DDC Enterprise re-purchased 100 bitcoins, increasing the total Bitcoin reserve to 588 coins

By the end of 2025, achieve a holding of 10,000 bitcoins, maximize shareholder value through high-yield bitcoin returns, and establish DDC as one of the top three publicly traded companies globally with a Bitcoin treasury.

DDC Enterprise Limited (referred to as "DDC") announced today that, as part of its ongoing corporate treasury strategy, the company has added an additional 100 bitcoins to its holdings.

This marks DDC's second bitcoin purchase within a week, bringing its total holdings to 588 BTC. This transaction reflects DDC's consistent execution in its bitcoin treasury strategy and demonstrates its long-term goal of building a leading global publicly traded company bitcoin reserve.

Transaction Highlights

Treasury Expansion: Addition of 100 BTC, with a company's average holding cost of $102,144 per BTC.

Return Improvement: Compared to the initial purchase in May, the investment return has improved by 1007%.

Shareholder Value: The updated holdings now equate to 0.070741 BTC per 1,000 shares of DDC common stock.

Norma Chu, Founder, Chairwoman, and CEO of DDC, stated, "We are accelerating the pace of bitcoin acquisitions, with the recent goal to achieve a holding of 10,000 bitcoins by the end of 2025. Our objective is clear – to maximize shareholder value through high-value bitcoin returns and to establish DDC as one of the top three publicly traded companies with a bitcoin treasury globally."

About DDC Enterprise Limited

DDC Enterprise Limited (NYSE: DDC), while driving the corporate bitcoin treasury revolution, remains steadfast in its foundation as a leading global Asian cuisine platform. The company has strategically positioned bitcoin as a core reserve asset and is executing a bold and accelerated accumulation strategy. While continuing to expand its portfolio of food brands (including DayDayCook, Nona Lim, Yai's Thai), DDC is at the forefront of publicly traded companies integrating bitcoin into their financial architecture.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SoftBank shares drop 5%, snapping 9-day rally after $2 billion Intel deal

Share link:In this post: SoftBank shares fell over 5% after it announced a $2 billion deal to buy Intel stock at $23 per share. Asian markets dropped across the board as investors waited for the U.S. Fed’s Jackson Hole meeting. Jerome Powell is expected to signal a possible rate cut, with futures showing an 83% chance for September.

Texas judge sides with Logan Paul’s effort to dismiss CryptoZoo lawsuit

Share link:In this post: Judge Ronald Griffing said Logan Paul’s bid to remove a lawsuit over the collapse of CryptoZoo should be allowed. Griffin also urged the class-action plaintiff to update all but one of its 27 claims against Paul, the one linking him to commodity pool fraud. The judge dismissed Paul’s bid to accuse CryptoZoo co-founders of the project’s failure.

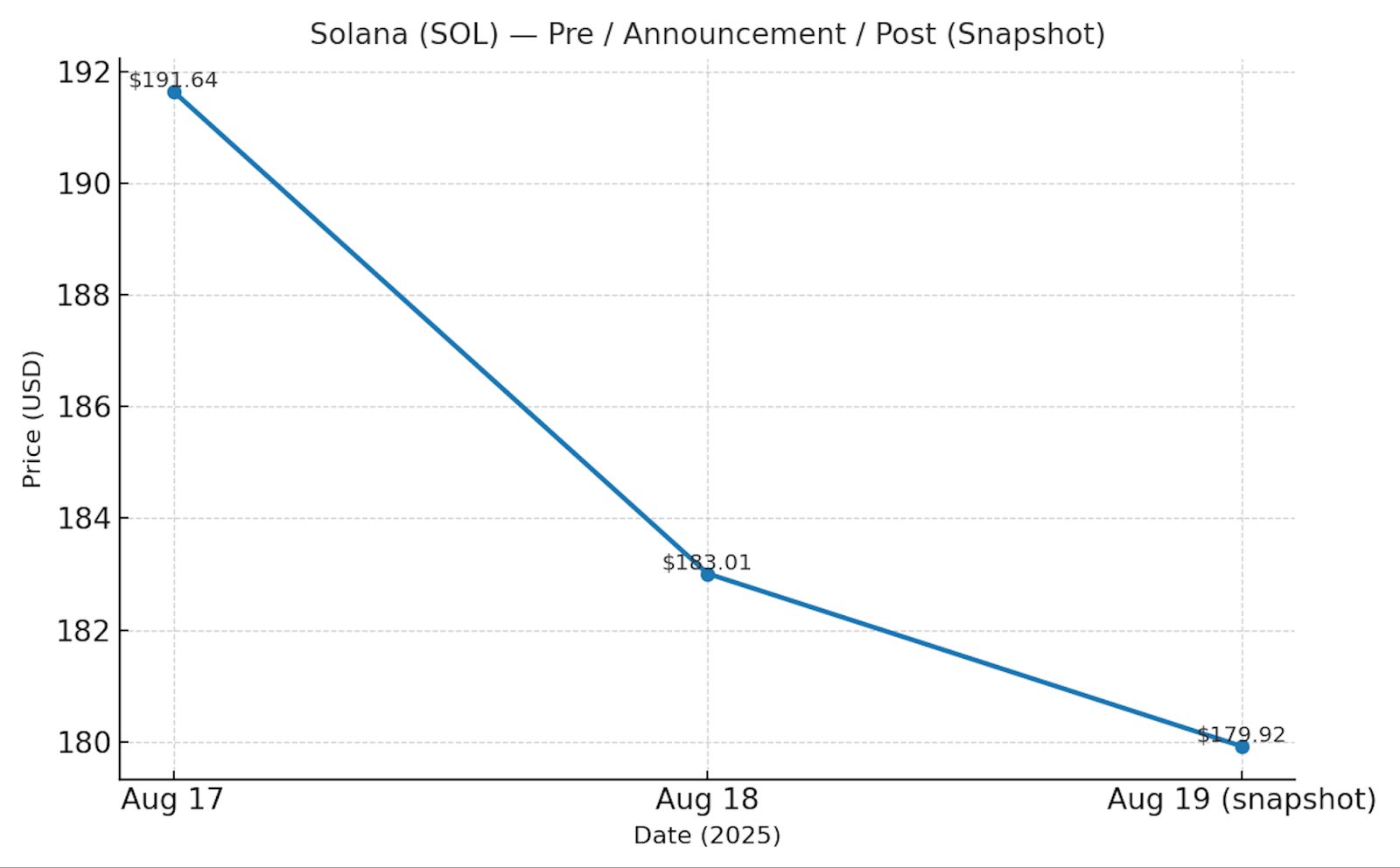

XRP & Solana ETF delays spark volatility – Stay or exit before October?

Share link:

Ethereum ETFs supply holdings to exceed BTC ETF’s holdings by September

Share link:In this post: Ethereum ETFs now hold over 6.5M ETH, with projections showing a September flip as they close in on Bitcoin ETFs’ share of the circulating supply. US spot ETH ETFs saw $59M in outflows on August 15 after record weekly inflows of 649,000 ETH pushed totals above $3.7B. Institutional investors dominate Ethereum with 19.2M ETH, while retail holdings fall sharply, highlighting shifting market influence amid price swings near $4,450.