Analysis: Interest Payments on Stablecoins Should Be Prohibited to Safeguard Efficiency and Stability

According to Jinse Finance, Hans Gersbach and other scholars from the KOF Swiss Economic Institute at ETH Zurich delivered a speech titled "Contagious Stablecoins?" at the World Congress of Economists (ESWC) on the 18th. They stated: "In an environment where multiple issuers compete, if one issuer starts paying interest, the others will be compelled to follow. This will lead to overall inefficiency and instability in the stablecoin system." They added, "This interest payment mechanism for stablecoins is contagious and could ultimately trigger a series of problems. Therefore, prohibiting interest payments through regulation is a core measure to maintain an efficient and stable stablecoin market." The scholars also pointed out that in the so-called 'secondary market for stablecoins,' if investors circulate stablecoins through market trading rather than redeeming directly from issuers, any failed adjustment could also trigger panic, which likewise requires regulatory oversight.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTFS Community Releases BTIP-104 Proposal Introducing New File Storage Renewal Feature

James Wynn Activates Old Wallet and Opens ETH Position with 25x Leverage

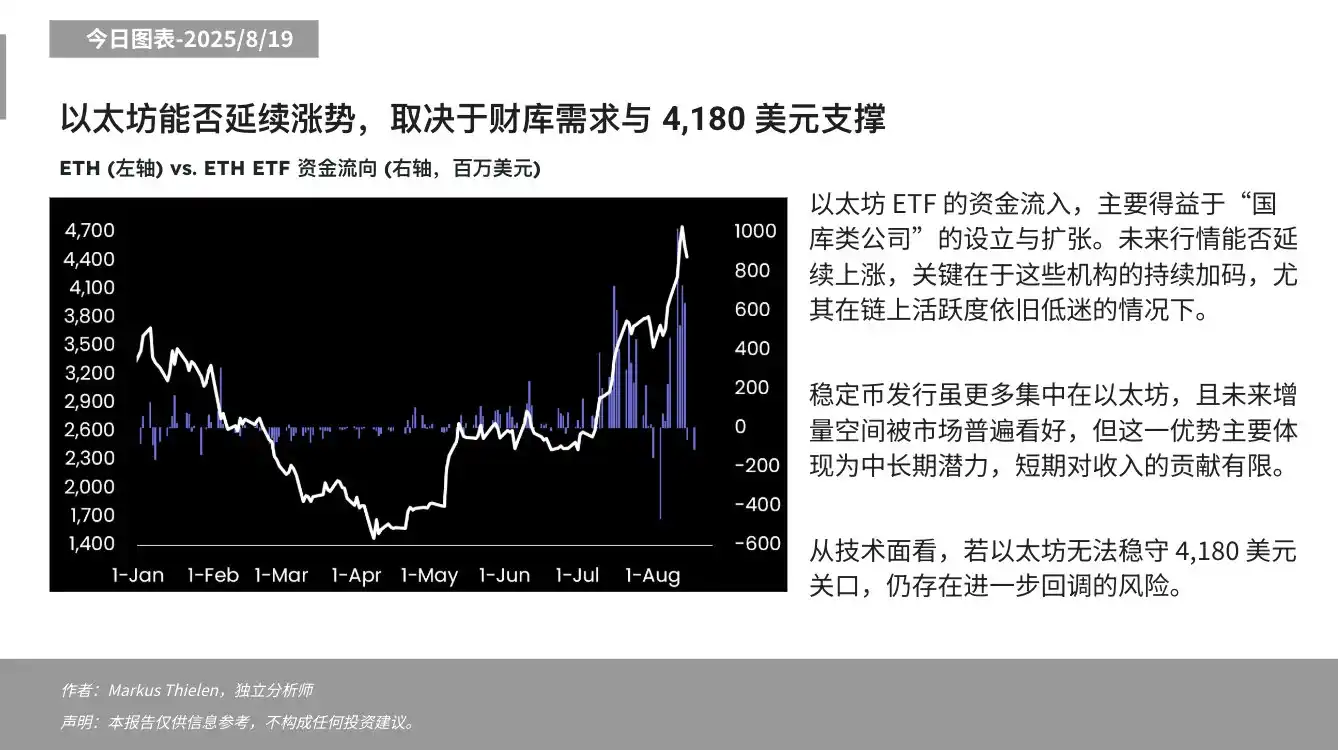

Matrixport: If Ethereum Fails to Hold the $4,180 Level, Further Downside Risk Remains

James Wynn Reactivates Old Wallet to Open 25x Leveraged Long Position on Ethereum