Ethereum Exchange Reserves Sink—Is All-Time High Imminent?

Ethereum has surged nearly 20% in a week and is just one key stop away from its all-time high. Two cohorts could provide the push for an aggressive upmove .

Ethereum price is up almost 20% over the past seven days, easily breaking through the much-watched $4,000 mark. Now trading at $4,310, the ETH price sits just 11.7% below its all-time high of $4,878.

But that peak might be closer than you think, with two powerful cohorts lining up that could push it there.

Spot Buyers Keep Ethereum Supply Tight

One of the most important indicators to watch during a strong uptrend is exchange reserves, the total amount of ETH held on centralized exchanges. When reserves are high, there’s more potential selling pressure. When they’re low, supply is tight, and any surge in demand can push prices up quickly.

On July 31, Ethereum’s exchange reserves hit an all-time low of 18.72 million ETH. As of August 12, they remain near that level at 18.85 million ETH, despite ETH’s sharp climb. That tells us something critical: even with Ethereum price pushing toward multi-month highs, the buyer-seller tussle is skewed towards the former.

Ethereum price and low exchange reserves:

Cryptoquant

Ethereum price and low exchange reserves:

Cryptoquant

Do note that aggressive selling is happening, but low exchange reserves mean that buyers are fast outpacing the sellers.

An #Ethereum participant who received 20,000 $ETH (cost $6,200, now $86.6M) just sold another 2,300 $ETH($9.91M) 20 minutes ago, leaving him with 1,623 $ETH($6.99M).

— Lookonchain (@lookonchain) August 11, 2025

Historically, the ETH price has struggled to sustain rallies when reserves spike. The fact that reserves are holding near record lows while the price is close to breaking its final major resistance suggests sustained buying interest from the spot market.

Derivative Traders Stack Positions

If the spot market is the foundation, derivatives are the accelerant. Open interest, the total value of outstanding futures and perpetual contracts, reached an all-time high of $29.17 billion on August 9 and is still hovering near that level.

Ethereum Open Interest Hitting All-Time Highs:

Cryptoquant

Ethereum Open Interest Hitting All-Time Highs:

Cryptoquant

Why does this matter? High open interest increases the potential for cascading moves. If the Ethereum price breaks an important resistance, leveraged short positions could be forced to cover, triggering a short squeeze that amplifies upward momentum.

Conversely, if bulls lose control, heavy leverage could also accelerate the downside. But right now, with spot supply tight, the setup favors an upside squeeze.

The combination of record-low reserves and record-high open interest means both cohorts, spot buyers and derivatives traders, are aligned in a way that could fuel a sharp upside move.

Key Ethereum Price Levels to Watch: One Stop Could Trigger A New Peak

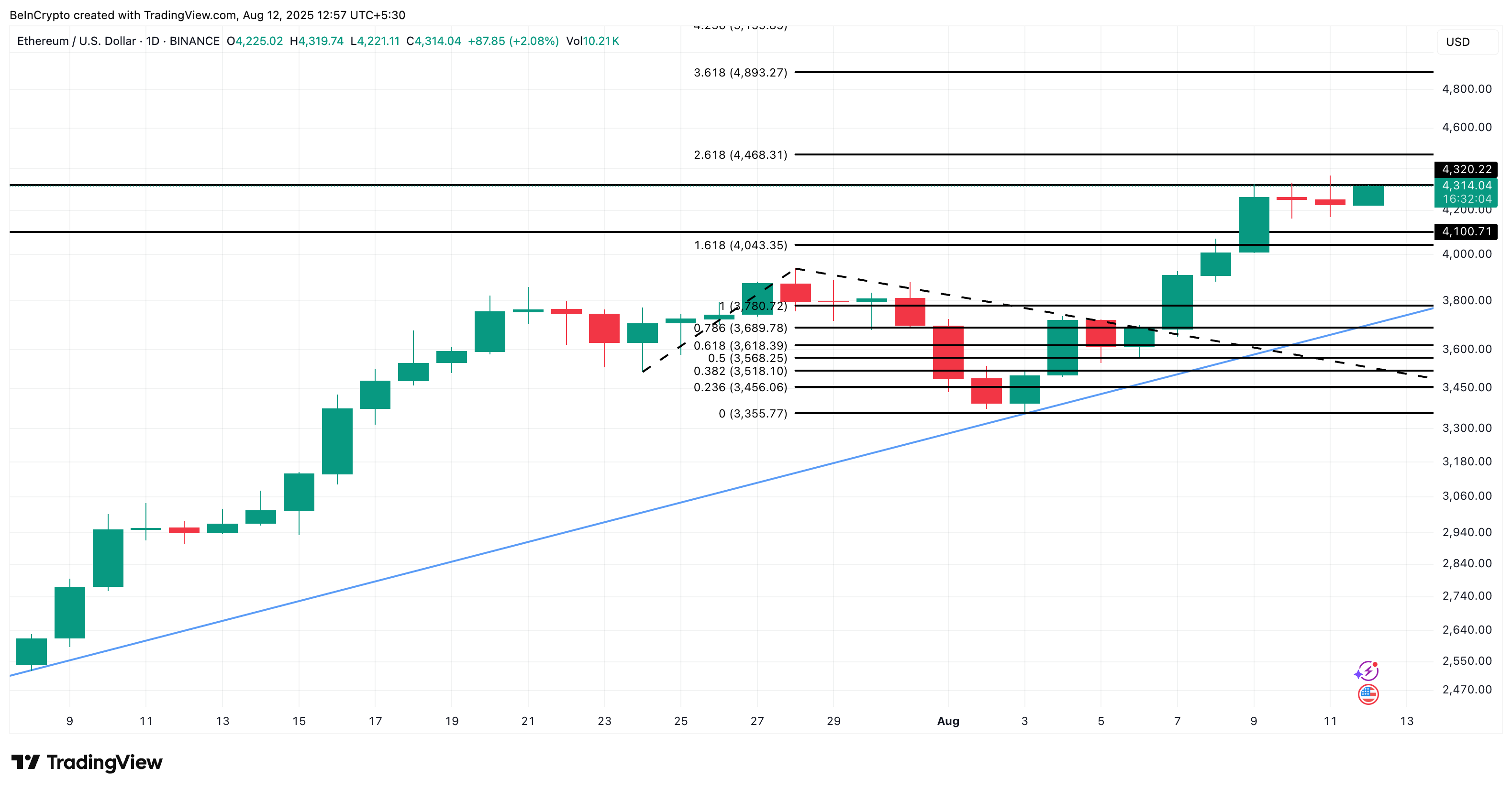

From a technical perspective, Ethereum is trading inside a bullish continuation pattern (an ascending triangle), with the key resistance at $4,468, the 2.618 Fibonacci extension from its recent rally.

A clean break above this level would put the previous all-time high of $4,878 within easy reach.

With the Fibonacci levels acting as resistance bases to the ascending trendline, the Ethereum price managed to break out of the bullish triangle on several occasions, on its way to the multi-month high.

Ethereum price analysis:

TradingView

Ethereum price analysis:

TradingView

If bulls clear $4,468, another breakout zone, the next Fibonacci target sits near $4,893, essentially marking a fresh record high. On the downside, immediate support lies at $4,043; losing that could open a deeper pullback risk.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Strategic Inflection Point: How Ethereum and Arbitrum Are Reshaping Institutional Crypto Infrastructure

- Ethereum's $566B market cap and 60% stablecoin dominance solidify its role as institutional blockchain infrastructure. - Arbitrum's 2025 upgrades (12x faster transactions, 50+ Orbit chains) enable scalable multi-chain solutions for institutional use. - Cold Wallet's $6.3M presale addresses institutional demand for secure, multi-chain custody amid Ethereum/Arbitrum growth. - Infrastructure investments align with $9.4B Ethereum ETF inflows and PayPal/Euler Labs' Arbitrum expansions, signaling $10T crypto f

Ethereum's Undervalued Treasury Play: Why ETH and DAT Companies Offer a Stronger Case Than Bitcoin

- Ethereum (ETH) outperforms Bitcoin (BTC) in 2025 as institutional capital shifts toward ETH-based digital asset treasuries (DATs) due to staking yields and utility-driven growth. - Institutional ETH accumulation hit 4.1M ($17.6B) by July 2025, driven by 4.5–5.2% staking yields and ETF inflows surpassing Bitcoin’s, with ETH/BTC ratio hitting a 14-month high of 0.71. - Regulatory clarity (CLARITY/GENIUS Acts) and deflationary supply dynamics position ETH as a yield-generating infrastructure asset, with Sta

Bitcoin's Derivatives-Long Overhang and Spot-Derivatives Divergence: Navigating Structural Risks and Contrarian Opportunities

- Bitcoin's August 2025 market shows sharp divergence: derivatives funding rates hit 0.0084 (211% rebound) amid $1.2B ETF outflows and $900M liquidations. - Structural risks emerge as long/short ratio normalizes to 1.03, masking leveraged fragility exposed by $2.7B whale dump triggering $500M liquidations. - On-chain signals highlight overbought conditions (NUPL 0.72) and technical bearishness with 100-day EMA breakdown to $106,641. - Contrarian opportunities arise as Derivative Market Power index stabiliz

Bitcoin's $110K Correction as a Buying Opportunity

- Bitcoin's 7% correction to $115,744 in August 2025 triggered $500M in liquidations but stabilized leverage ratios, signaling a potential buying opportunity. - Institutional capital shifted toward Ethereum in Q2 2025, with whales accumulating 200,000 ETH ($515M) amid Bitcoin's structural resilience. - Technical indicators suggest $115,000 is a critical support level, with historical cycles pointing to a potential rebound toward $160,000 by Q4 2025. - Strategic entry points at $110,000–$115,000 recommend d