Riot Platforms posts net profit in Q2 as cost to mine bitcoin doubles year-over-year

Quick Take Bitcoin miner Riot Platforms posted net income of $219.5 million for Q2, a reversal from its nearly $300 million net loss in Q1. Riot has posted a net loss of $76.9 million this year so far, as the cost to mine one BTC has increased by 93% year-over-year.

Riot Platforms, a bitcoin mining firm that trades on the Nasdaq exchange, nearly undid its first-quarter losses with strong second-quarter earnings .

Riot brought in $219.5 million in net income over the second quarter of 2025, driven mainly by a $470.8 million unrealized revaluation of its bitcoin treasury following its $296.4 million net loss in the first quarter. Overall, the firm has posted a net loss of $76.9 million over the first half of 2025, as it continues its pivot towards high-performance computing and AI workloads.

The company produced 1,426 BTC in the quarter, bringing its holdings to 19,273 BTC, the fourth-most among publicly traded companies globally. The production comes as the cost to mine a single bitcoin has risen 93% since the same period last year, primarily as a result of a rise in the average global network hash rate.

"Strong tailwinds in the price of bitcoin contributed to Riot achieving a record $219.5 million in net income and $495.3 million in adjusted EBITDA, representing exceptionally strong results for the quarter," Riot CEO Jason Les said in a statement.

Shares of Riot Platforms' stock fell about 5% in after-hours trading following the earnings announcement, according to Yahoo Finance data . The company boasts a market capitalization of around $4.8 billion, according to the data, making it the second-largest publicly-traded bitcoin mining firm, behind Marathon.

Riot also disclosed that it has purchased more land around its Corsicana facility, intended to further develop its high-performance computing and AI offerings as a way to diversify its income streams. The company has spent $28 million on the land acquisition year-to-date and forecasts an additional $49 million of capital expenditures by the end of the year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

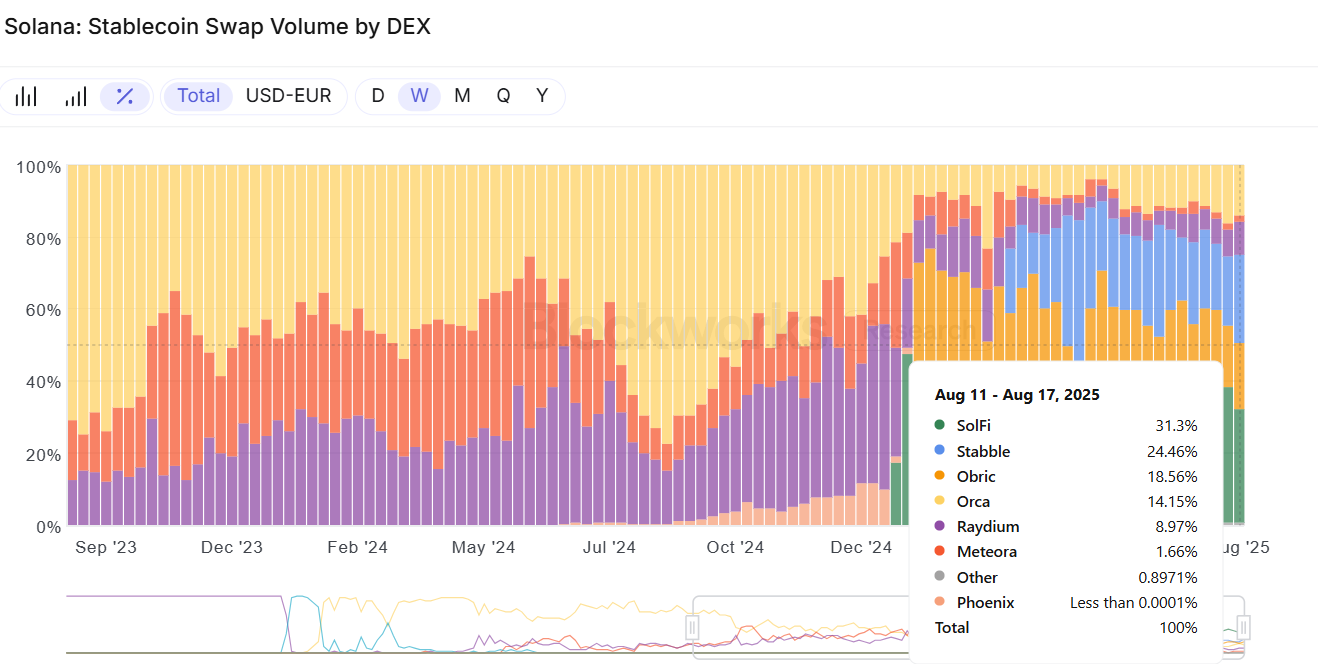

Solana’s proprietary AMMs are reshaping liquid asset markets for users

Prop AMMs like SolFi, HumidFi and Obric are taking over liquid capital markets

Pennsylvania Bill Proposes Jail for Crypto-Holding Officials

Federal Reserve Impact Sparks Crypto Market Surge

U.S. GENIUS Act Prompts ECB Digital Euro Acceleration