Analyst: Bitcoin Likely to Remain Range-Bound as Market Awaits Powell’s Speech This Friday

BlockBeats News, August 19 — CryptoQuant analyst Axel Adler Jr stated, “The futures market sentiment index has dropped below neutral to 36%. Between August 11 and 14, this indicator briefly surged to 70% as Bitcoin’s price soared to $123,000. Currently, Bitcoin is holding at $115,000, while the sentiment index momentum is declining: in the index composition, sellers are dominating in the short term (with negative net takers and volume difference), and open interest remains neutral. This indicates that the market has transitioned from a peak of euphoria to a phase of range-bound consolidation.”

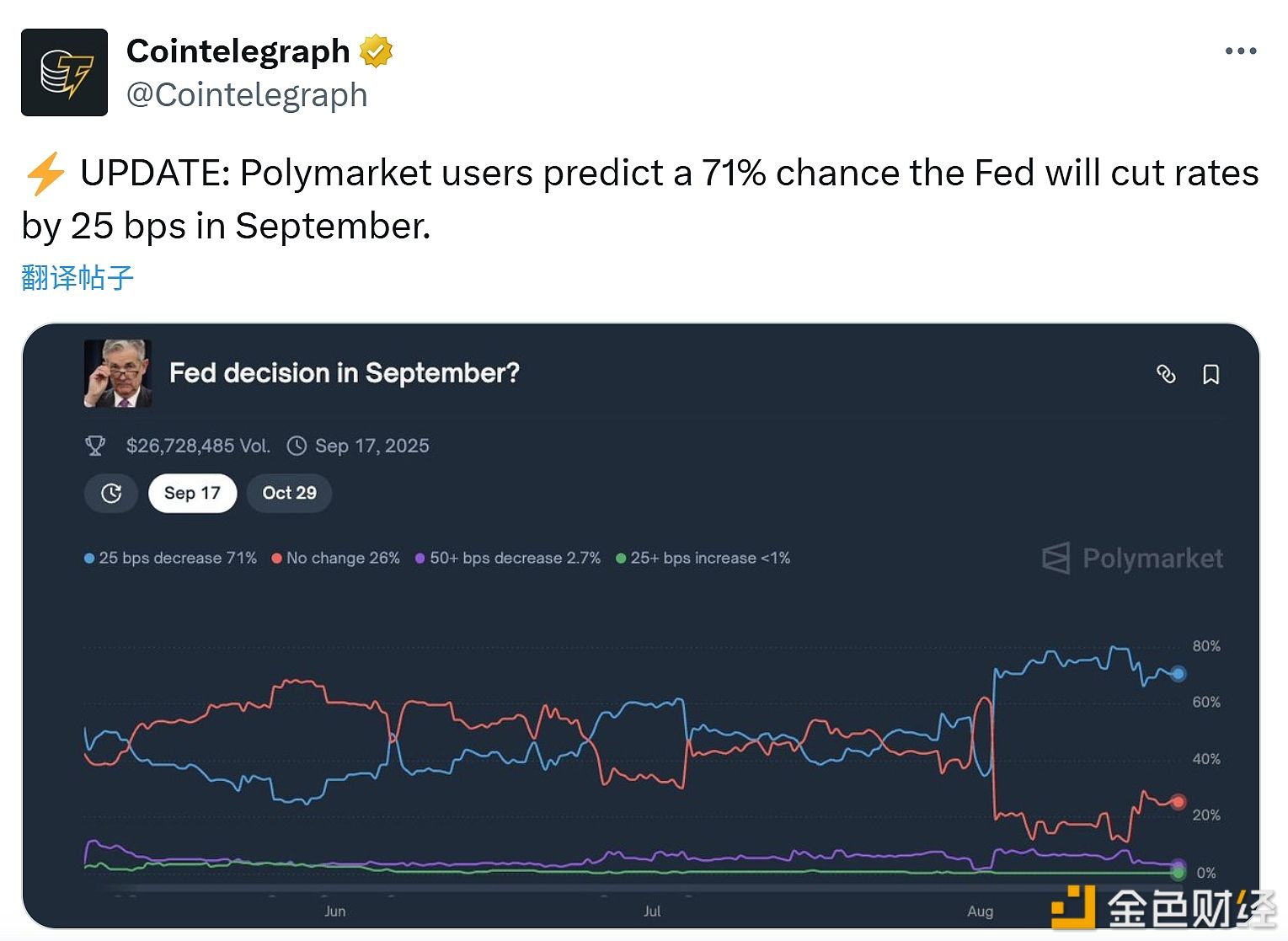

This situation means that when the index remains below 45-50%, any rebound may trigger selling, and prices are likely to fluctuate within a narrow range. If the index continues to languish during weak rebounds, the likelihood of testing $112,000 increases. The key event this week is Powell’s speech at the Jackson Hole summit on Friday (regarding the economic outlook and framework review), which could determine the direction of future market sentiment.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.