SharpLink has increased its staked Ether holdings to 521,939 ETH, valued at $1.91 billion, reinforcing its position as a leading ETH treasury holder amid volatile market conditions.

-

SharpLink acquired 83,562 ETH worth $264.5 million between July 28 and August 3, boosting its total staked ETH.

-

BitMine Immersion Technologies leads ETH treasury rankings with 833,137 ETH, valued at over $3 billion.

-

Spot Ether ETFs experienced record $465 million outflows, signaling shifting investor preferences.

SharpLink’s staked Ether holdings surge to 521,939 ETH worth $1.91B amid record spot ETH ETF outflows. Stay updated on ETH treasury trends at COINOTAG.

SharpLink’s Aggressive ETH Accumulation Strategy Advances

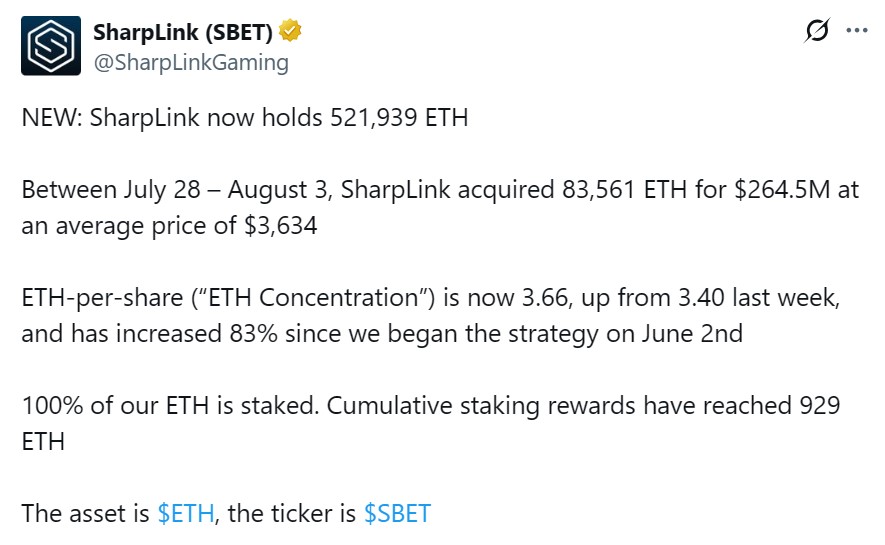

SharpLink continues its bold Ether accumulation strategy, adding 83,562 ETH valued at $264.5 million between late July and early August. This latest purchase raises its total staked Ether to 521,939 ETH, currently worth approximately $1.91 billion. The firm’s strategy focuses on maximizing returns through Ethereum’s proof-of-stake mechanism, with cumulative staking rewards reaching 929 ETH, valued at over $3.3 million.

How Does SharpLink Measure ETH Investment Success?

SharpLink employs an ETH-per-share metric called ETH concentration to evaluate its strategy’s effectiveness. This metric reflects the amount of ETH backing each outstanding share. Since initiating its Ether purchases, SharpLink’s ETH concentration has surged by 83%, now standing at 3.66. This metric highlights the firm’s growing commitment and confidence in Ethereum’s long-term value.

Source: SharpLink Gaming

Where Does SharpLink Rank Among ETH Treasury Holders?

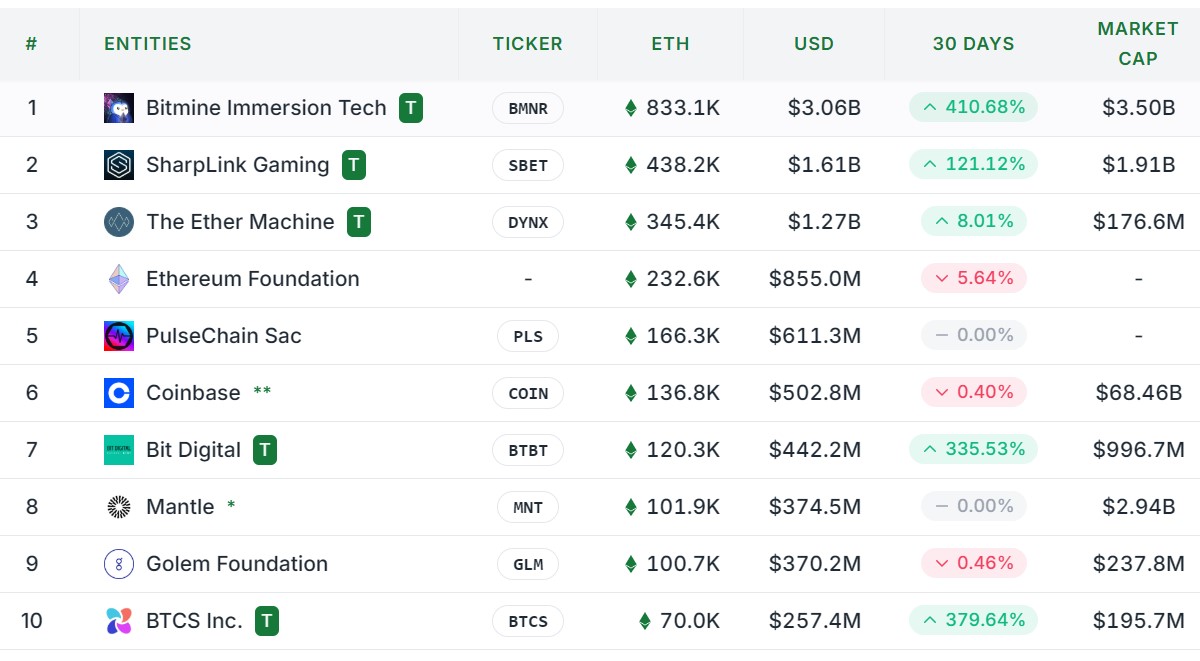

SharpLink ranks second in the public Ether treasury race, following BitMine Immersion Technologies, which holds 833,137 ETH worth over $3 billion. SharpLink’s initial $463 million ETH purchase in June made it the largest public holder at that time. Other notable holders include the Ethereum Foundation with 232,600 ETH and PulseChain with 166,300 ETH.

Data from Strategic ETH Reserve places Ether Machine third with 345,000 ETH valued at $1.27 billion. These rankings illustrate the competitive landscape of institutional ETH accumulation and staking strategies.

Top 10 entities holding Ether. Source: Strategic ETH Reserve

What Is Driving Spot Ether ETF Outflows?

SharpLink’s recent Ether purchases coincide with record outflows from spot Ether ETFs, which saw $465 million in net daily withdrawals. BlackRock’s iShares Ethereum Trust experienced the largest outflow of nearly $375 million, followed by the Fidelity Ethereum Fund with $55.11 million in outflows. These trends suggest a shift in investor preference from liquid ETFs to direct staking and treasury accumulation strategies.

How Does This Affect Ethereum’s Market Dynamics?

The growing preference for staking and treasury accumulation over ETFs may impact Ethereum’s liquidity and price stability. Institutional investors like SharpLink are capitalizing on staking rewards, which could reduce circulating supply and support long-term price appreciation. This dynamic underscores Ethereum’s evolving ecosystem and the increasing role of proof-of-stake in asset management.

Key Takeaways

- SharpLink’s ETH holdings: Increased to 521,939 ETH valued at $1.91 billion.

- ETH concentration metric: SharpLink’s ETH per share rose 83% to 3.66.

- Market shifts: Spot Ether ETFs recorded historic $465 million outflows.

- Competitive landscape: BitMine leads ETH treasury with 833,137 ETH.

- Staking rewards: SharpLink earned 929 ETH, worth $3.3 million.

Conclusion

SharpLink’s continued accumulation and staking of Ether highlight a strategic shift towards maximizing returns through Ethereum’s proof-of-stake network. As spot Ether ETFs face significant outflows, institutional investors increasingly prefer direct ETH holdings and staking. This trend may influence Ethereum’s liquidity and price dynamics, signaling robust confidence in the network’s future.

Frequently Asked Questions

What is SharpLink’s ETH concentration metric?

SharpLink’s ETH concentration measures the amount of Ether backing each outstanding share. It has increased by 83% to 3.66, reflecting the firm’s growing Ether holdings relative to shares.

Why are investors moving away from spot Ether ETFs?

Investors are favoring direct Ether staking and treasury accumulation over ETFs due to higher potential returns from staking rewards and concerns about ETF liquidity.