Bitcoin recently surged past $117K, reaching $123,429, driven by strong institutional demand and new 401(k) crypto rules.

-

Bitcoin breaks $117K resistance with a 5% surge, reaching $123,429 on strong institutional demand.

-

Fibonacci levels suggest potential targets at $127K, $137K, and $153K in upcoming sessions.

-

New 401(k) crypto rules and ETF buying fuel record BTC adoption, addresses hit yearly high.

Bitcoin’s price has surged past $117K, driven by institutional demand and new regulations, indicating a bullish trend ahead.

| $117K | $127K | Strong Institutional Demand |

| $123K | $137K | Positive Market Sentiment |

| $130K | $153K | Increased Adoption |

What is Driving Bitcoin’s Recent Surge?

The recent surge in Bitcoin’s price to $123,429 is primarily driven by strong institutional demand and favorable regulatory changes. Bitcoin broke the $117,000 resistance level, indicating a bullish trend in the market.

How Do Fibonacci Levels Impact Bitcoin’s Price?

Fibonacci extension levels suggest potential price targets for Bitcoin at $127,000, $137,000, and $153,000. This technical analysis indicates that the current momentum may lead to further price increases.

Frequently Asked Questions

What is the significance of Bitcoin breaking the $117K resistance?

Breaking the $117K resistance signifies strong bullish momentum, indicating that Bitcoin may continue to rise as institutional interest grows.

How do new regulations affect Bitcoin adoption?

New regulations allowing cryptocurrency investments in 401(k) plans open access for millions, significantly boosting Bitcoin adoption among institutional investors.

Key Takeaways

- Bitcoin’s price surge: Bitcoin recently broke through the $117K resistance level, reaching $123,429.

- Institutional interest: Strong demand from institutions is driving the current price momentum.

- Fibonacci targets: Analysts predict potential price targets of $127K to $153K in the near future.

Conclusion

Bitcoin’s recent surge past $117K, driven by institutional demand and favorable regulations, indicates a strong bullish trend. As adoption increases, the cryptocurrency may reach new heights, with Fibonacci targets suggesting significant price potential ahead.

-

Bitcoin surges past $117K, reaching $123,429 due to strong institutional demand.

-

Fibonacci levels indicate potential targets at $127K, $137K, and $153K.

-

New regulations are boosting Bitcoin adoption, with addresses hitting yearly highs.

Bitcoin’s price has surged past $117K, driven by institutional demand and new regulations, indicating a bullish trend ahead.

Strong Momentum Drives Price to Multi-Month Highs

According to analysis prepared by Captain Faibik, Bitcoin traded within a descending channel before breaking resistance with strong upward momentum. The move took BTC to $123,429, representing a 3,272-point increase or 2.72% gain. The breakout also pushed prices to the highest level since mid-July.

$BTC #Bitcoin BULLS NAILED IT! 📈🚀

Bitcoin smashed through 117k Resistance and delivered a clean 5%+ Breakout.. pic.twitter.com/Th0vrHNH4y

— Captain Faibik 🐺 (@CryptoFaibik) August 11, 2025

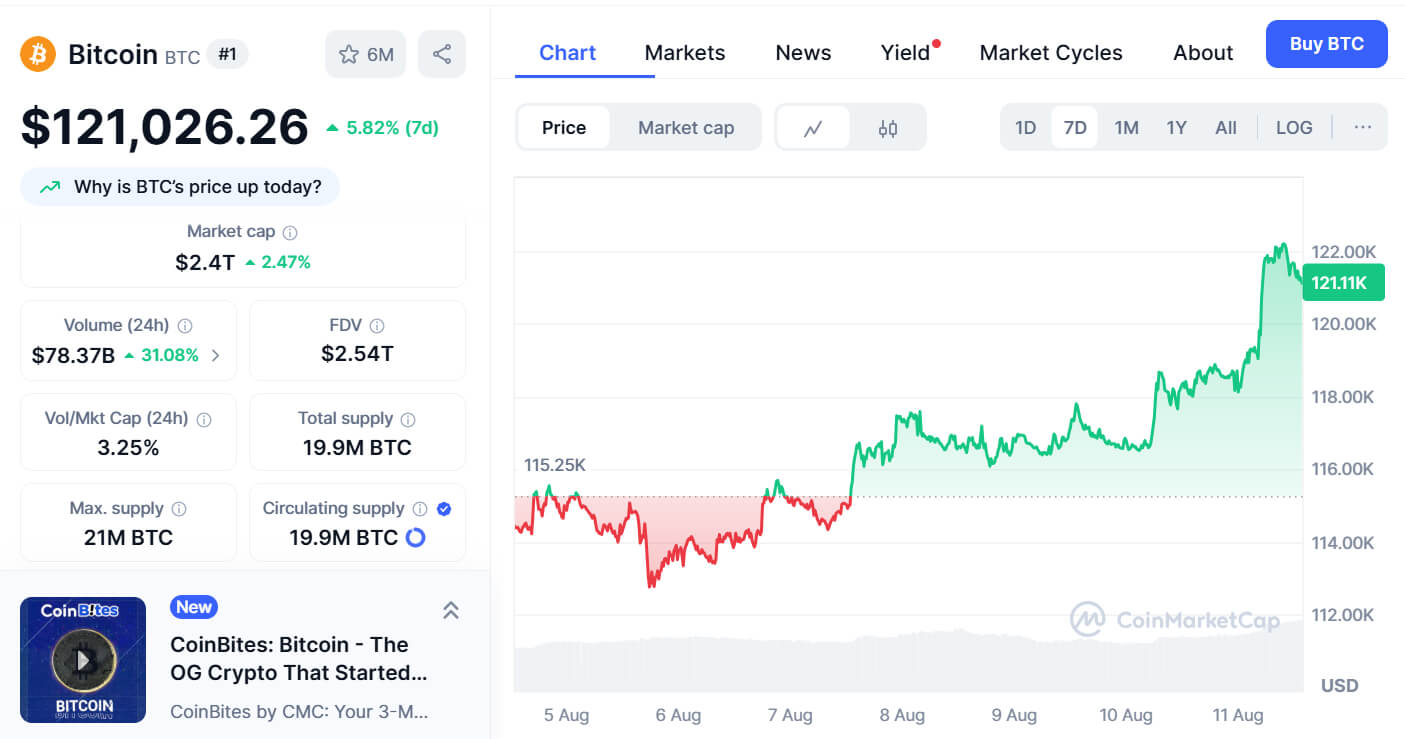

During European trading hours, Bitcoin tested the $122,335 level, approaching its July peak of $123,218. Data from CoinMarketCap shows Bitcoin’s market capitalization at $2.4 trillion, with 24-hour trading volume of $78.37 billion. Analysts note that the rally reflects sustained institutional interest rather than short-term retail speculation.

Source: CoinMarketCap

The move is also supported by the Fibonacci extension levels. Based on the BTC/USDT chart, the 61.8% extension lies near $127,000, the 100% at $137,000, and the 161.8% near $153,000. According to market analyst Donald Dean, a “volume shelf” between $116,000 and $118,000 may act as a base for a push toward $131,000.

Institutional Adoption and Policy Shifts Boost Market Confidence

Institutional treasury rebalancing is accelerating as major corporations increase Bitcoin allocations. According to an observation by Wincent Director Paul Howard, “The signing of an executive order from the US administration last week has initiated fresh ETF buying and positive sentiment ahead of CPI and PPI data.”

The policy change allows cryptocurrency investments in 401(k) plans, opening access for millions of Americans. Market analysts suggest that post-halving trends, reduced exchange reserves, and rising institutional demand are aligning to create favorable market conditions.

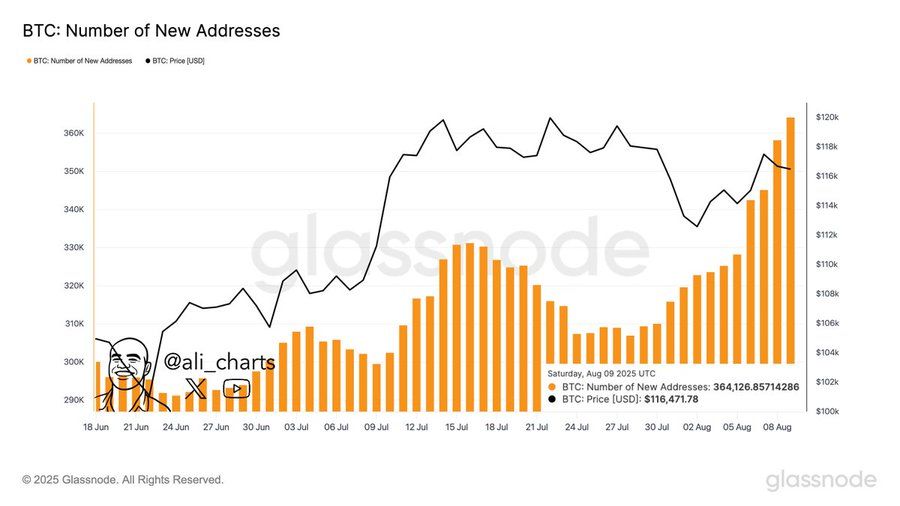

Source: AliMartinez(X)

On-chain data also shows long-term holders accumulating. Crypto analyst Ali Martinez reported 364,126 new Bitcoin addresses created daily, the highest in a year. With the Fear & Greed Index at 67, traders are watching for further moves toward $130,000 and beyond.