Historic Bitcoin Indicator Signals Huge Volatility Spike – Where is BTC Price Headed?

Bitcoin faces low volatility, but a surge could lead to big price swings; support at $117,000 is key for further upside.

Bitcoin’s price has recently experienced a drop from its all-time high (ATH), signaling a potential shift in market conditions. This decline, while seemingly typical, may signal underlying concerns about future volatility.

Historical cues suggest that a volatility explosion could be on the horizon, prompting key holders to turn neutral.

Bitcoin is Facing The Calm Before The Storm

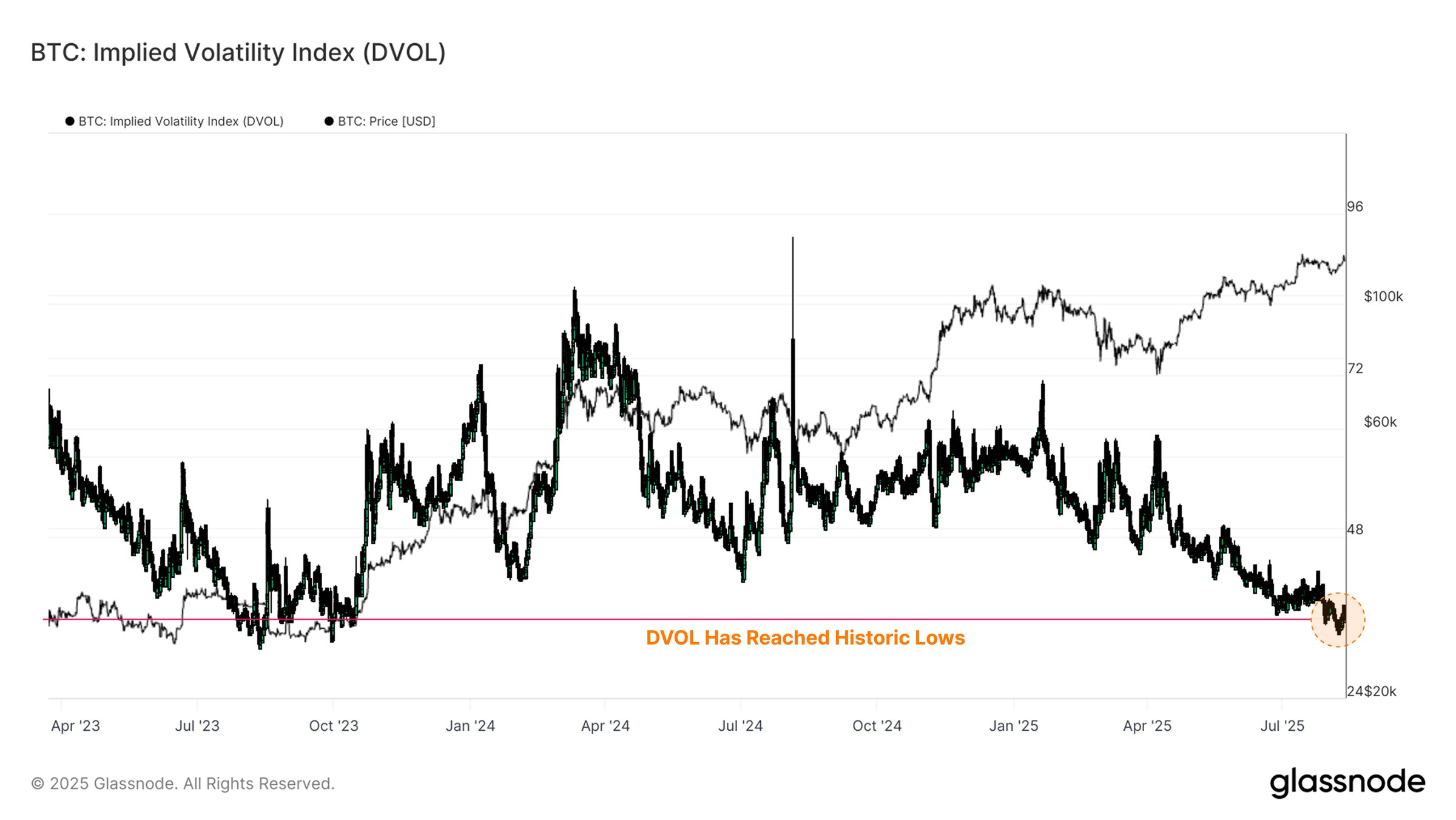

The Bitcoin DVOL index, which tracks the volatility of the asset, is at historically low levels. Only 2.6% of days have experienced lower values, indicating extreme complacency in the market. This suggests that investors are not hedging against potential downturns, which could lead to significant price movements if unforeseen events trigger volatility.

DVOL measures expected price fluctuations over the coming month, and the current low levels indicate a relaxed outlook from traders. However, this calm could be fleeting, as volatility shocks often follow periods of complacency. If an unexpected market event occurs, Bitcoin could see rapid price swings, potentially catching investors off guard.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin DVOL Index. Source:

Glassnode

Bitcoin DVOL Index. Source:

Glassnode

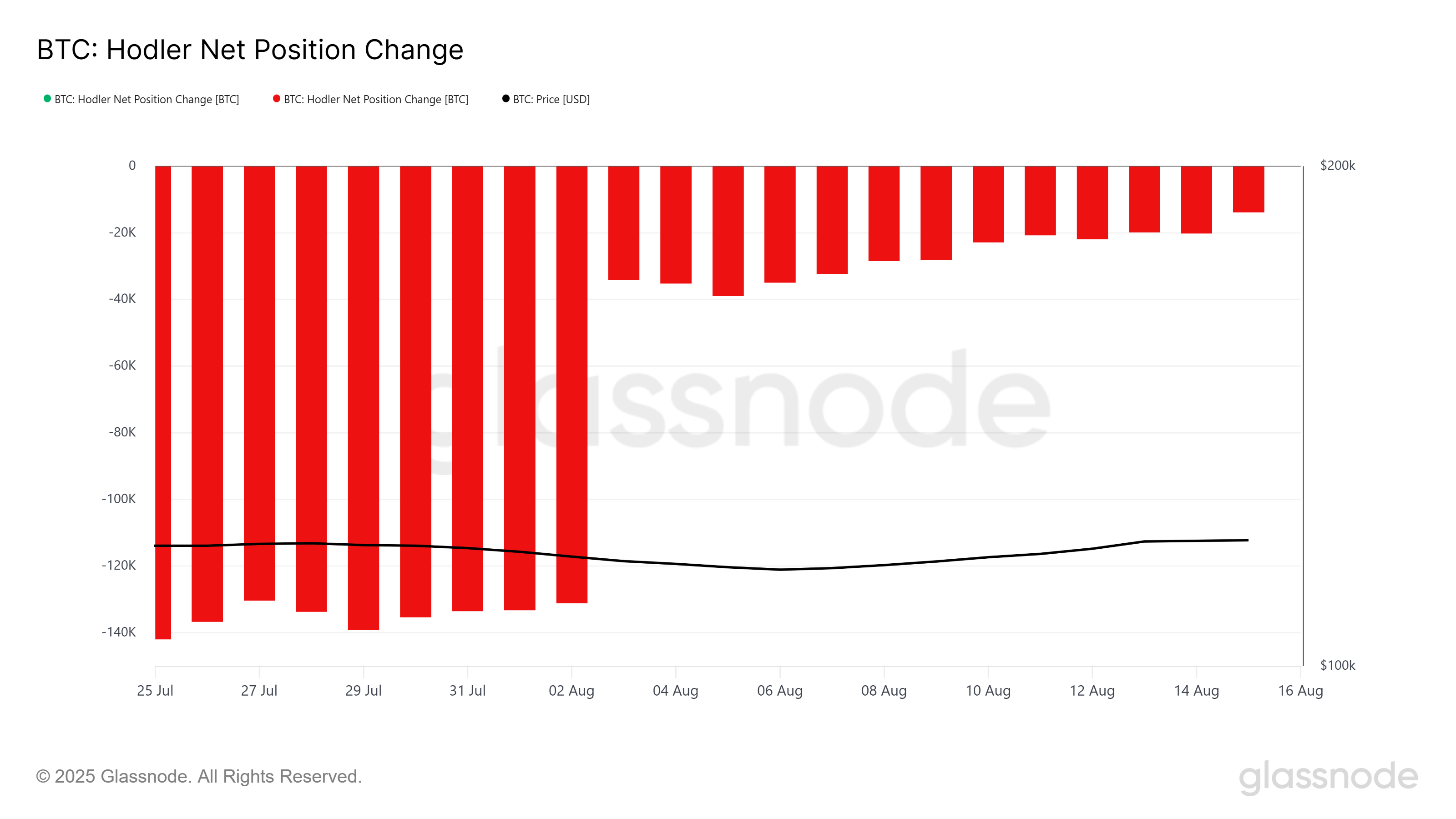

The overall macro momentum of Bitcoin shows a marked shift in investor behavior. The HODLer Net position change has slowed, signaling reduced activity from long-term holders (LTHs). Although LTHs had begun accumulating at the beginning of the month, this buying trend paused, likely due to the prevailing uncertainty in the market.

Despite the lack of new buying activity, the absence of selling suggests a degree of optimism among these holders. They appear to be waiting for a clearer market direction before making their next move. This suggests that LTHs are cautious but expect that any volatility spike could eventually lead to a price increase, keeping their positions intact for now.

Bitcoin HODLer Net Position Change. Source:

Glassnode

Bitcoin HODLer Net Position Change. Source:

Glassnode

BTC Price Can Hold Its Support

Bitcoin’s price had shown an upward trend throughout the month, but this momentum faltered in the last 24 hours, with BTC falling to $117,305. This decline occurred as the price slipped below the established uptrend line, signaling a shift in market sentiment.

If investors maintain their positions during the expected volatility surge, Bitcoin could stabilize above $117,000. This would open the door for a potential push toward $120,000, turning it into support and allowing further upside movement.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, if investor sentiment turns bearish and selling increases in response to volatility, Bitcoin could face a significant drop. In this case, the price may fall through the $115,000 support level, potentially reaching as low as $112,526. This would wipe out the gains seen in August, invalidating the bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

59.4 Million SHIB Burned as Price May Track Bitcoin’s Recent Upswing

Bitcoin May Face Continued Volatility After Powell’s Rate-Cut Signals and Brief Surge Past $124,000

Ethereum’s Bullish Engulfing and Rising Open Interest May Signal Institutional-Led Market Shift

Ethereum Could Extend Gains After Fed Hints at September Rate Cuts Amid Institutional Inflows