Dogecoin (DOGE) is experiencing a significant decline in futures open interest, dropping by 8.24% in just one day, indicating weakening investor confidence amid a broader crypto market downturn.

-

Dogecoin’s futures open interest has decreased to 15.16 billion DOGE, valued at approximately $3.25 billion.

-

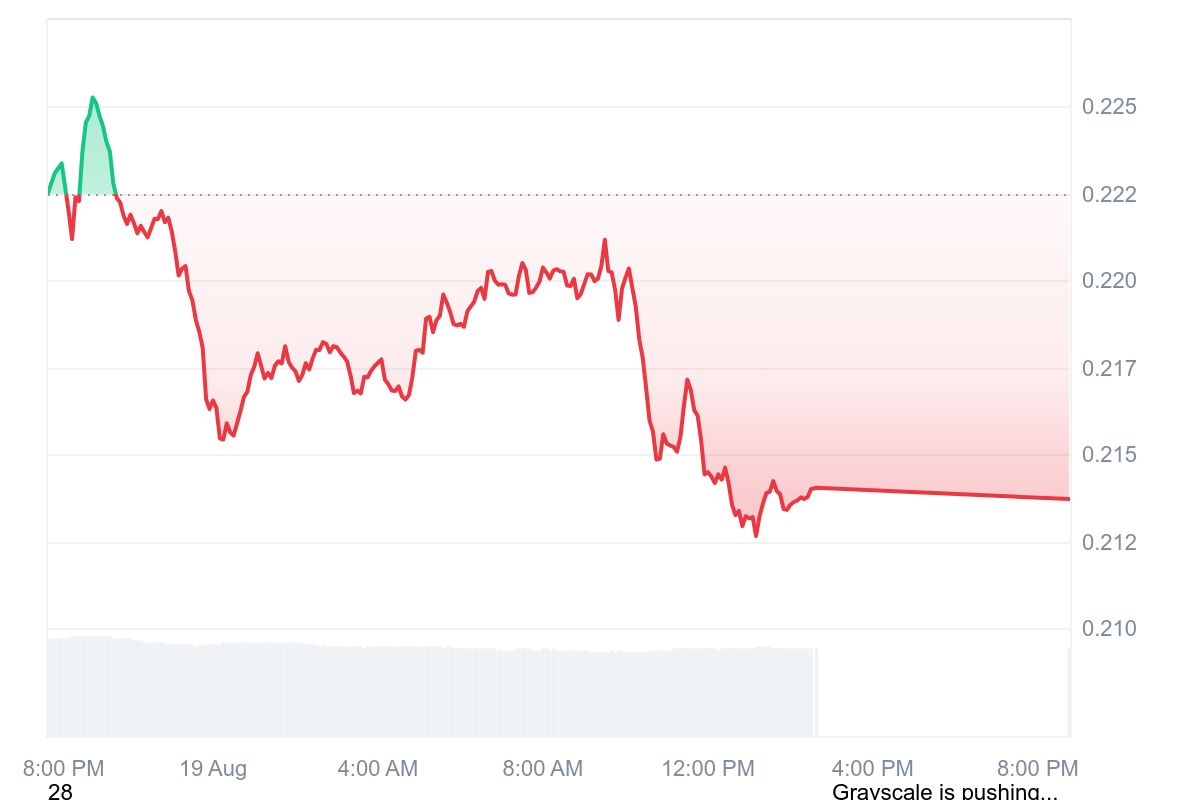

The price of DOGE has fallen by 4.4%, trading at $0.2137 as of the latest data.

-

Historically, sustained decreases in open interest have often preceded deeper market declines.

Dogecoin (DOGE) faces a significant downturn as futures open interest declines, prompting cautious investor sentiment. Stay informed for updates.

What is Dogecoin (DOGE)?

Dogecoin (DOGE) is a cryptocurrency that started as a meme but has gained significant popularity and market capitalization. Currently, DOGE is facing challenges as its futures open interest declines, reflecting a lack of confidence among investors.

What factors are affecting Dogecoin’s price?

The recent downturn in Dogecoin’s price can be attributed to a broader market decline led by Bitcoin and Ethereum. As altcoins and meme coins mirror this trend, DOGE’s trading price has dropped significantly, leading to a decrease in open interest as traders exit positions.

Frequently Asked Questions

What is the current price of Dogecoin?

As of the latest data, Dogecoin is trading at approximately $0.2137, reflecting a 4.4% decline over the last day.

Why is Dogecoin’s open interest declining?

The decline in Dogecoin’s open interest is due to traders exiting leveraged positions amid a broader bearish trend in the crypto market.

Key Takeaways

- Market Sentiment: Investor confidence in Dogecoin is waning as futures open interest decreases.

- Price Movement: DOGE has seen a significant price drop, trading at $0.2137.

- Historical Trends: Decreases in open interest often precede further market declines.

Conclusion

In summary, Dogecoin (DOGE) is currently facing significant challenges as its futures open interest declines and prices drop. Investors should remain cautious, as historical trends suggest that such declines may lead to deeper market downturns. Keeping an eye on market developments will be crucial for future trading strategies.

Source: CoinMarketCap

Source: CoinMarketCap