Trump to order probe of crypto and political debanking claims: WSJ

US President Donald Trump is reportedly planning to sign an executive order directing banking regulators to investigate claims of debanking made by the crypto sector and conservatives.

Bank regulators would be directed to probe whether any financial institutions violated antitrust, consumer financial protection or fair lending practice laws, according to a draft of the executive order seen and reported by The Wall Street Journal on Monday.

Those found violating the laws could face fines or other legal action. Trump may sign the order this week, reportedly, but the White House could delay or change the plan.

Crypto industry executives have long alleged that the Biden administration conspired to cut crypto off from the financial system by using regulators to pressure banks into shirking clients involved in digital assets.

Executive order to demand regulatory overhaul

The reported draft order directs bank regulators to scrap any of their policies that may have contributed to banks dropping some customers, such as crypto firms.

It also directs the US government’s Small Business Administration to review banking practices that guarantee the loans made by the agency to small businesses.

The order asks regulators to refer some of the potential violations to the attorney general for the Department of Justice to follow up.

The Journal reported in June that the White House was planning for Trump to sign a similar order aiming at stopping banks from cutting off services to industries such as crypto.

“Operation Choke Point 2.0” claims

Crypto executives have claimed that former President Joe Biden began to cut off their industry from banking in late 2022 after the collapse of FTX, with the crypto exchange being revealed as a massive fraud.

Coinbase chief legal officer Paul Grewal testified at a Congressional hearing in February that the Biden-era Federal Deposit Insurance Corporation (FDIC) “bludgeoned the banks” with examinations and questions around crypto and stablecoins until they “relented under the pressure.”

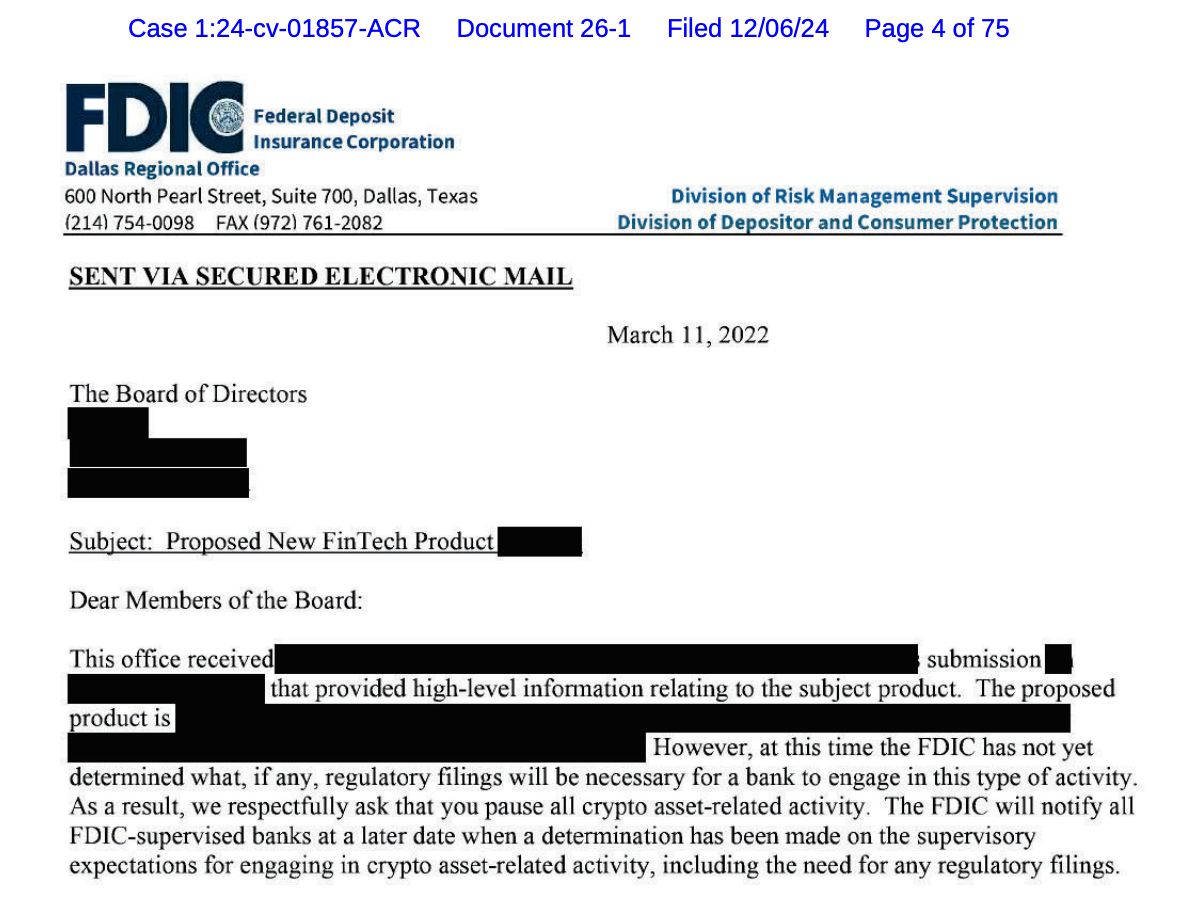

A Coinbase-supported Freedom of Information Act lawsuit against the FDIC showed the agency asked certain financial institutions to pause crypto banking activities , which Grewal said showed the industry’s claim “wasn’t just some crypto conspiracy theory.”

A redacted letter the FDIC sent in 2022 to a company asking it to pause its crypto activities. Source: FDIC

A redacted letter the FDIC sent in 2022 to a company asking it to pause its crypto activities. Source: FDIC

Crypto venture capitalist Nic Carter coined the term “Operation Choke Point 2.0” in February 2023 to describe the perceived debanking phenomenon, taking inspiration from the Justice Department’s “Operation Choke Point” against banks and payday lenders in the 2010s.

Trump’s order to also target alleged political debanking

The order will also reportedly probe the role of banks in supposedly denying or cancelling services to political conservatives.

The draft didn’t name any specific banks, but it did criticize the role of financial institutions that are said to have helped federal investigators with probing the Jan. 6, 2021, riots at the US Capitol, the Journal reported.

Conservatives have also claimed that banks have denied them services based on political beliefs.

The banking industry calls the practice “derisking,” and financial institutions have broad discretion to close accounts, whether the account holder poses a legal, financial or reputational risk to the firm.

The Federal Reserve said in June that it would stop examining for reputational risk following similar moves made by the Office of the Comptroller of the Currency and the FDIC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Shield Against Currency Debasement: Brunell Highlights

Ethereum Price Rebounds from $3,400 Support, Targets $3,800 Resistance

BitMine Becomes Largest Public Ethereum Holder

Ethereum’s Path to Potential $4K Resistance