Metaplanet expands Bitcoin holdings with 775 BTC purchaseMetaplanet’s strategic Bitcoin bid

Metaplanet is not slowing down on its accumulation of Bitcoin, boosting its portfolio with fresh funds.

- Metaplanet has purchased an additional 775 BTC for $93 million at an average price of $120,006 per coin.

- The company now holds 18,888 BTC, valued at $1.94 billion at current market prices.

- CEO Simon Gerovich reaffirmed Metaplanet’s commitment to its Bitcoin strategy, hinting at more buys ahead.

According to an August 18 disclosure, Metaplanet has purchased an additional 775 Bitcoin ( BTC ) for approximately $93 million. The acquisition was made at an average price of $120,006 per coin, bringing its total holdings to 18,888 BTC, worth $1.94 billion at current prices.

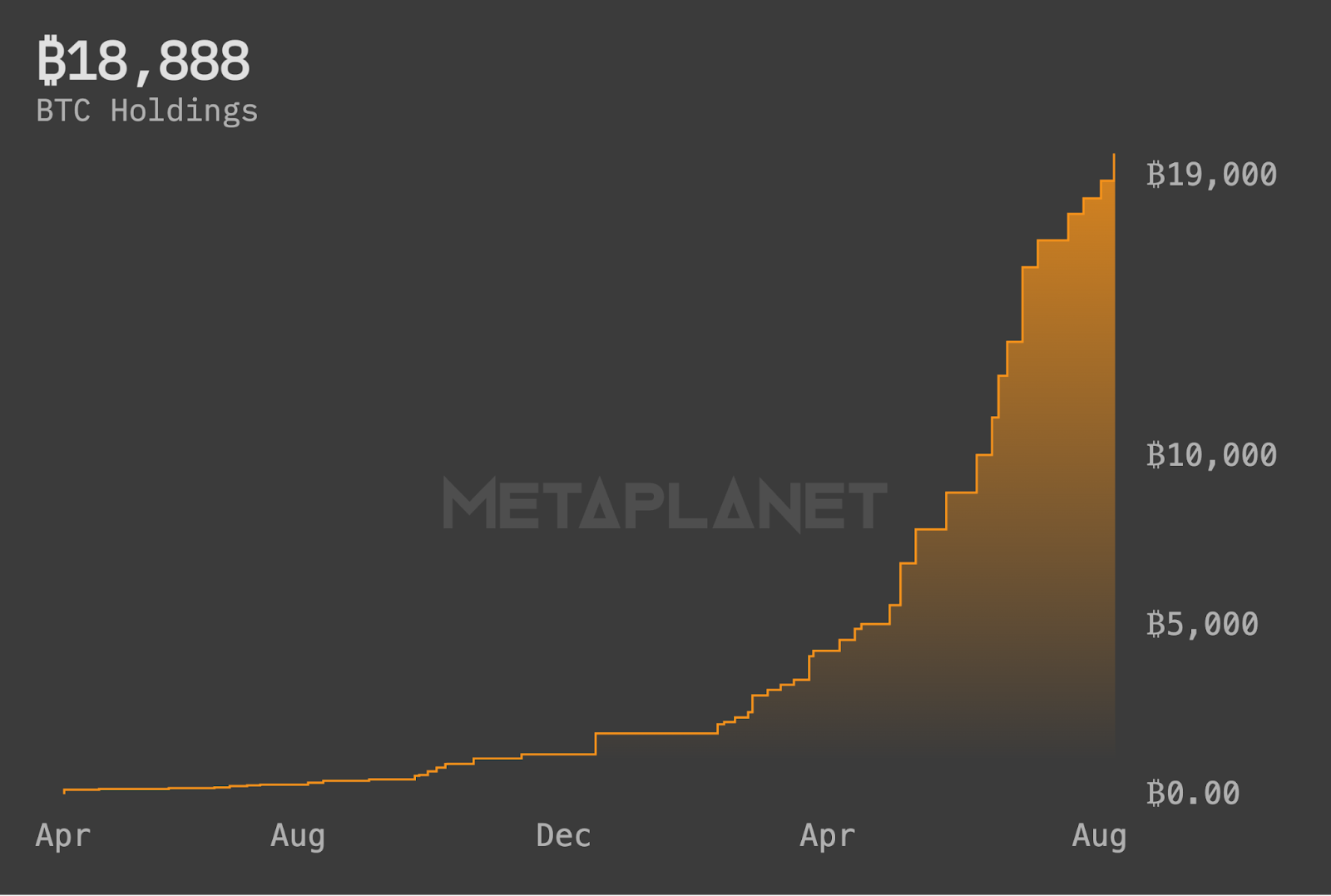

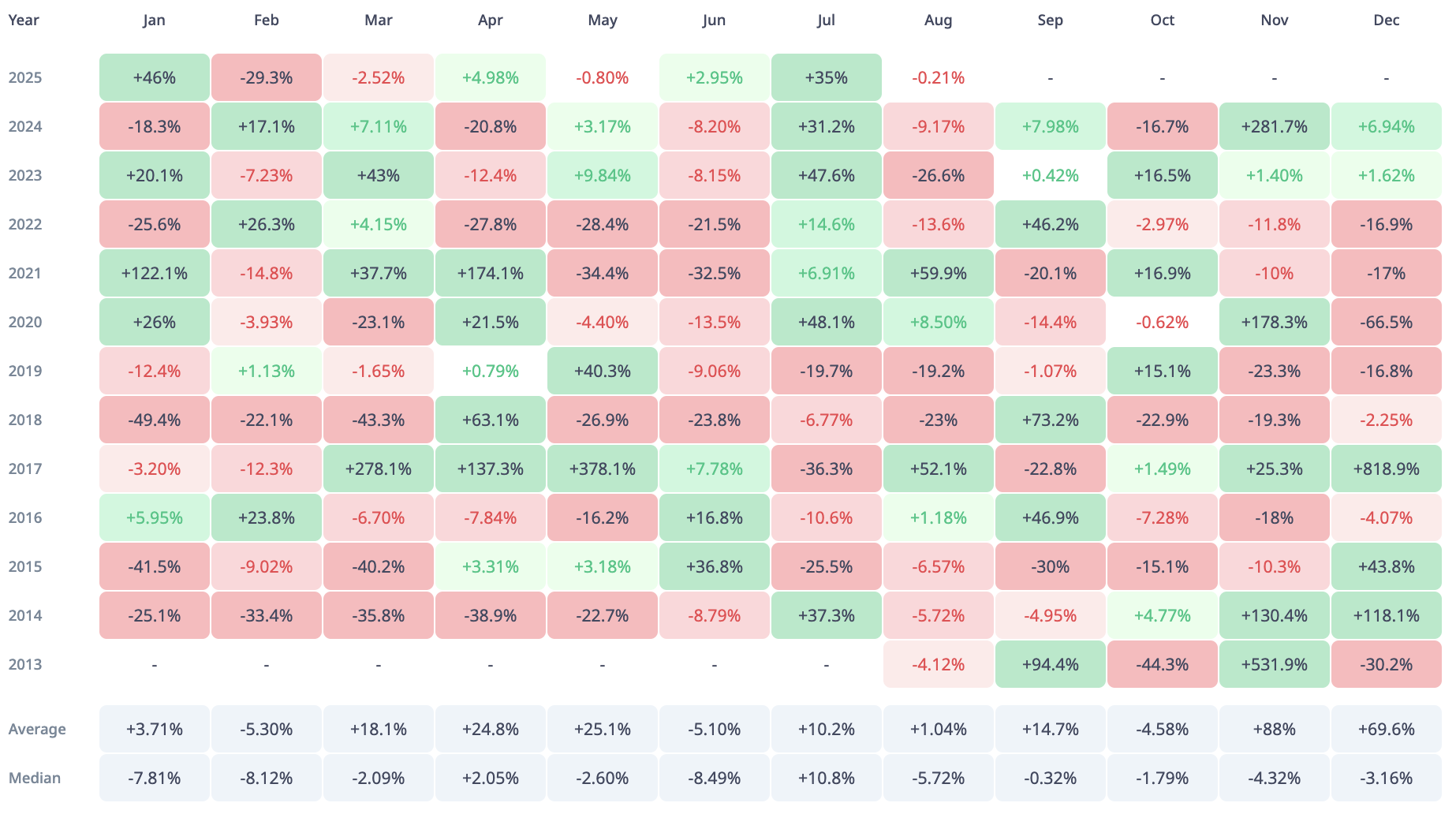

The latest acquisition contributes to a year-to-date BTC Yield of 480%, with the most recent quarter-to-date yield at 29.3%. Metaplanet uses the BTC Yield metric as a performance indicator for assessing shareholder accretion, measuring Bitcoin per fully diluted share growth over time.

Commenting on the latest purchase, CEO Simon Gerovich reiterated that the company remains committed to its Bitcoin strategy, hinting at more purchases ahead.

“18,888 BTC. Onward and upward,” he wrote in an X post.

Metaplanet’s strategic Bitcoin bid

With an ambitious target to eventually control 1% of BTC’s total supply by acquiring 210,000 BTC by 2027, Metaplanet has been ramping up its accumulation throughout 2025.

So far in Q3 alone, the company has bought around 5,556 BTC, largely funded through a mix of equity issuance, debt financing, and proceeds from the exercise of stock acquisition rights.

Growth of Metaplanet’s Bitcoin holdings | Source: Metaplanet.jp

Growth of Metaplanet’s Bitcoin holdings | Source: Metaplanet.jp

Metaplanet is also laying the groundwork for far larger acquisitions. Earlier this month, it filed plans to raise 555 billion yen ($3.8 billion) by issuing two classes of Bitcoin-backed preferred shares over the next two years.

In the near term, the company aims to hold 30,000 BTC by year-end 2025. and 100,000 BTC by 2026. With its latest purchase, Metaplanet now sits 11,112 BTC away from this year’s target. To close the gap over the next six months, the firm will need to stay committed to or step up its current accumulation pace, as it pushes toward its bigger 210,000 BTC ambition.

Meanwhile, Bitcoin has been under pressure in recent days. Trading at $115,436 at press time, the asset is down about 2.3% over the past 24 hours and 5.4% on the week, as it continues to cool off from last week’s surge to a new all-time high above $124,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Price Analysis: August’s Challenges and Potential for Recovery Above $3.14

Dogecoin (DOGE) Consolidation May Signal Potential 40% Price Move Amid Ongoing Market Developments

SEC Delays Key Crypto ETF Approvals Affecting Market Dynamics

In Brief SEC delays crypto ETF approvals, scrutinizing regulatory changes further until October 2025. Postponements affect various ETFs: Bitcoin, Ethereum, XRP, Litecoin, and others. Approval delays impact market expectations and institutional interest in crypto assets.

BTCS to Distribute Ethereum Dividends and Loyalty Rewards to Shareholders