Date: Sun, Aug 03, 2025 | 06:20 AM GMT

The cryptocurrency market is currently undergoing a sharp correction, led by Ethereum (ETH), which has pulled back from the $3,940 resistance zone to around $3,440 — a 7% weekly decline that’s put downward pressure on several altcoins . Ondo (ONDO) is among those affected, sliding 16% this week and trimming its monthly gains to just 13%.

However, despite the recent pullback, ONDO’s price action is beginning to reflect a familiar setup — one that previously marked the start of a major uptrend.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Suggests a Bullish Reversal

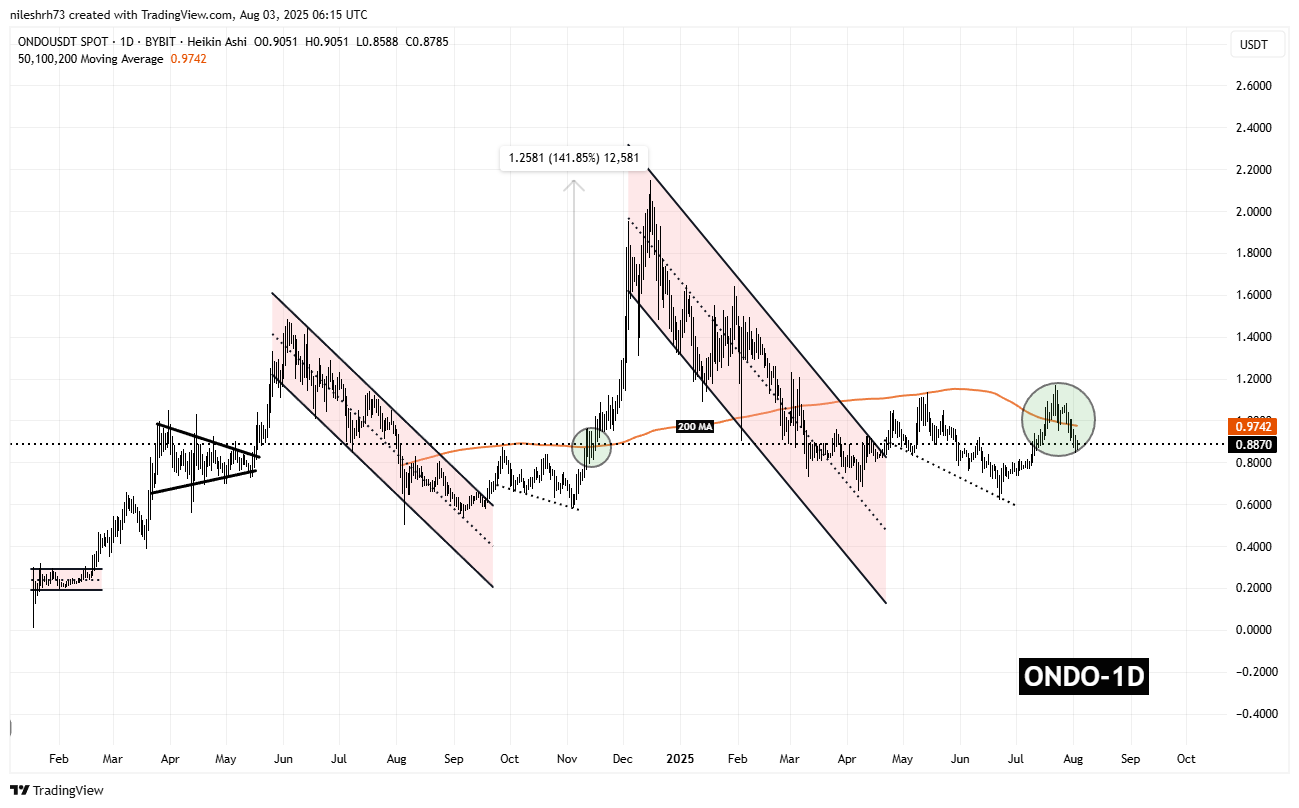

Zooming out on the daily chart, ONDO appears to be forming a nearly identical fractal pattern to the one observed in late 2024.

Back then, the token broke out of a well-defined descending channel and reclaimed its 200-day moving average (200 MA). This breakout was followed by a short-lived pullback, forming a small base just above the 200 MA — marked by a green circle — which served as a springboard for a 141% rally in the weeks that followed.

ONDO Fractal Chart/Coinsprobe (Source: Tradingview)

ONDO Fractal Chart/Coinsprobe (Source: Tradingview)

Now, in 2025, ONDO has once again broken out of a descending channel and recently reclaimed the 200 MA, only to enter another brief corrective phase. The current pullback — again occurring just above the 200 MA — is creating a nearly perfect fractal of the previous setup, hinting that history may be on the verge of repeating itself.

What’s Next for ONDO?

The key level to watch is the 200-day moving average at $0.9742. If ONDO can hold or reclaim this zone and begin pushing higher, it could validate the fractal and ignite another strong upward leg.

Should the pattern unfold similarly to its previous breakout, ONDO could rally toward the $2.14 range — revisiting its all-time high and potentially delivering gains of over 140% from current prices.