Date: Tue, Aug 05, 2025 | 09:04 AM GMT

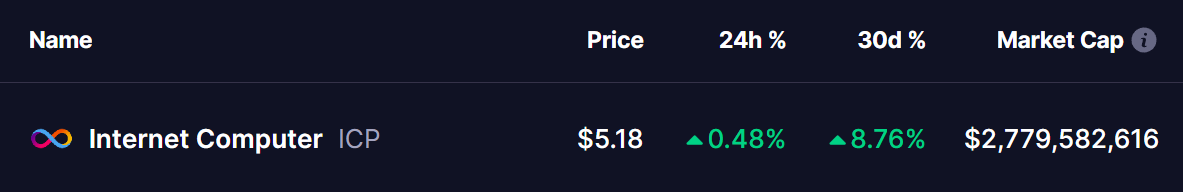

The cryptocurrency market is showing early signs of recovery after the recent sharp decline, with Ethereum (ETH) rebounding to $3,650 from its recent low of $3,357. Several altcoins are beginning to display promising technical setups — and Internet Computer (ICP) is one of them.

ICP has turned green today with modest gains, but beyond the short-term bounce, the chart is revealing something potentially much bigger — a bullish fractal setup strikingly similar to a past pattern that led to a major upside move.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Hints at a Bullish Reversal

On the daily chart, ICP has been moving within a broad falling wedge — a long-term structure often linked with accumulation phases and eventual breakouts.

Looking back to late 2024, ICP reclaimed the 100-day moving average, formed a smaller symmetrical triangle, and then faced rejection at the 200-day moving average. This rejection led to a brief, healthy correction that retested the 100-day MA as support. From there, ICP broke out sharply and surged 94%, touching the wedge’s upper boundary.

Internet Computer (ICP) Daily Chart/Coinsprobe (Source: Tradingview)

Internet Computer (ICP) Daily Chart/Coinsprobe (Source: Tradingview)

Fast forward to the present, and the resemblance is hard to ignore. ICP has again reclaimed the 100-day MA, attempted a breakout from a smaller symmetrical triangle, and faced rejection at the 200-day MA — entering another short correction in the same price region that acted as a launchpad before.

What’s Next for ICP?

If history repeats itself, ICP could be gearing up for a strong rally from its current support zone. A confirmed breakout above both the 100-day and 200-day MAs (around $5.25 and $5.84 respectively), along with a triangle breakout, could trigger a push toward the wedge’s upper resistance line, potentially above $8.32.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.