Solana Holders Gobble Up $367 Million SOL in A Week Amid Price Fall

Bitcoin faces potential downward pressure after a brief dip following the FOMC report. A recovery above $120,000 is crucial for pushing toward new highs, while a drop below $117,261 could signal further losses.

Solana’s recent price action has been marked by a slight decline, as the cryptocurrency failed to maintain support above the $200 level. While the market sentiment appears mixed, signs suggest that Solana could potentially recover and climb higher.

However, the next few days will be crucial to determine whether it can regain momentum or face further challenges.

Solana Investors Move To Accumulate

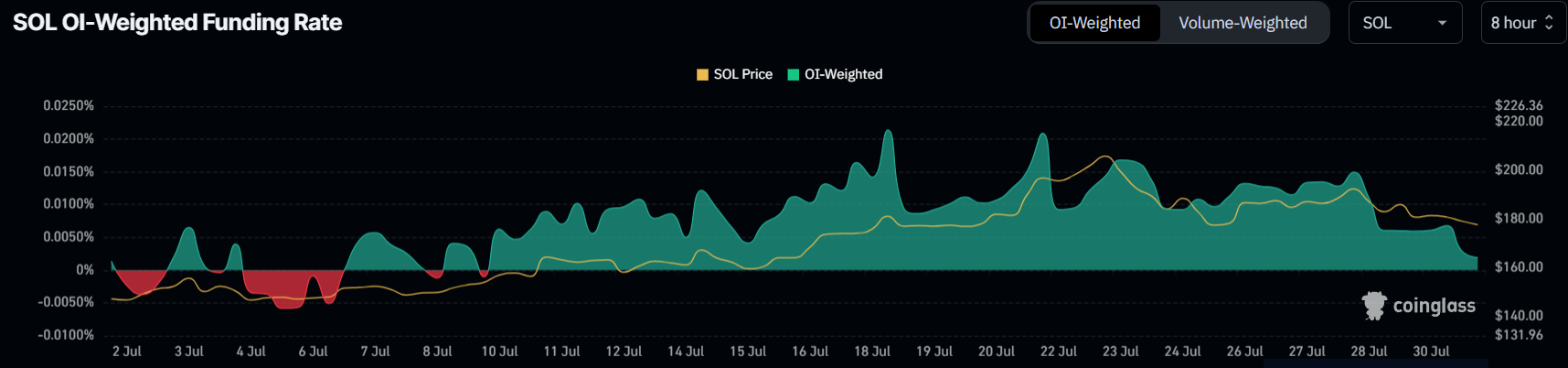

Throughout July, Solana’s funding rate had remained positive, signaling trader confidence in the cryptocurrency’s potential. However, the funding rate is now nearing the point of turning negative. If this occurs, it would reflect waning optimism among traders.

The shift in sentiment is crucial, as a negative funding rate would signal that traders are no longer betting on a price rise. Instead, they may anticipate further declines, which could lead to a higher concentration of short positions. This change would likely push the price lower in the short term.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Solana Funding Rate. Source:

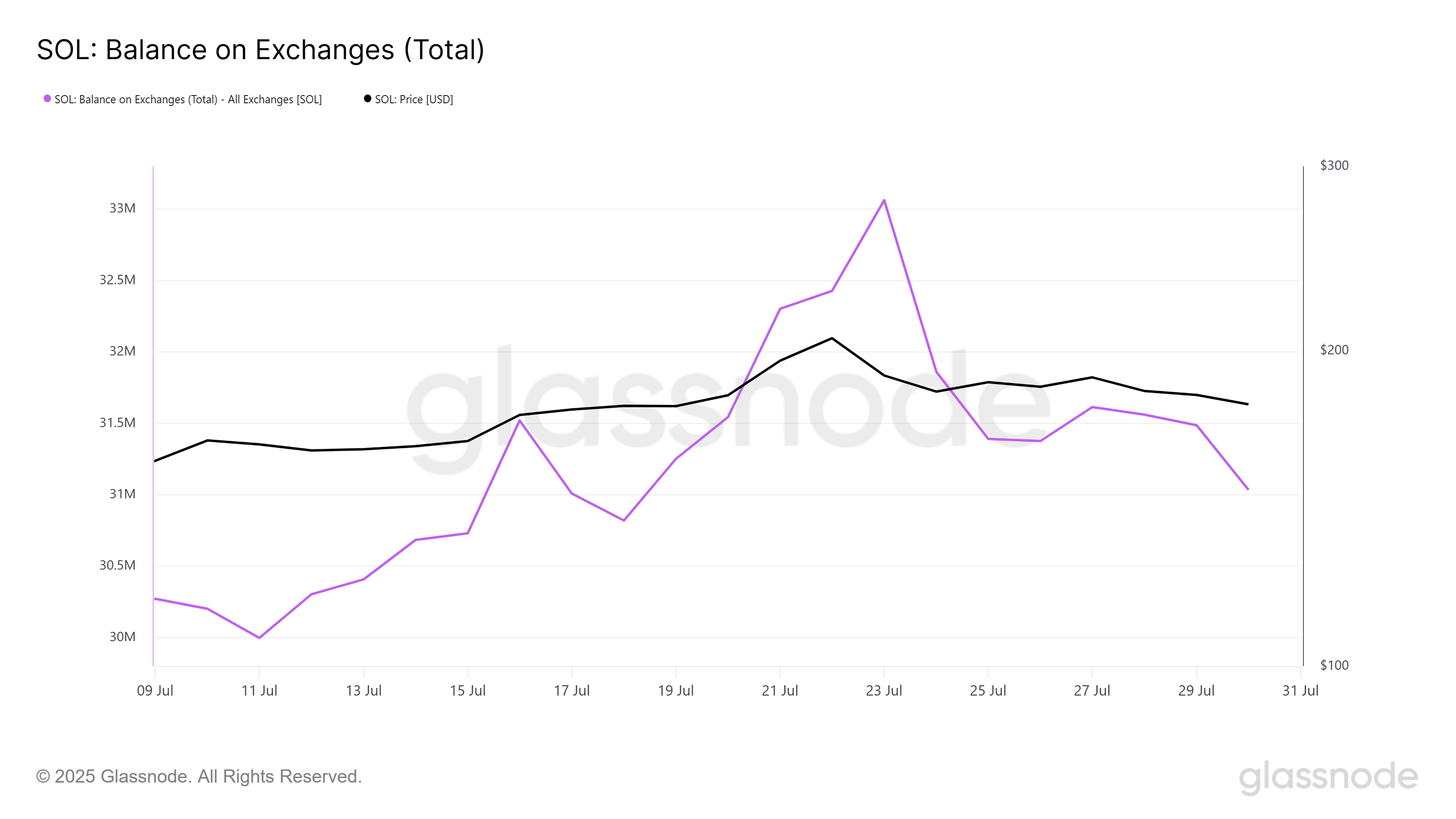

Solana’s balance on exchanges has dropped by 2.03 million SOL in the past week, signaling increased accumulation. This is indicative of investors purchasing $367 million worth of SOL, likely in anticipation of future gains. As the price of Solana declined, many investors have accumulated tokens.

Solana Funding Rate. Source:

Solana’s balance on exchanges has dropped by 2.03 million SOL in the past week, signaling increased accumulation. This is indicative of investors purchasing $367 million worth of SOL, likely in anticipation of future gains. As the price of Solana declined, many investors have accumulated tokens.

This accumulation, however, shows that investors are expecting Solana to recover eventually. With more SOL leaving exchanges, there is a growing belief that prices could rise again, with investors preparing to book profits once the price rebounds.

Solana Exchange Balance. Source;

Solana Exchange Balance. Source;

SOL Price Has Not Lost A Lot

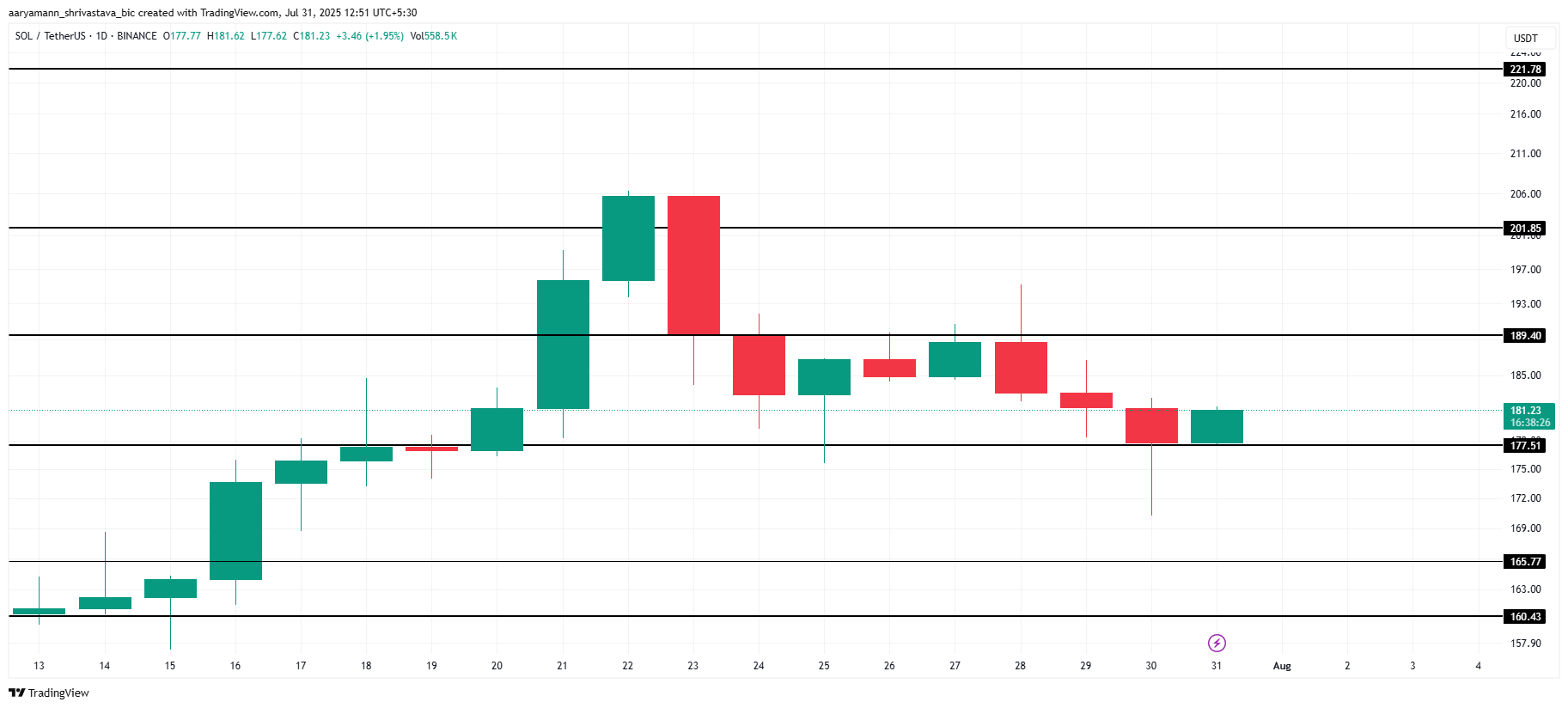

Solana’s price currently sits at $181, holding above the crucial support level of $171. While the spot market remains optimistic, mixed signals from the derivatives market suggest that the SOL price may face downward pressure in the coming days.

If the bearish trend continues, Solana’s price could decline further to the $165 range or remain in a consolidation phase between $189 and $177 until a clear direction is established. This period of uncertainty may persist until market conditions stabilize.

Solana Price Analysis. Source:

Solana Price Analysis. Source:

However, should the accumulation continue to outweigh the bearish pressure from shorts, Solana could break through $189 and convert it into a support level. This shift would allow the altcoin to rise toward $201, potentially invalidating the bearish outlook and reigniting bullish momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple releases volume 1 of its OCC banking license application

Share link:In this post: Ripple has released the first volume of its OCC banking license application, taking a formal step to increase its financial infrastructure. The firm proposes its National Trust Bank, with its application focusing on the use of RLUSD. Ripple unveils its five-man governance panel, establishing its commitment towards regulatory oversight.

Pakistan and Kyrgyzstan to deepen collaboration in crypto and blockchain innovation

Share link:In this post: Pakistan and Kyrgyzstan have agreed to deepen collaboration in crypto and blockchain innovation. Both countries also agreed to share knowledge, expertise, and best practices to help their economies. Pakistan signs several MoUs with Kyrgyzstan amid the downturn in its economic conditions.

Trump’s TMTG reports $3.1B assets, $20M loss in Q2 report

Share link:In this post: Trump Media & Technology Group reported a net loss of $20 million on net sales of $883,300 for Q2 2025. Donald Trump owns 52% of TMTG through a revocable trust, with his stake valued at approximately $1.9 billion. TMTG attributed its Q2 results to various factors, but the most notable one is reportedly its Bitcoin treasury.

India defies Trump warning, vows to continue Russian oil imports

Share link:In this post: India confirmed it will continue importing Russian oil despite Trump’s threat of penalties and a 25% tariff. Officials said no instruction has been given to oil companies to cut back on Russian crude. India now gets over 33% of its oil from Russia, up from less than 1% before the Ukraine war.