U.S. Economic Policies Set to Impact Crypto Markets

- Upcoming economic data releases and tariff fallout elevate crypto volatility.

- Federal Reserve and presidential actions influence BTC and ETH markets.

- Jackson Hole Symposium crucial for future economic policy signals.

The upcoming Jackson Hole Symposium, U.S. tariff impacts, and key economic data releases are set to influence cryptocurrency markets, drawing attention from industry leaders and impacting assets like Bitcoin and Ethereum.

These events could lead to significant volatility, affecting cryptocurrency valuations and market sentiment globally, as stakeholders brace for shifts in economic and policy landscapes.

In the week ahead, cryptocurrency markets anticipate elevated volatility due to three core factors: U.S. economic data, tariff policy impacts, and financial policy events at the Jackson Hole Symposium.

Federal Reserve leadership, including Chair Jerome Powell, will play a central role at the symposium offering signals on future rate policy. “The Jackson Hole Symposium will provide direct signals on future rate policy, which are anticipated to influence market sentiment significantly,” said Jerome Powell, Chair, Federal Reserve. Recent U.S. tariffs have also spurred crypto market liquidation events.

The immediate effect of these developments is heightened market sensitivity. Bitcoin and Ethereum are experiencing significant derivatives-driven selloffs due to macroeconomic risks.

Financial implications are evident with funding shifts and institution-driven market activities. Increased liquidation volumes in BTC and ETH are triggered by policy announcements involving automated trading responses.

The historical pattern of U.S. macroeconomic releases causing volatility continues. Anticipated CPI, PPI, and employment data releases often result in substantial market fluctuations.

Potential outcomes involve market corrections in response to rate policy changes. Previous large-scale liquidations serve as precedent, with affected assets including BTC, ETH, and riskier altcoins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SoftBank shares drop 5%, snapping 9-day rally after $2 billion Intel deal

Share link:In this post: SoftBank shares fell over 5% after it announced a $2 billion deal to buy Intel stock at $23 per share. Asian markets dropped across the board as investors waited for the U.S. Fed’s Jackson Hole meeting. Jerome Powell is expected to signal a possible rate cut, with futures showing an 83% chance for September.

Texas judge sides with Logan Paul’s effort to dismiss CryptoZoo lawsuit

Share link:In this post: Judge Ronald Griffing said Logan Paul’s bid to remove a lawsuit over the collapse of CryptoZoo should be allowed. Griffin also urged the class-action plaintiff to update all but one of its 27 claims against Paul, the one linking him to commodity pool fraud. The judge dismissed Paul’s bid to accuse CryptoZoo co-founders of the project’s failure.

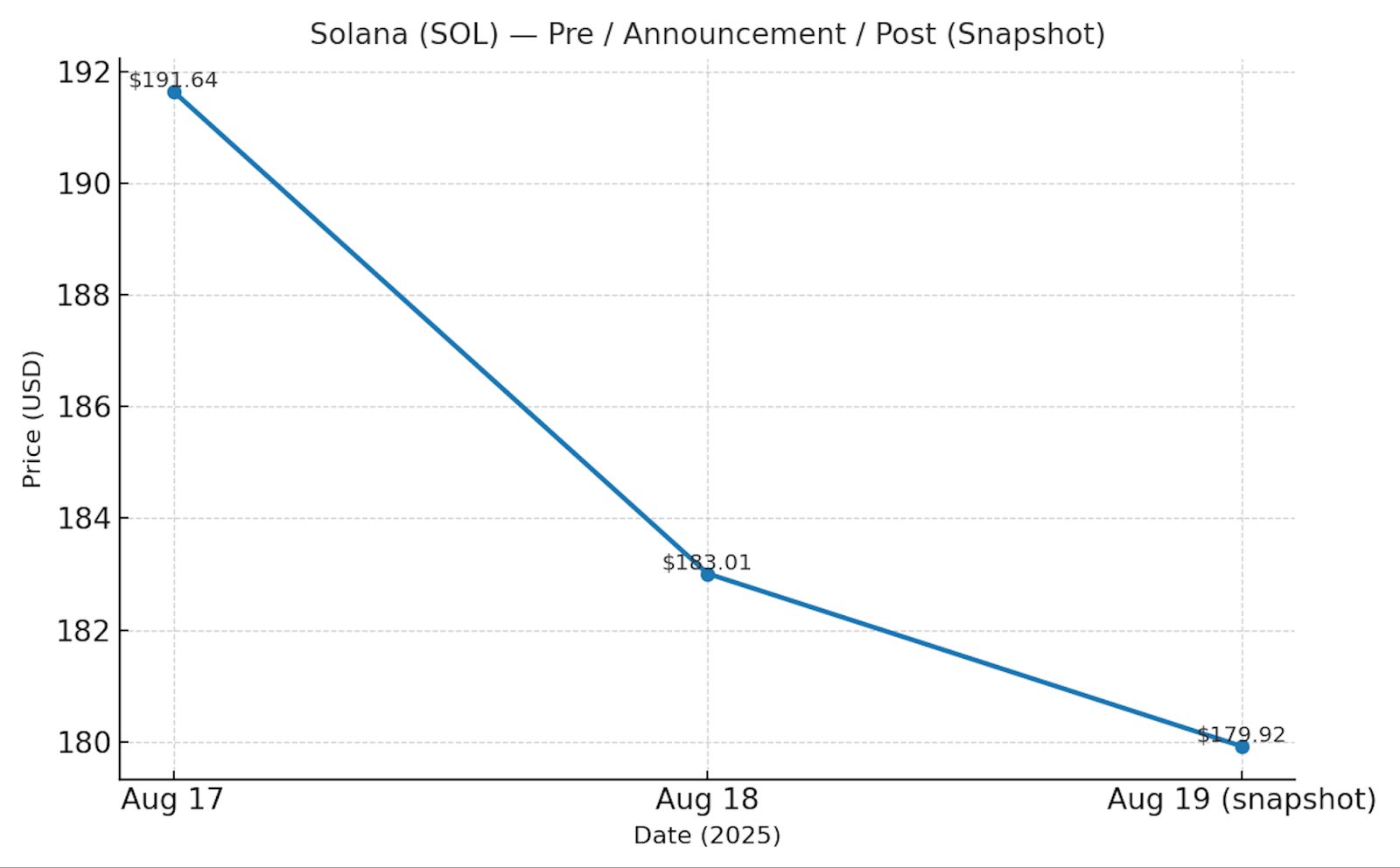

XRP & Solana ETF delays spark volatility – Stay or exit before October?

Share link:

Ethereum ETFs supply holdings to exceed BTC ETF’s holdings by September

Share link:In this post: Ethereum ETFs now hold over 6.5M ETH, with projections showing a September flip as they close in on Bitcoin ETFs’ share of the circulating supply. US spot ETH ETFs saw $59M in outflows on August 15 after record weekly inflows of 649,000 ETH pushed totals above $3.7B. Institutional investors dominate Ethereum with 19.2M ETH, while retail holdings fall sharply, highlighting shifting market influence amid price swings near $4,450.