Bitcoin’s September Correction Warning by Analysts

- Bitcoin expected to move sideways before a correction in September.

- Experts predict significant short-term volatility for BTC.

- Long-term bullish sentiment persists among key analysts.

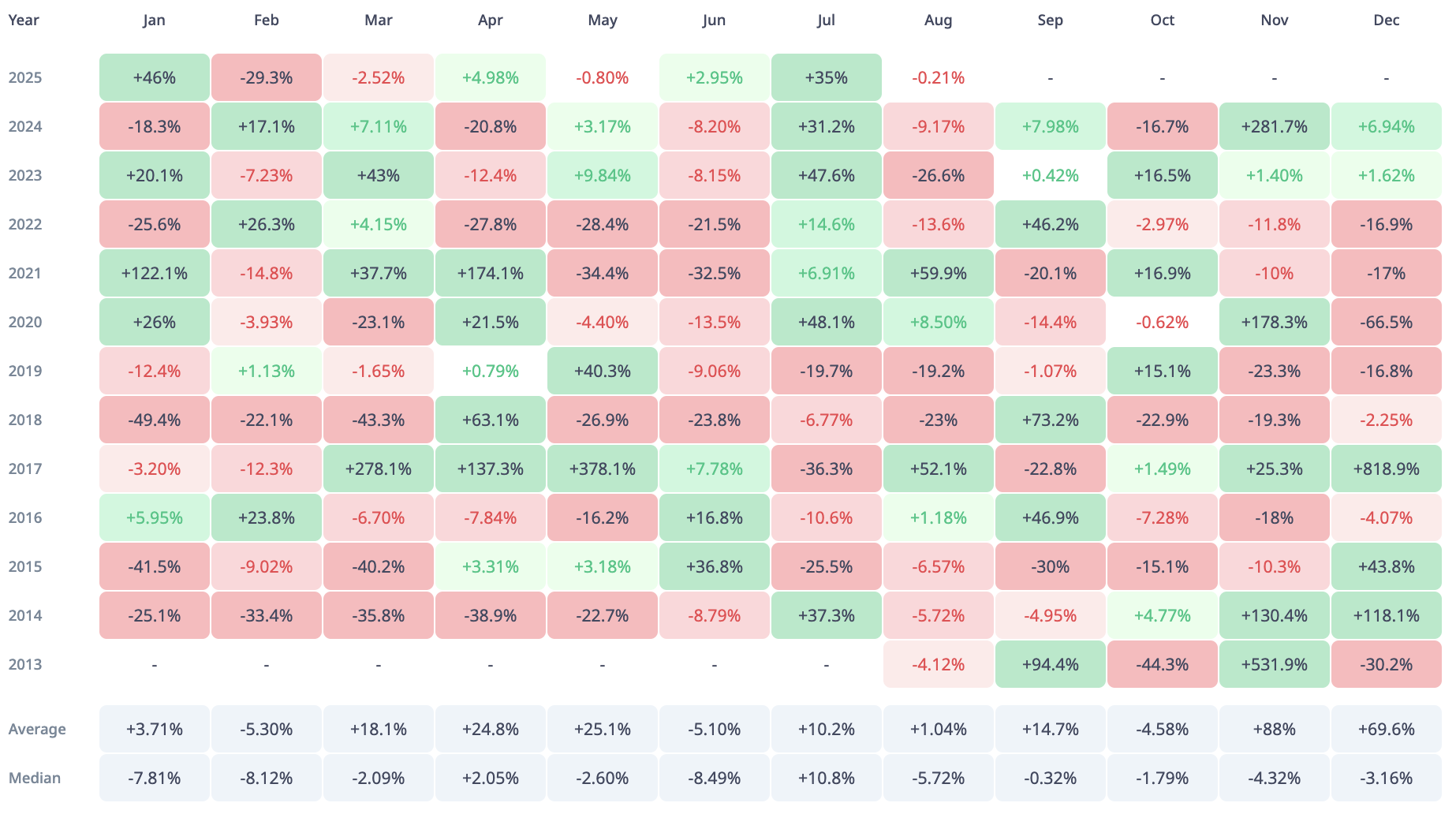

Bitcoin may face a significant price correction in September, according to analysts, following a cycle of summer rallies seen in previous years.

Nascent consolidation supports caution among investors, as historical patterns and institutional insights suggest looming volatility, potentially impacting BTC and related cryptocurrency markets.

Bitcoin’s price action has been notably sideways, with analysts stating that a painful correction might be imminent in September. This prediction stems from observing historical trends and market influences.

Key figures, including analyst Benjamin Cowen, highlight the similarity with previous post-halving cycles, where a summer rally is often followed by a September drop.

Bitcoin’s post-halving cycle often includes July–August rallies, followed by a painful correction in September, before moving into a cycle top in late Q4. – Benjamin Cowen.

Such predictions underline the potential impact on market sentiment, potentially cooling investor enthusiasm. Market structure changes and ETF inflows are partly responsible for this sideways movement.

Experts suggest that an eventual correction might signal a buying opportunity before a Q4 recovery, driven by institutional investments, as noted by Coin Central .

The current setup implies potential volatility for Bitcoin and correlated assets, such as Ethereum and Solana. Analysts emphasize looking for patterns similar to 2013 and 2017, where a September correction preceded a significant Q4 rally, as discussed by Bitcoin Magazine .

Long-term, analysts remain optimistic, anticipating bullish outcomes from ETF approvals and greater market regulation. Such moves could pave the way for a renewed price surge heading into 2025, aligning with expert forecasts shared by Peter Brandt .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Price Analysis: August’s Challenges and Potential for Recovery Above $3.14

Dogecoin (DOGE) Consolidation May Signal Potential 40% Price Move Amid Ongoing Market Developments

SEC Delays Key Crypto ETF Approvals Affecting Market Dynamics

In Brief SEC delays crypto ETF approvals, scrutinizing regulatory changes further until October 2025. Postponements affect various ETFs: Bitcoin, Ethereum, XRP, Litecoin, and others. Approval delays impact market expectations and institutional interest in crypto assets.

BTCS to Distribute Ethereum Dividends and Loyalty Rewards to Shareholders