PI Network Resumes Freefall Toward Historical Low Amid Strong Selling Pressure

PI Network’s PI token is in freefall, dropping below key support levels and facing strong selling pressure. Despite this, the Chaikin Money Flow indicator hints at possible buying interest, potentially stabilizing the token.

PI Network’s native token PI is once again under pressure. The token’s price has dipped below a crucial support level as investor interest in the altcoin continues to wane.

Market sentiment has turned increasingly negative, raising fears that PI could soon revisit its all-time low of $0.32.

PI Faces Strong Downward Momentum

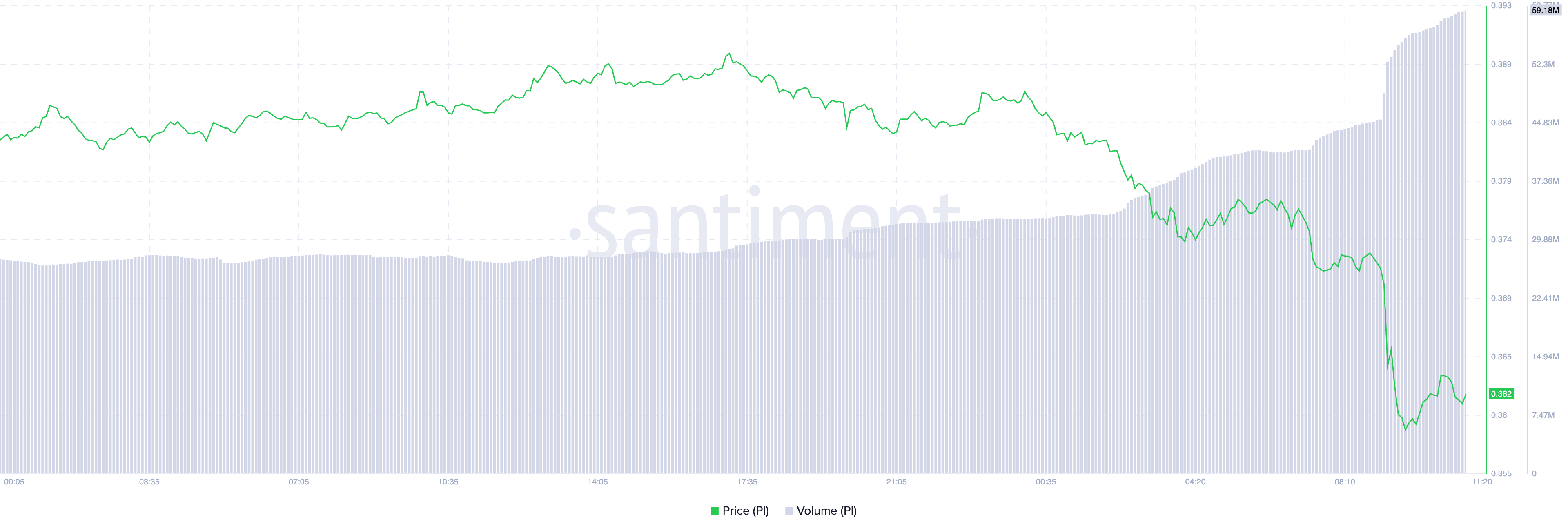

Today’s broader market decline has weighed on PI’s price. It has witnessed a 4% drop, pushing it below the critical $0.37 support level, a zone that had prevented deeper losses since August 1.

At press time, PI trades at $0.36, with trading volume surging 104%. A rising trading volume alongside a falling price signals heightened selling pressure, as more market participants are offloading their positions.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

PI Price and Trading Volume. Source:

Santiment

PI Price and Trading Volume. Source:

Santiment

This combination confirms the strong bearish sentiment against PI, suggesting that the downward move may continue unless new buying interest emerges to stabilize the market.

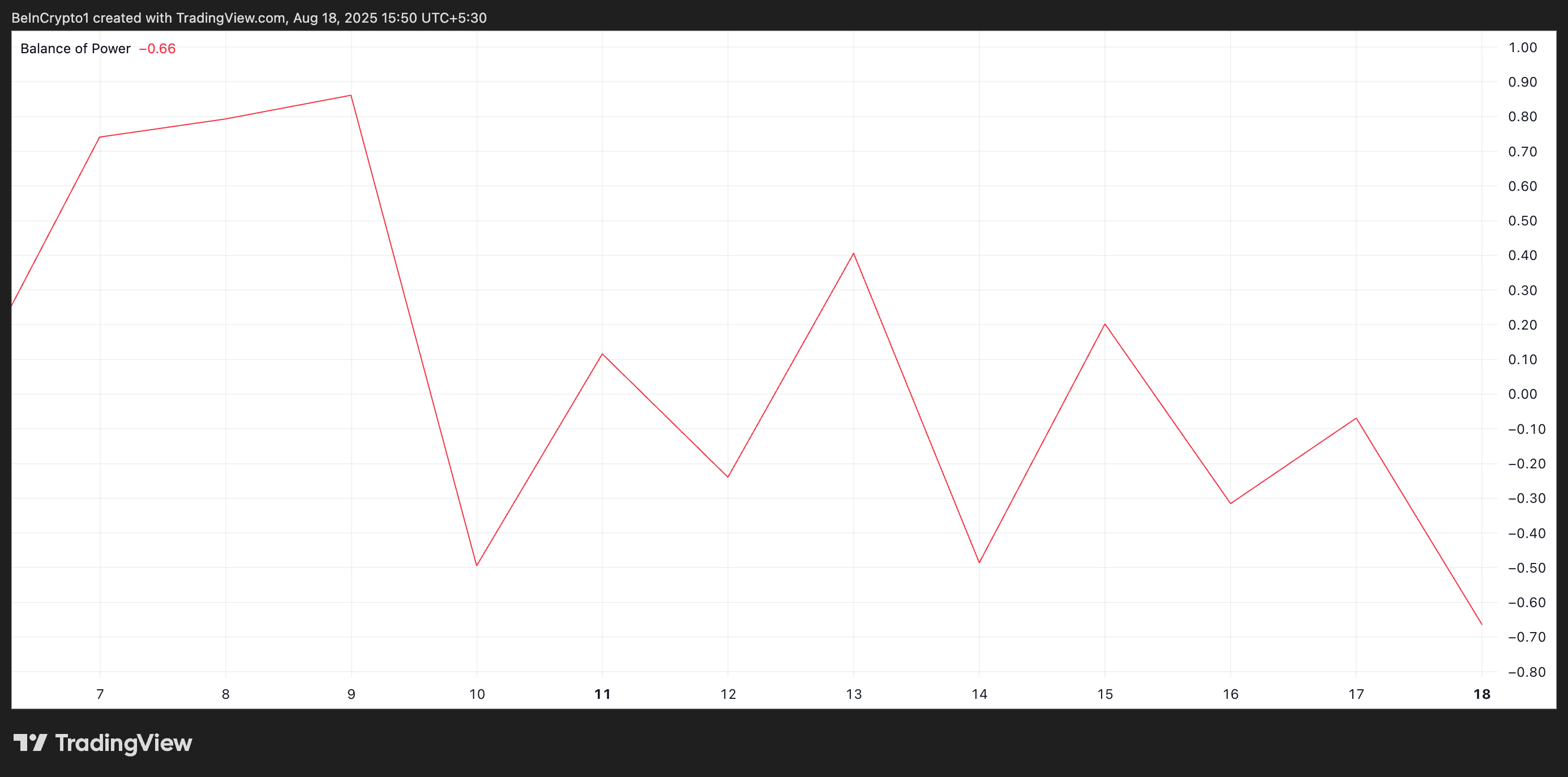

Moreover, the altcoin’s negative Balance of Power (BoP) supports this bearish outlook. As of this writing, the indicator is at -0.66 and trending lower, highlighting the weakening demand for PI.

PI BoP. Source:

TradingView

PI BoP. Source:

TradingView

The BoP indicator measures the strength of buyers versus sellers in a market. It calculates whether bulls or bears are dominating price movements over a given period. A positive BoP indicates buying strength, while a negative BoP signals selling pressure.

PI’s negative BOP signals sellers exert more influence over price action than buyers. It is a bearish signal that indicates further downside pressure on PI if the trend continues.

PI Nears All-Time Low; Traders Eye $0.37 Support Reclaim

Intensifying sell-side pressure could push PI toward its all-time low of $0.32, and if buyers fail to defend this critical support zone, the altcoin could slide even further. However, there is a catch.

PI’s Chaikin Money Flow (CMF) is trending upward, currently reading 0.04, signaling a bullish divergence. An asset’s CMF forms a bullish divergence with its price when it returns a positive value during a period of price decline.

This suggests that despite recent selling pressure, buying interest is starting to emerge.

PI Price Analysis. Source:

TradingView

PI Price Analysis. Source:

TradingView

If buyers continue to step in, PI could rebound, reclaim its $0.37 support, and even attempt to breach the $0.40 level in the short term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

LRC -109.29% 24H Drop Amid Sharp Short-Term Volatility

- LRC plunged 109.29% in 24 hours on Aug 28, 2025, following a 1036.59% 30-day surge. - The 5347.04% annual drop highlights long-term bearish trends despite short-term volatility. - Technical indicators show oversold RSI and negative MACD divergence, signaling continued downward pressure. - A backtest using RSI/MACD strategies identified short-term reversal signals but failed to predict the 24-hour crash.

Cold Wallet's $6.8M Raise: A Paradigm Shift in Payment Crypto Adoption

- Cold Wallet raises $6.8M in presale, surpassing Litecoin and Dogecoin in utility and institutional appeal. - Its cashback rewards system incentivizes on-chain activity, creating a flywheel effect with tokenomics capping supply at 10B. - Security audits and Plus Wallet acquisition boost institutional credibility, contrasting with Litecoin/Dogecoin's lack of infrastructure. - Strategic tokenomics lock 90% presale tokens for three months, aligning incentives vs. infinite/limited supplies of Dogecoin/Litecoi

South Korean Lawmakers' Crypto Holdings Signal Institutional Confidence in Digital Assets

- South Korean lawmakers increasingly hold Bitcoin, XRP, and meme coins, signaling institutional confidence in crypto as personal investments influence policy. - 2025 regulatory reforms include leverage caps, stablecoin capital requirements, and alignment with EU MiCA to balance innovation and stability. - FSC plans KRW-backed stablecoins and Bitcoin ETFs by late 2025, aiming to attract institutional capital and reduce reliance on offshore tokens. - Risks persist from regulatory delays, fragmented infrastr

Critical Price Levels and Market Sentiment in XRP, Bitcoin, and Ethereum: A Pathway to Strategic Entry or Exit

- XRP forms a symmetrical triangle near $3.00, with $25M daily institutional flows supporting potential breakout above $3.04 or retest of $2.89 support. - Bitcoin shows bullish EMA divergence and Fed-driven macro tailwinds, but faces critical resistance at $123,000 and risk of bearish pressure below $110,000. - Ethereum exhibits mixed signals: long-term bullish EMAs contrast with bearish MACD and RSI below 50, requiring $4,676 breakout confirmation for renewed upward momentum. - Strategic implications emph