Key Notes

- Bitcoin climbed above $122K, just 0.84% below its all-time high.

- The daily creation of addresses reached a new peak of 364,126.

- Historical cycle patterns point to a potential September pullback.

Bitcoin BTC $119 979 24h volatility: 1.2% Market cap: $2.39 T Vol. 24h: $53.50 B surged past $122,000 for the first time in nearly a month, coming within 0.84% of its all-time high of $123,091.61, making it one of the best crypto to buy in 2025.

The rally coincided with a surge in network activity, with daily creation of 364,126 new Bitcoin addresses, the highest in a year, indicating massive adoption as per analyst Ali Martinez.

364,126 new Bitcoin $BTC addresses created daily, the highest in a year! pic.twitter.com/GJTzrT3Yo9

— Ali (@ali_charts) August 11, 2025

The Perfect Asset

Veteran investor Willy Woo described Bitcoin as an perfect financial asset with the potential to last for the next millennium, yet acknowledged it remains far from overtaking gold or the US dollar in market dominance.

📊 MARKET INSIGHT: Bitcoin $BTC is the ‘perfect asset’ for the next 1,000 years, according to Willy Woo. Woo emphasizes the need for increased flows for Bitcoin to compete with the US dollar and gold.

— CryptoAlert (@SatoshiWatch) August 11, 2025

Bitcoin’s current market capitalization of $2.43 trillion is still under 11% of gold’s $23 trillion and follows the US dollar’s $21.9 trillion supply. Woo noted that for Bitcoin to achieve world reserve status, massive capital inflows are required.

Key Cautions

Woo warned that with Corporate adoption through Bitcoin treasury holdings expanding, opaque debt structures pose the threat of a treasury bubble.

Additionally, reliance on exchange-traded funds and custodial services concentrates ownership, potentially exposing Bitcoin to government intervention. While these on-ramps bring more capital, they also carry systemic risks if large holders do not adopt self-custody.

As reported earlier, even Harvard University held $117 million worth of shares of BlackRock’s iShares Bitcoin ETF. Other Bitcoin backers include Metaplanet and Strategy, with companies like Mill City Ventures expanding support for altcoins like SUI.

BTC Mirrors NASDAQ

Market analysts observed that Bitcoin’s price movements continue to mirror traditional risk-on assets, closely tracking NASDAQ performance.

Bitcoin’s correlation with the Nasdaq helps explain recent price action.

When stocks dropped sharply late last week, Bitcoin followed. That’s what you expect when correlations are elevated.

Now that the Nasdaq is resuming its uptrend, Bitcoin is moving with it again. pic.twitter.com/aUl4mg6GhA

— ecoinometrics (@ecoinometrics) August 8, 2025

The correlation, combined with upcoming macroeconomic data such as Tuesday’s US Consumer Price Index report, could turn BTC volatile.

Economists anticipate a modest rise in annual inflation to 2.8%, with softer data potentially accelerating expectations for a Federal Reserve rate cut in September.

Historical Cycle Analysis

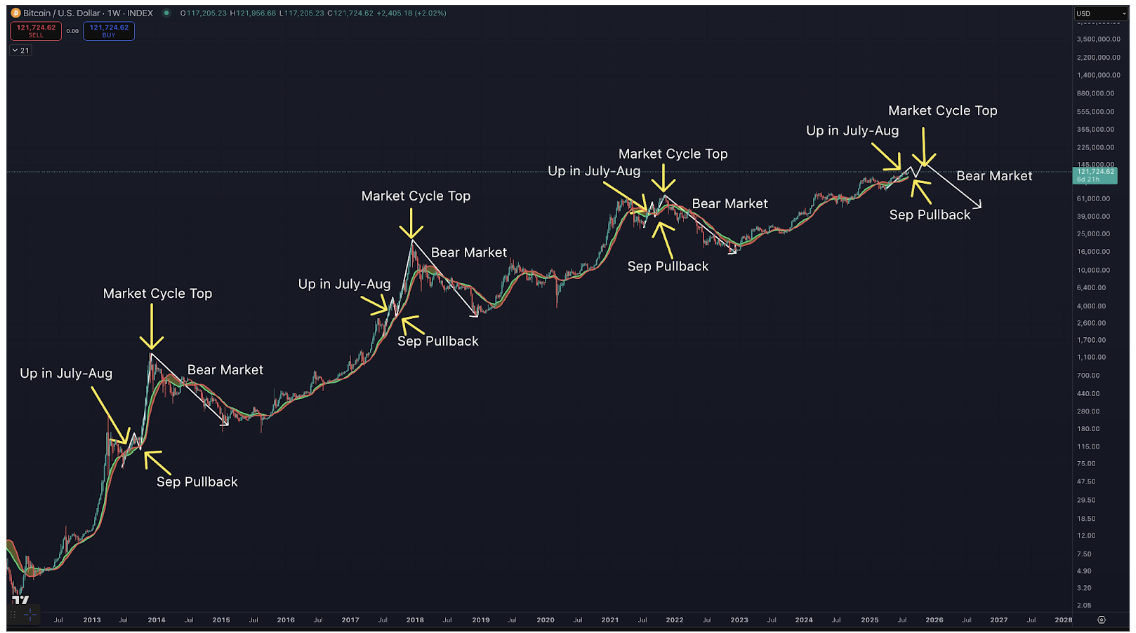

Bitcoin may be following its post-halving year playbook. In previous cycles, prices rose through July and August, faced a September pullback, then rallied toward a market cycle peak in the fourth quarter before entering a prolonged bear market.

Bitcoin Historical Cycle Analysis | Source: Benjamin Cowen

According to market analyst Benjamin Cowen, the current pattern appears consistent, with Bitcoin’s upward momentum in recent weeks fitting into this historical cycle. Based on historical patterns, BTC could rally in Q4 after a slight pullback this month.

next