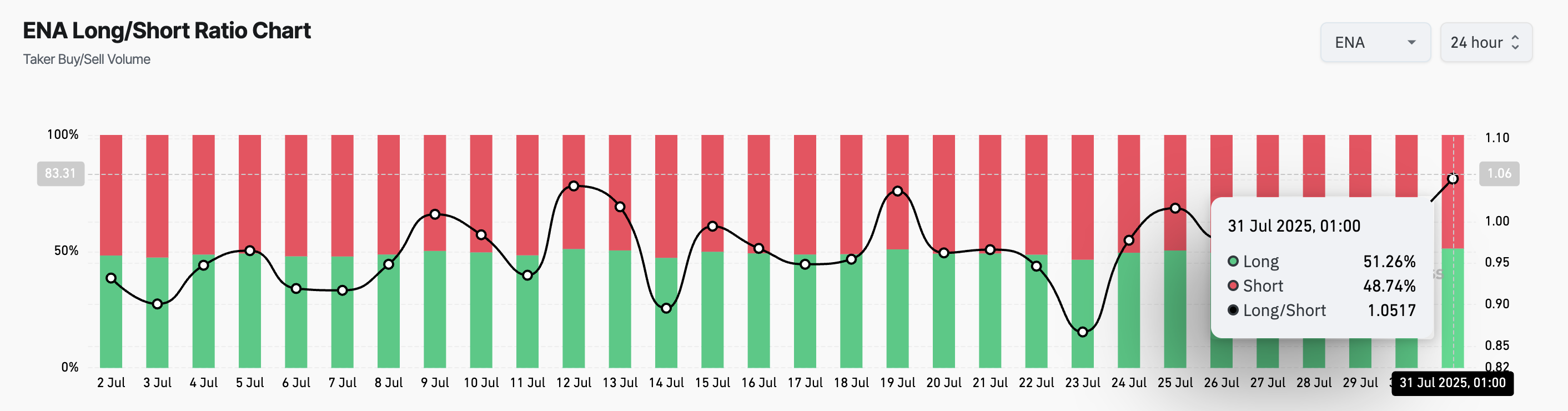

This trend is reflected in its long/short ratio, which now sits at a monthly high of 1.05, indicating significantly more bullish bets than bearish ones across the derivatives market.

ENA Long/Short Ratio. Source:

Coinglass

ENA Long/Short Ratio. Source:

Coinglass

The long/short metric measures the proportion of long bets to short ones in an asset’s futures market. A ratio above one signals more long positions than short ones. This indicates a bullish sentiment, as most traders expect ENA’s value to rise.

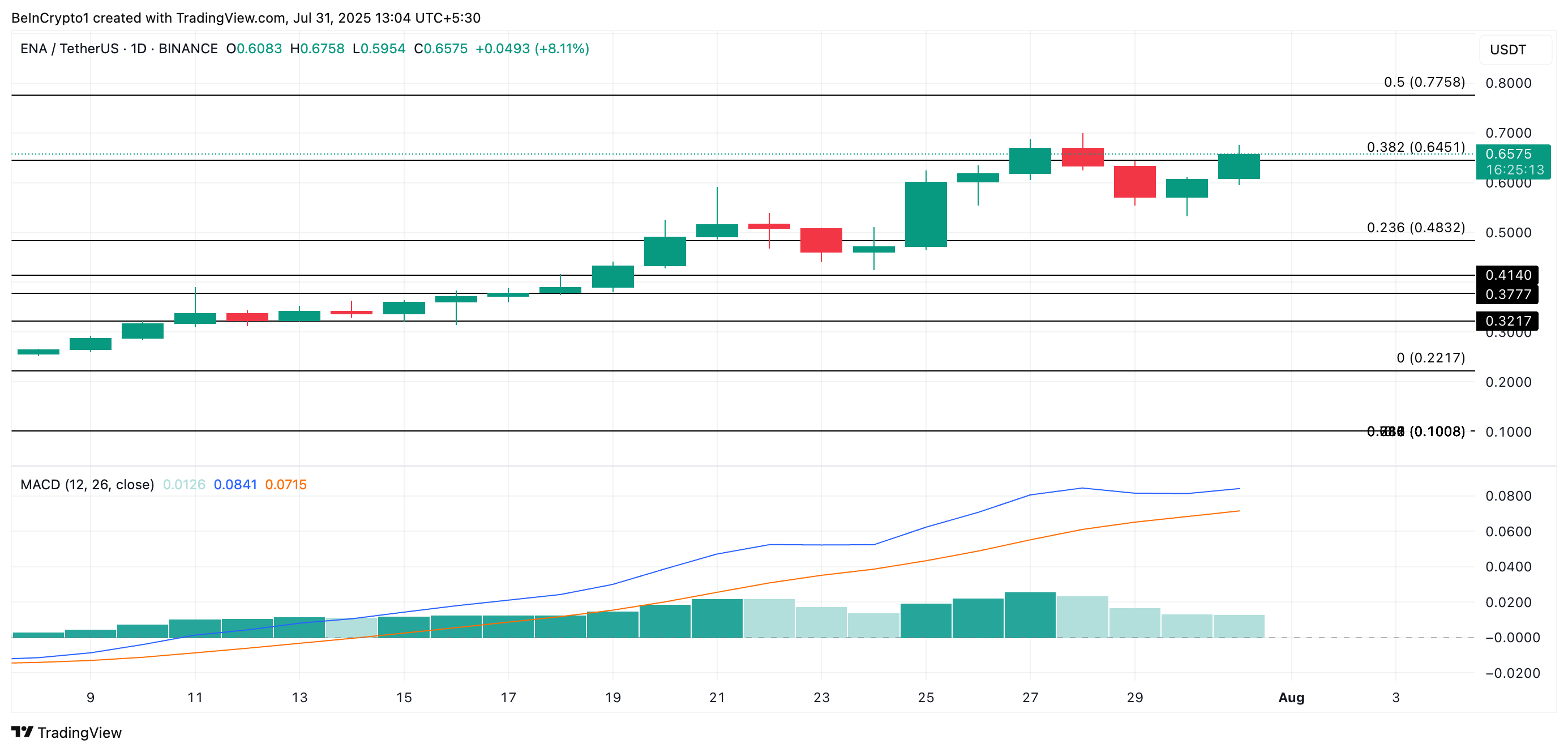

ENA Eyes $0.77 as Bullish Indicator Signals Strong Momentum Ahead

Technical indicators also support the case for continued upside. ENA’s Moving Average Convergence Divergence (MACD) remains in a bullish crossover pattern on the daily chart. This happens when an asset’s MACD line (blue) rests above its signal line (orange), a signal often associated with sustained upward momentum.

If current trends persist, ENA could extend its gains and rally to $0.77 over the coming weeks.

ENA Price Analysis. Source:

TradingView

ENA Price Analysis. Source:

TradingView

However, if demand falls and the bears regain dominance, they could trigger a price dip below $0.64 and fall toward $0.48.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

French AI start-up Mistral seeks funding at $10B valuation to compete with U.S., Chinese rivals

Share link:In this post: Mistral has announced its plan to raise $1B at a $10B valuation, up from €5.8B. The company’s revenue is on track to go beyond $100M annually. The raised funds may support its planned €8.5B data center project.

Florida leads U.S. solar boom with 3GW surge, beating California

Share link:In this post: Florida added over 3GW of utility-scale solar in one year, surpassing California. Florida Power & Light built more than 70% of the state’s new solar capacity. Trump’s new law cuts solar tax credits, hurting homeowners and developers.

Arthur Hayes calls BTC at $100K, ETH at $3K after dumping $10M+ crypto

Share link:In this post: Arthur Hayes sold over $13 million in crypto, including ETH, ENA, and PEPE, within hours. He predicts Bitcoin will “test” $100K and Ethereum will dip to $3K due to macroeconomic pressures. The BitMEX founder cites weak U.S. job data and the upcoming tariff bill as key bearish indicators.

Anthropic restricts Claude API access for OpenAI

Share link:In this post: Anthropic cut OpenAI’s API access after discovering it was using Claude in violation of terms, allegedly to benchmark and fine-tune GPT-5 through unauthorized custom API integration. Anthropic will introduce weekly usage caps for Claude Code starting August 28, affecting all paid tiers, to reduce excessive background usage. High demand for Claude Code has strained Anthropic’s systems, causing multiple service outages in the past month.