Cardano’s Case for a 200% Rally: ETF Odds, Whale Activity, and Golden Cross

Cardano’s return above $1, combined with ETF optimism, technical breakouts, and strong whale accumulation, positions ADA for a possible explosive rally—potentially reaching $3 in the near term.

Cardano (ADA) is drawing strong attention from investors. Multiple signals, both technical and on-chain, suggest a major rally may be on the horizon.

Recently, Cardano reclaimed the $1 mark for the first time in over five months. Could this be when ADA transitions from a promising altcoin to the centerpiece of the entire crypto market?

Multiple Bullish Signals for Cardano

Several factors could drive this latest surge in Cardano (ADA). Notably, the likelihood of an ADA-based ETF being approved is rising significantly, with the probability estimated at up to 80%.

ADA broke $1 mark. Source:

TradingView

ADA broke $1 mark. Source:

TradingView

At the same time, Grayscale has officially filed for an HBAR & ADA ETF, potentially opening the door for institutional capital to flow into Cardano.

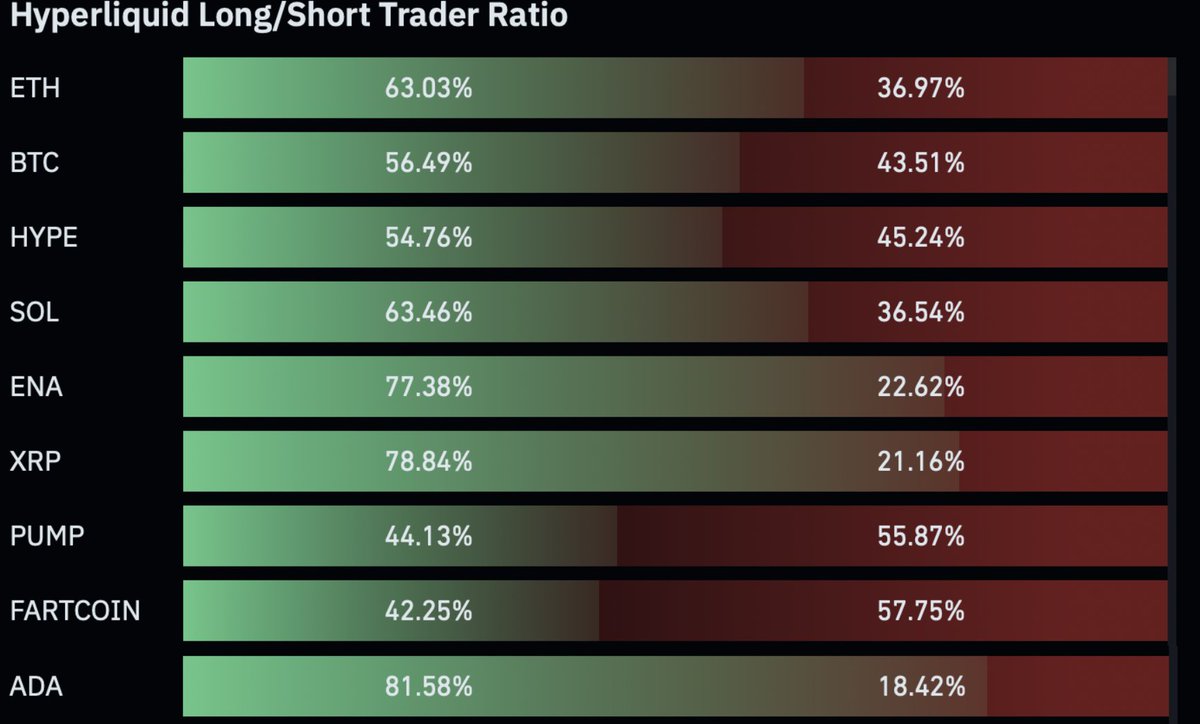

Data from TapTools also shows that futures traders on Hyperliquid are currently more bullish on ADA than on XRP, Solana, ETH, and BTC. In addition, the Cardano network has surpassed 3.1 million ADA-holding wallets, showing the project’s appeal to the global investor community.

Futures traders on Hyperliquid are currently bullish on ADA. Source:

TapTools

Futures traders on Hyperliquid are currently bullish on ADA. Source:

TapTools

Technical Analysis and On-Chain Data Reinforce Bullish Outlook

Technically, ADA is at a crucial threshold, and many experts believe a breakout is imminent. Analyst Ali forecasts that ADA could surge to $1.50 if it breaks through current resistance levels.

Ali also notes that the current price structure mirrors the previous cycle—albeit moving more slowly—suggesting this could be the early stage of an explosive rally.

ADA price projection. Source:

Ali

ADA price projection. Source:

Ali

In particular, a “Golden Cross” signal is forming when the 50-day moving average crosses above the 200-day moving average. According to another analyst, the last time this signal appeared, ADA rallied by 230%, and if a similar scenario unfolds, the price could reach $3 in less than a month.

Furthermore, Tom Crown predicts a potential 232% rally to $1.687 if the Golden Cross completes.

Golden Cross signal on the ADA chart. Source:

Deezy

Golden Cross signal on the ADA chart. Source:

Deezy

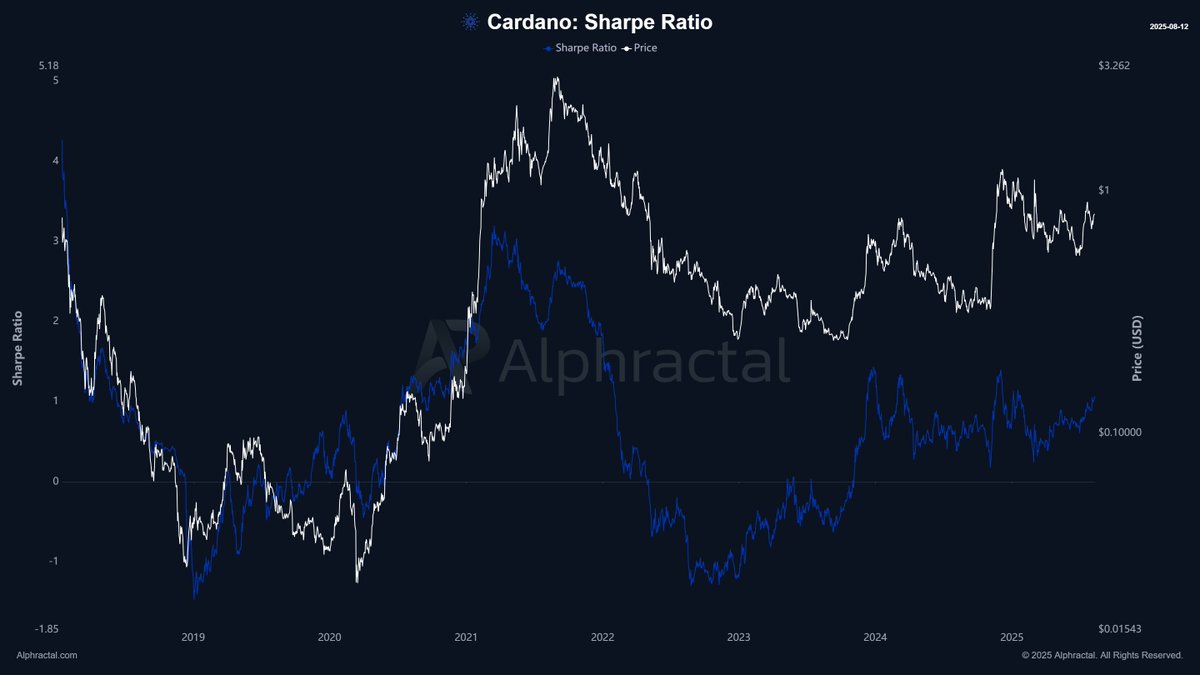

On-chain data further strengthens the bullish case. According to analysis from Alphractal, long-term investors have consistently accumulated ADA since 2021 without significant distribution.

Meanwhile, short-term investors have shown a slight accumulation trend in recent days.

Recently, whales have also purchased over 200 million ADA, signaling high confidence from large-cap holders. Risk-adjusted return metrics also trend upward, reflecting increased profit potential amid controlled volatility.

Adjusted Sharpe ratio. Source:

Alphractal

Adjusted Sharpe ratio. Source:

Alphractal

“Long-term holders remain strong and are still accumulating. Short-term selling pressure is low. Risk and temperature metrics do not yet signal market euphoria. Rising adjusted Sharpe Ratio could be a sign of strong upcoming moves for ADA Cardano.” Alphractal concluded

Bringing these factors together, Cardano stands at a pivotal moment. If favorable conditions converge, ADA could fully reclaim its all-time high and open a new chapter in Cardano’s journey in 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Strategic Inflection Point: How Ethereum and Arbitrum Are Reshaping Institutional Crypto Infrastructure

- Ethereum's $566B market cap and 60% stablecoin dominance solidify its role as institutional blockchain infrastructure. - Arbitrum's 2025 upgrades (12x faster transactions, 50+ Orbit chains) enable scalable multi-chain solutions for institutional use. - Cold Wallet's $6.3M presale addresses institutional demand for secure, multi-chain custody amid Ethereum/Arbitrum growth. - Infrastructure investments align with $9.4B Ethereum ETF inflows and PayPal/Euler Labs' Arbitrum expansions, signaling $10T crypto f

Ethereum's Undervalued Treasury Play: Why ETH and DAT Companies Offer a Stronger Case Than Bitcoin

- Ethereum (ETH) outperforms Bitcoin (BTC) in 2025 as institutional capital shifts toward ETH-based digital asset treasuries (DATs) due to staking yields and utility-driven growth. - Institutional ETH accumulation hit 4.1M ($17.6B) by July 2025, driven by 4.5–5.2% staking yields and ETF inflows surpassing Bitcoin’s, with ETH/BTC ratio hitting a 14-month high of 0.71. - Regulatory clarity (CLARITY/GENIUS Acts) and deflationary supply dynamics position ETH as a yield-generating infrastructure asset, with Sta

Bitcoin's Derivatives-Long Overhang and Spot-Derivatives Divergence: Navigating Structural Risks and Contrarian Opportunities

- Bitcoin's August 2025 market shows sharp divergence: derivatives funding rates hit 0.0084 (211% rebound) amid $1.2B ETF outflows and $900M liquidations. - Structural risks emerge as long/short ratio normalizes to 1.03, masking leveraged fragility exposed by $2.7B whale dump triggering $500M liquidations. - On-chain signals highlight overbought conditions (NUPL 0.72) and technical bearishness with 100-day EMA breakdown to $106,641. - Contrarian opportunities arise as Derivative Market Power index stabiliz

Bitcoin's $110K Correction as a Buying Opportunity

- Bitcoin's 7% correction to $115,744 in August 2025 triggered $500M in liquidations but stabilized leverage ratios, signaling a potential buying opportunity. - Institutional capital shifted toward Ethereum in Q2 2025, with whales accumulating 200,000 ETH ($515M) amid Bitcoin's structural resilience. - Technical indicators suggest $115,000 is a critical support level, with historical cycles pointing to a potential rebound toward $160,000 by Q4 2025. - Strategic entry points at $110,000–$115,000 recommend d